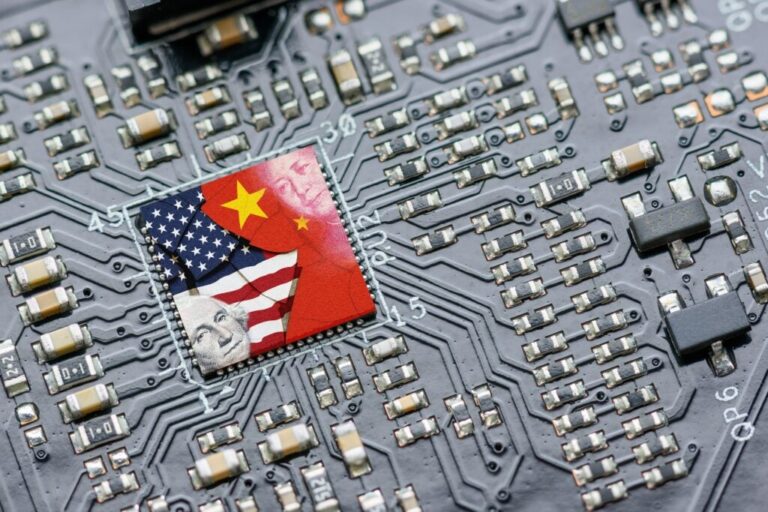

The proposed $35 billion merger in between Synopsys Inc. SNPS and Ansys Inc. ANSS is apparently dealing with a hold-up due to the Chinese antitrust regulator.

What Taken Place: The State Administration for Market Guideline ( SAMR) in China has actually put a hang on the approval of the merger in between Synopsys, a chip style tool maker, and Ansys, an engineering software application designer, reported the Financial Times. This hold-up is credited to the current imposition of chip export controls by the Trump administration, which has actually even more strained trade relations in between the U.S. and China.

The offer, formerly authorized by regulators in the U.S. and Europe, remained in the last stage of evaluation by China’s SAMR and was prepared for to nearby completion of June.

Nevertheless, a source informed the publication that SAMR’s approval timeline was just recently extended beyond the preliminary 180-day schedule due to the fact that of the offer’s intricacy, instead of any direct connection to the continuous trade war. The offer consists of a “drop dead stipulation” on January 15, 2026, according to the business filings.

SEE LIKEWISE: Mark Cuban Backs Ro Khanna’s $12 Trillion ‘Progressive Deficit Decrease Strategy,’ Targeting Medicare Scams And Armed Force Costs

Why It Matters: The hold-up in the Synopsys-Ansys merger approval is a direct outcome of the intensifying trade stress in between the United States and China. This advancement can be found in the wake of the United States enforcing brand-new export constraints on China, consisting of semiconductor style software application, chemicals, and other crucial products.

Today’s Finest Financing Offers

China, in turn, has actually threatened legal action versus any private or company helping with or carrying out these United States steps, even more intensifying the tech competition in between the 2 nations.

The hold-up in the Synopsys-Ansys merger approval is a sign of the more comprehensive effect of the US-China trade stress on the international tech market.

Over the previous year, Synopsys stock decreased 15.6%, while Ansys climbed up 5.69%, according to information from Benzinga Pro.

Image by means of Shutterstock

Disclaimer: This material was partly produced with the aid of AI tools and was evaluated and released by Benzinga editors.