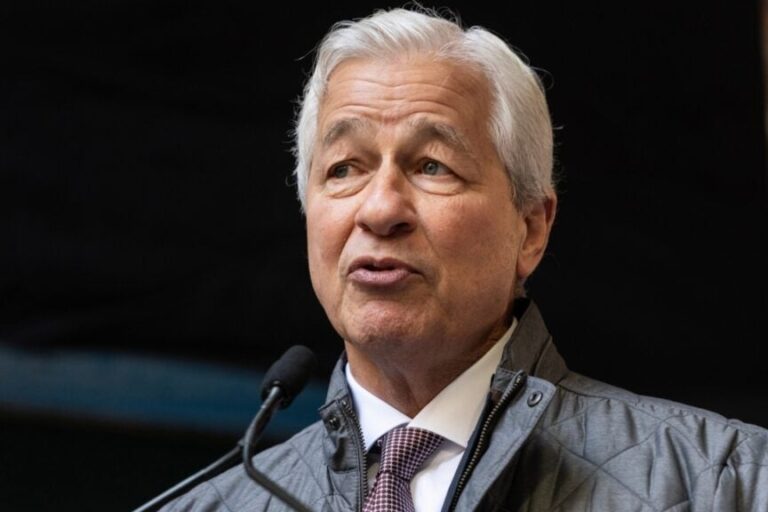

Jamie Dimon, CEO of JPMorgan Chase & & Co. JPM, revealed his views on the existing financial landscape, highlighting issues over geopolitical stress and prospective tariff effects.

What Occurred: In a current discussion with Home ADBE CEO Shantanu Narayen at Adobe’s yearly top, Dimon defined the economy as remaining in a “soft landing” stage, “however there’s a great deal of turbulence out there.” He highlighted the unpredictability surrounding President Donald Trump‘s proposed tax strategy and the prospective implications of tariffs on the international economy, reported Fortune.

Geopolitical problems, specifically the scenarios in Ukraine, Russia, and the Middle East, were likewise a point of issue for Dimon. He stressed their effect on the future of totally free democratic societies.

On the subject of customer costs in the U.S., Dimon kept in mind a decrease in costs amongst lower-income people, while wealthier people stay considerably wealthier due to the increase in home and stock costs over the previous twenty years.

” The bottom 20% [of earners in the U.S.] didn’t get a pay raise for 25 years; they’re passing away more youthful. Their schools aren’t excellent and they reside in crime-ridden communities,” specified Dimon as he revealed issue.

Resolving inflation, Dimon revealed optimism for its reduction. He acknowledged that the shift to a green economy and trade restructuring might result in inflation, recommending the audience to concentrate on long-lasting patterns instead of the current inflation reports.

SEE ALSO: Bitcoin’s Current Battles Aside, Gold Struck A Brand-new All-Time High Shining An Intense Spotlight On These Rare-earth Element Cryptos That Rocked In 2025

Why It Matters: Trump’s current tariff statements have actually gotten blended responses from leading economic experts. While, Lawrence H. Summers, previous U.S. Treasury Secretary, highly slammed current tariff policies, warning versus prospective economic downturn threats and unfavorable long-lasting impacts.

Nevertheless, Justin Wolfers, Senior Fellow at Brookings Institute, specified that an economic downturn is ‘not inescapable,’ while thinking that Trump acquired a robust U.S. economy and has actually not remained in workplace enough time to considerably modify it.

Dimon’s current remarks at the Adobe top supply more insight into his viewpoint on the more comprehensive financial landscape, highlighting prospective obstacles and unpredictabilities that might affect the international economy and customer costs.

Image by means of Shutterstock

Disclaimer: This material was partly produced with the assistance of AI tools and was evaluated and released by Benzinga editors.

Momentum 19.17

Development 61.41

Quality 23.10

Worth 17.00

Market News and Data gave you by Benzinga APIs