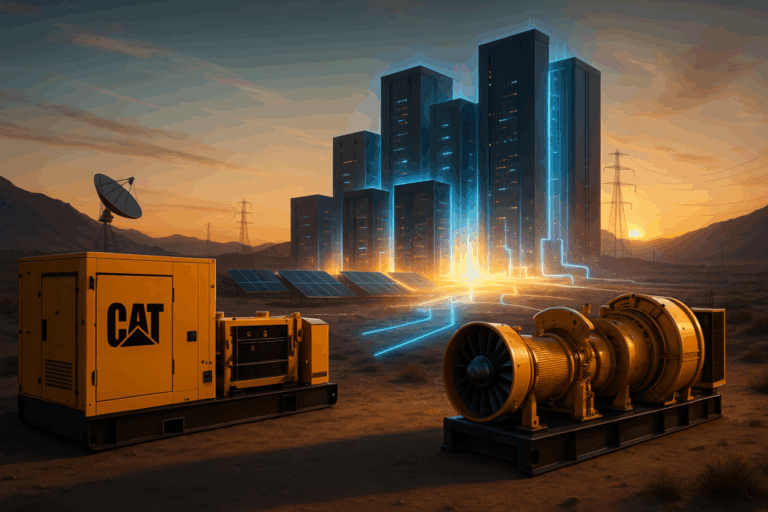

Caterpillar Inc (NYSE: FELINE) is well placed to gain from the pattern of information center operators significantly trying to find speed-to-power and dependability, which has actually “opened more doors for Solar beyond its standard fortress in the O&G market,” according to Raymond James.

The Caterpillar Expert: Expert Tim Thein restated a Market Perform score on the stock.

The Caterpillar Thesis: Some operators are utilizing a bigger variety of smaller sized turbines instead of a smaller sized variety of bigger turbines due to the benefits of much shorter preparation and run the risk of diversity, Thein stated in the note.

Have a look at other expert stock rankings.

” This pattern plays to Solar’s benefit as its Titan lines extend just to ~ 40mw, simply reaching the edges of the energy market,” he composed.

Caterpillar’s diesel and gas engine line of product along with its Solar turbines enhance the business’s position amongst international engine OEMs to record the power generation upside, the expert mentioned.

” Less clear to us is how to triangulate this behind-the meter recip chance into an earnings/ revenue price quote for E&T, though we anticipate this to be a main focus of Caterpillar’s approaching financier day,” he even more stated.

Feline Cost Action: Caterpillar shares were down 0.36% at $525.16 at the time of publication on Tuesday. The stock is approaching its 52-week high of $544.98, according to Benzinga Pro information.

Image produced utilizing expert system by means of DALL-E.

Market News and Data gave you by Benzinga APIs