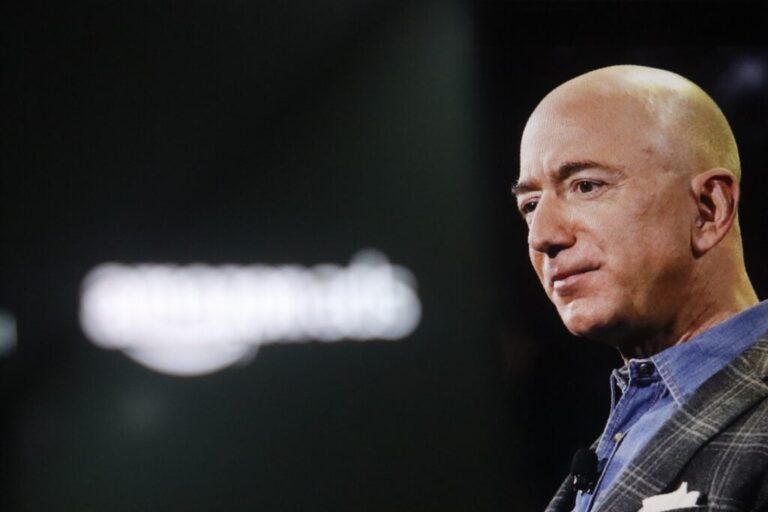

Amazon.com Inc. (NASDAQ: AMZN) creator Jeff Bezos acknowledged that expert system remains in “a sort of commercial bubble” however worried that the innovation is genuine and will provide “massive” advantages to society.

Bezos Calls AI Bubble Positive

At Italian Tech Week in Turin on Friday, Bezos explained the existing rise in AI financial investment as fitting the meaning of a bubble, keeping in mind that appraisals are often separated from the underlying service principles.

He described that throughout bubbles, every experiment gets moneyed– the excellent concepts and the bad concepts, including that it ends up being tough for financiers to different winners from losers.

” That’s likewise most likely taking place today,” he kept in mind.

Nevertheless, the Amazon creator stated that this does not decrease AI’s transformative capacity. “AI is genuine and it is going to alter every market,” he mentioned, calling the buzz cycle a natural phase of development.

See Likewise: Short-Seller Jim Chanos Bets Versus AI Buzz, Challenges Brookfield’s Data Center Projections Of 10X Development By 2034

Lessons From Past Industrial Bubbles

Bezos compared today AI boom to the biotech bubble of the 1990s, when lots of start-ups collapsed however advancements in medication and drug advancement eventually benefited society.

” The [bubbles] that are commercial are not almost as bad, it can even be excellent, due to the fact that when the dust settles and you see who are the winners, societies gain from those creations,” he stated.

Zuckerberg And Altman Raise Bubble Issues

Bezos’s remarks echo issues from other tech leaders, consisting of Meta Platforms Inc. ( NASDAQ: META) CEO Mark Zuckerberg and OpenAI CEO Sam Altman, both of whom have actually confessed the market reveals bubble-like qualities.

Zuckerberg cautioned previously this month that today’s AI costs craze might mirror the dot-com boom-and-bust cycle, however recommended that AI advancement may prevent a collapse if both design abilities and need continue to grow yearly.

Financiers Weigh In On AI Craze

Wall Street stays divided. Goldman Sachs CEO David Solomon on Friday warned that market interest might cause a “reset” in appraisals, reported CNBC.

Previously this month, financial investment company GQG Partners compared the AI boom to the 1999 dot-com crash, pointing out inflated principles.

By contrast, Wedbush expert Dan Ives dismissed collapse worries, calling AI the “4th commercial transformation” and anticipating the market is still in the “2nd inning.”

Benzinga’s Edge Stock Rankings rank Amazon’s development in the 92nd percentile, highlighting its strong efficiency relative to leading AI peers like META.

Read Next:

Disclaimer: This material was partly produced with the assistance of AI tools and was evaluated and released by Benzinga

Image through Shutterstock