The handling director of The Future Fund LLC, Gary Black, believes that the current video including an Optimus Robotic at the business’s Miami occasion over the weekend has actually raised concerns and is driving Tesla Inc. (NASDAQ: TSLA) stock down.

Optimus Plainly Not Scalable, States Gary Black

In a post shared on the social networks platform X on Monday, Black laid out that the current video has actually raised eyebrows about Optimus being “AI-driven” or tele-operated. “If tele-operated instead of AI-driven, Optimus would plainly not be scalable as it would require one tele-operator for every single robotic,” the financier shared.

Sawyer Merritt Weighs In

Estimating Black’s post, Merritt slammed the financier’s ideas that the stock was moving since one Optimus robotic “dropped.” Merritt included that “it was currently understood” that the Optimus robotics serving individuals at the EV giant’s numerous occasions were tele-operated, likewise laying out that the video was being overplayed by individuals on social networks.

Optimus’ Tele-Operated Issues

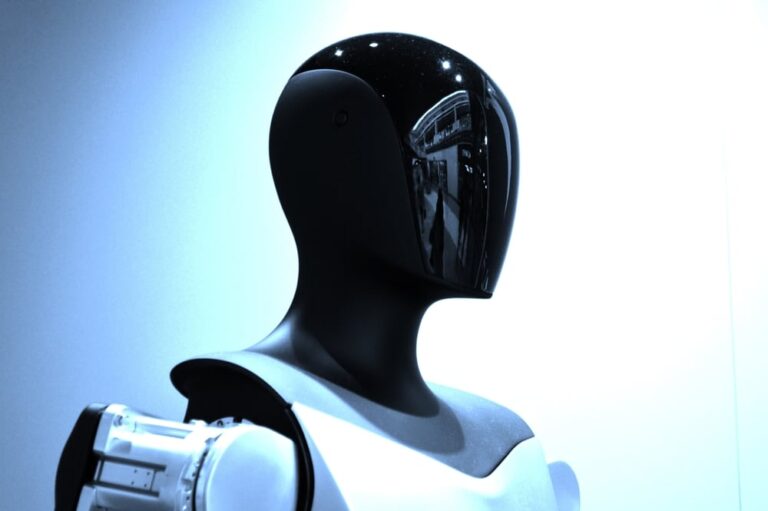

The remarks follow issues about Optimus robotics being teleoperated after a video from the business’s Miami occasion showcased among the robotics simulating the action of removing a headset/headgear, other than it wasn’t using anything of that sort. The robotic then fell.

Surprisingly, Tesla CEO Elon Musk had actually declared that the robotic wasn’t teleoperated when Optimus was showcased watching a martial arts professional’s relocations, including that Optimus was AI-driven. Musk had actually likewise declared that the Optimus robotic would represent over 80% of Tesla’s future worth.

Financiers, Experts Bearish On Tesla

It deserves keeping in mind that Tesla was just recently devalued to Equal-weight by financial investment bank Morgan Stanley expert Andrew Percoco, who took over from Tesla bull Adam Jonas, who held an Outperform score for the stock considering that 2023.

Financier Cathie Wood, CEO of ARK Invest, likewise dropped the EV giant’s show the company’s ARK Development ETF (BATS: ARKK), offering over 2,100 shares of Tesla. The trade was valued at around $923,118. Tesla stays ARKK’s leading holding, boasting 12.19% weightage in the ETF’s financial investments.

Tesla ratings well on Momentum, while providing satisfying Quality and Development, however bad Worth. It likewise has a beneficial rate pattern in the Short, Medium and Long term. For more such insights, register for Benzinga Edge Stock Rankings today!

Cost Action: TSLA dropped 3.39% to $439.58 at Market close, decreasing 0.02% throughout After-hours to $439.49, according to Benzinga Pro information.

Take A Look At more of Benzinga’s Future Of Movement protection by following this link.

Read Next:

Picture courtesy: All over the world Photos by means of Shutterstock.com