On CNBC’s “Mad Cash Lightning Round,” Jim Cramer stated he has actually protested Annaly Capital Management, Inc. NLY for numerous, several years. “It’s got a huge yield, however I wish to own development,” he included.

On the profits front, Annaly Capital Management will launch its monetary outcomes for the quarter that ended June 30 after the closing bell on Wednesday, July 23. Experts anticipate the business to report quarterly profits at 71 cents per share, up from 68 cents per share in the year-ago duration.

” The rocket story’s excellent,” Cramer stated when inquired about Karman Holdings Inc. KRMN “These are the type of business that are making a great deal of individuals a great deal of cash.”

Supporting his view, on July 3, RBC Capital expert Ken Herbert preserved an Outperform ranking on Karman Holdings and raised the cost target from $44 to $51.

Lincoln Educational Solutions Corporation LINC is “where you wish to be,” Cramer stated.

Providing assistance to his option, Lincoln Educational Solutions, on Might 12, reported better-than-expected first-quarter monetary outcomes and raised its FY25 sales assistance above quotes.

Rate Action:

- Karman Holdings shares acquired 0.5% to settle at $45.24 on Monday.

- Annaly Capital Management shares fell 0.9% to close at $19.32.

- Lincoln Educational shares fell 1.5% to settle at $22.63 on Monday.

Read Next:

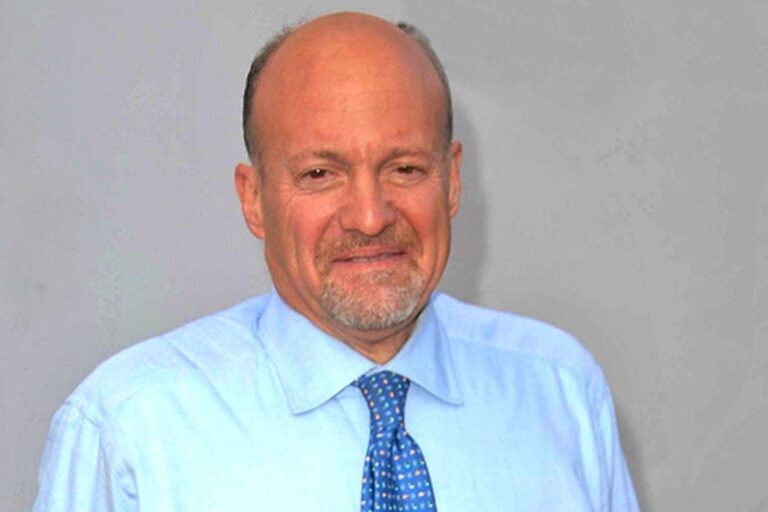

Picture: Shutterstock

Market News and Data gave you by Benzinga APIs