After an unstable Monday on Wall Street, stock futures enhanced in after-hours trading, using a break after a day of extreme whiplash. The Dow, S&P 500, and Nasdaq-100 futures each increased more than 1%, recuperating from previous mayhem triggered by revitalized U.S.-China trade stress. An early morning rally, activated by guesswork that brand-new tariffs may be postponed, briefly pressed the S&P 500 up 7% from its low. However markets altered course after the Trump administration validated that the tariff walking on Chinese products was still in location, leading China to threaten more retaliation.

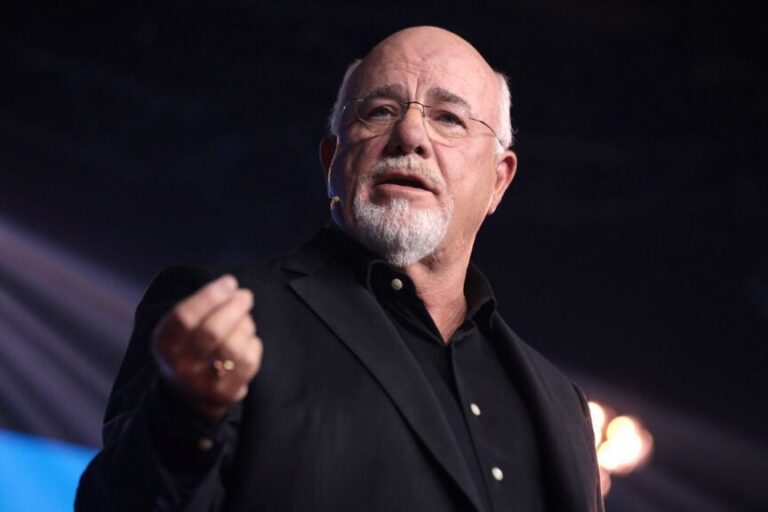

As financiers continue to rush and headings magnify the panic, individual financing professional Dave Ramsey’s guidance from a stock exchange crash a couple of months ago can offer some helpful insight on how to manage the wild trip.

What Occurred: Throughout a contact The Ramsey Program, a listener asked Ramsey how to react to the collapsing stock exchange. Ramsey quipped, “Cue the whining, shouting and gnashing of teeth that everybody’s going to pass away and we’re all going to retire and need to consume Alpo.”

Ramsey worried that significant headings and market swings are not a brand-new phenomenon– and not a factor to desert healthy investing practices. While lots of people are lured to pull cash out or stop briefly contributions throughout uncertain times, Ramsey doubled down on a contrary technique: remain constant, keep investing, and do not let feelings rule your choices.

See Likewise: Dave Ramsey Caller Informs Him Following Recommendations To Settle Home ‘Didn’t Work’ Due To The Fact That Now She Has No Credit– However He States That Was The Point

Why It Matters: Ramsey’s core approach centers on long-lasting discipline. He cast aside the concept of day trading or attempting to time the marketplace, stating, ” I do not do anything … due to the fact that I do not day trade.” Rather, he states financiers ought to remain constant no matter what the marketplace is doing. ” I simply keep purchasing all the time … on a monthly basis I simply keep purchasing.”

Ramsey’s Recommendations For A Volatile Market

When stocks drop, he sees it as a purchasing chance, not a crisis. “When it decreases I’m going to smile ’cause I simply purchased it on sale.”

To prevent getting swept up in the buzz, Ramsey deliberately secures himself from the sound. When asked if he follows the news, his response was simple: “No, I do not see the news.” For him, the less psychological chatter, the much better.

Automation is another essential part of his method. “Set my 401k contributions … they occur immediately. I’m not thinking of it,” he described. And when it comes to watching on his financial investments? “I take a look at my own one or two times a year … if I’m doing some sort of year-end last.”

Ramsey likewise motivated listeners to hang on to a long-lasting viewpoint. “10 years from now, you will not even remember this crap. 10 years from now you will not even understand who was president,” he stated.

In a market environment where worry can take a trip faster than truths, Dave Ramsey desires financiers to remain constant. Geopolitical stress, tariff dangers, or unexpected selloffs are all part of the psychological rollercoaster of the marketplace, and, according to Ramsey, not a factor to desert your strategy.

” Short-term the stock exchange increasing or down is a lot of drama queens … They work on feeling daily,” he stated.

Read Next: Dave Ramsey Describes When Thriftiness Goes Too Far: ‘This Is A Psychological And Spiritual Concern’

Market News and Data gave you by Benzinga APIs