Individual financing professional Dave Ramsey is prompting moms and dads to stop bailing out adult kids who abuse monetary aid, stating guilt-driven demands just strengthen bad cash practices.

Moms And Dads Having Problem With Grownup Kid’s Financial Reliance

Danielle, a 27-year-old’s mom, composed to Ramsey looking for assistance after years of economically supporting her child and son-in-law regardless of their constant earnings, as reported by KTAR News on Tuesday.

” They both have good tasks, and we have no concept where their cash goes,” Danielle described.

” Recently, they have actually even attempted to regret us into providing cash by stating … our granddaughter may go without.”

Ramsey’s Hard Love Guidance On Preventing Guilt-Tripping And Enabling

Ramsey reacted with firm guidance. “It’s method previous time your child and your son-in-law discovered how to handle cash like accountable grownups,” he composed.

He advised moms and dads stop offering cash unconditionally and rather need adult kids to go to monetary therapy and send spending plans before providing any help.

He likewise recommended reframing actions to guilt-driven appeals. If they state, “Your granddaughter may go to sleep without supper, inform them to send her over to your location for an excellent, homecooked meal,” Ramsey composed.

He stressed offering assistance just when it motivates long-lasting monetary duty, not dependence.

See Likewise: Border Czar Tom Homan States ‘No Intent’ To Arrest Gavin Newsom In spite of Trump’s Remarks: ‘They Have Not Crossed A Line Yet’

Ramsey Alerts Moms And Dads About Making It Possible For Adult Kid And Financial Reliance

Ramsey provided difficult love on The Ramsey Program recently, highlighting that adult making it possible for can avoid adult kids from establishing duty.

One caller requested assist with her 19-year-old kid, who had actually left of college, worked part-time at Walmart, and lived in the house without paying costs, regardless of making $14 an hour and getting $10,000 in dividends.

Ramsey pushed the mom on why she had actually not instilled a work ethic previously, while co-host Dr. John Delony kept in mind the teenager’s very little duty was unsurprising considering that his moms and dads covered most expenditures.

Both hosts worried that the issue was adult making it possible for, not bad finance, and recommended setting firm borders to motivate responsibility.

In July, A caller shared that her daddy held his children accountable for his cash difficulties, leading Ramsey to recommend moms and dads to develop useful limitations and prevent straining their kids with unaffordable trainee loans.

Another caller reported adult kids making $180,000 yearly, yet living income to income and counting on loan forgiveness.

Ramsey alerted that bailing them out enhances bad practices and recommended his “matching program” as a much healthier method to mentor monetary duty.

Read Next:

Disclaimer: This material was partly produced with the aid of AI tools and was evaluated and released by Benzinga editors.

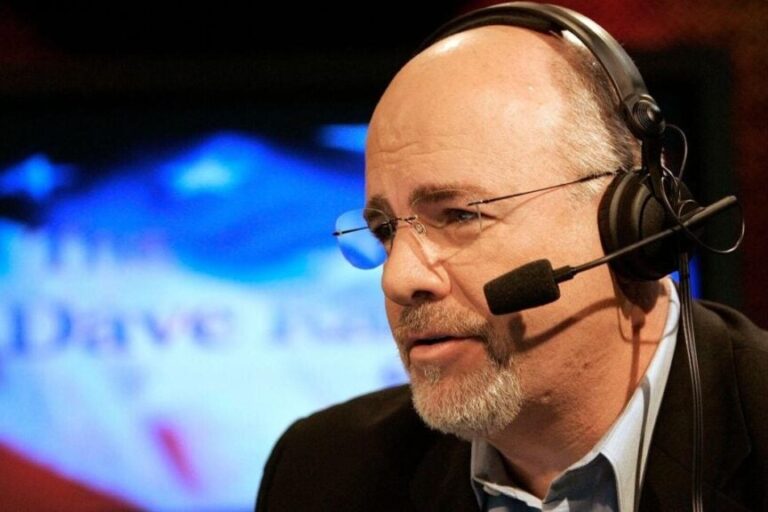

Image courtesy: Shutterstock