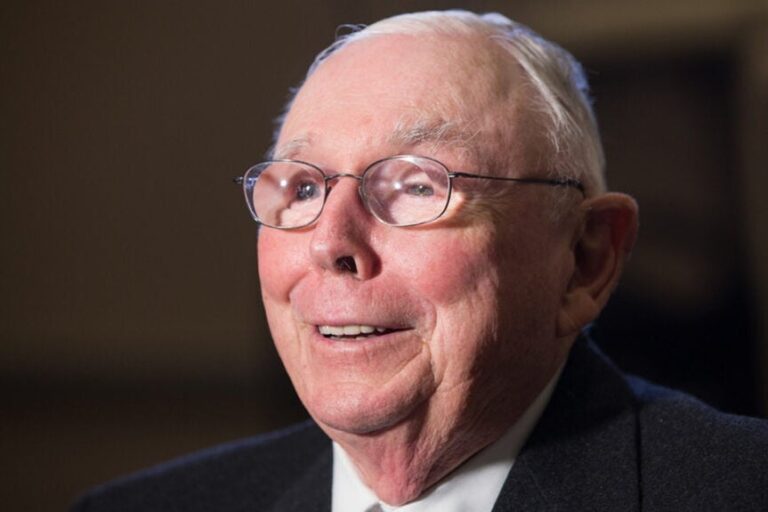

Charlie Munger, an enduring partner of Warren Buffett, as soon as clarified his financial investment method, highlighting the significance of gaining from mistakes and handling anticipations.

What Occurred: At a Berkshire Hathaway annual investor event in 2015, Munger said, “Warren, if individuals weren’t so frequently incorrect, we would not be so abundant.” This remark highlights the potential customers that emerge from others’ market misconceptions and mistakes.

Munger and Buffett collected their fortune by profiting from market ineffectiveness, believing autonomously, and averting typical financial investment traps. Munger’s financial investment approach wasn’t exclusively about making astute choices, however likewise about preventing mistakes that might deteriorate wealth.

Likewise Check Out: Charlie Munger’s 3 Financial investment Lessons: ‘Purchase Fantastic Organizations At Fair Rates, Huge Cash Isn’t In Purchasing Or Selling-It’s In Waiting, Excellent Organizations Are Ethical Organizations’

In 2024, a substantial variety of financiers held impractical anticipations about prospective rate of interest decreases by the Federal Reserve, based on Oxford Economics.

Munger warned versus such forecasts and rather focused on determining basically robust companies with appealing long-lasting capacity.

Likewise Check Out: Charlie Munger’s Financial Success and Durability Guidance: ‘My Video game in Life Was Constantly To Prevent All Basic Ways of Stopping Working’

A crucial takeaway from Munger’s financial investment viewpoint was the significance of gaining from mistakes. He was of the view that by seriously examining previous choices, financiers might obtain important understanding that forms future methods.

This commitment to constant knowing and self-enhancement was a distinguishing function of Munger’s technique to investing and company.

Why It Matters: Charlie Munger’s financial investment knowledge continues to resonate with financiers worldwide. His focus on gaining from errors and preventing typical risks offers an ageless guide for financiers browsing the complicated world of financing.

Munger’s technique highlights the significance of independent thinking and a long-lasting point of view in financial investment decision-making.

His knowledge functions as a tip that on the planet of investing, preventing errors can be simply as crucial as making wise choices.

Read Next

Charlie Munger’s 3 Guidelines For Success: ‘Do Not Offer What You Would Not Purchase, Work For Those You Appreciate, Partner With Individuals You Take Pleasure In’

This material was partly produced with the aid of AI tools and was evaluated and released by Benzinga editors.

Market News and Data gave you by Benzinga APIs