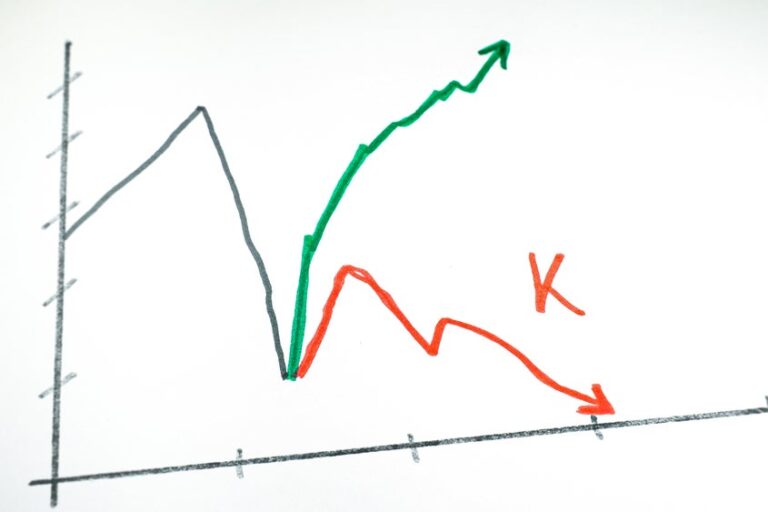

A K-shaped U.S. economy– where wealth continues to focus at the top while the bottom half has a hard time– is leaving its mark on American organizations, with high-end and high-end discretionary costs rebounding even as mass-market usage damages and customer belief plunges to recessionary levels.

According to Bank of America card information, U.S. high-end costs increased 4% year-over-year in October, a 5 portion point enhancement from the 3rd quarter’s 1% contraction. Fashion jewelry costs was specifically strong, speeding up from 10% in the previous quarter to 16% last month– the greatest development rate throughout all tracked classifications.

In a note shared Thursday, Ashley Wallace, expert at Bank of America, stated October revealed clear “green shoots” in U.S. high-end costs, including that “practically all information points enhanced on a 1-year and 2-year basis.”

October’s enhancement showed up throughout both soft high-end and fashion jewelry. In general, American high-end earnings in the 3rd quarter climbed up 5% year-over-year, outshining other worldwide areas and enhancing from the 2nd quarter’s 1%.

Main Street Self-confidence Falls Apart As Wealth-Gap Deepens

The rebound in high-end usage stands in plain contrast to what average Americans are feeling.

Recently, the University of Michigan’s Customer Study revealed that the belief gauge dropped to 50.3 in November, below 53.6 in October and far listed below the long-lasting average of 85. This marks the most affordable level because June 2022 and amongst the weakest readings because the study started in 1952.

Read likewise: Customer Belief Tanks To 2022 Lows, However The Wealthiest 3% Are Commemorating

Bank of America economic expert Aditya Bhave stated the costs space in between high- and low-income homes stays both “stable and considerable,” specifically in discretionary classifications such as airline companies, accommodations, furnishings and cruises.

Apollo Global Management’s primary economic expert Torsten Slok stated current information verifies the shift: “Today, wage development for low-income employees is substantially lower than wage development for middle- and high-income employees,” reversing the pattern seen throughout the pandemic.

Federal Reserve information reveals that the most affluent 10% of Americans own 87% of all U.S. stocks, with the leading 1% alone holding 38%.

Labor market discomfort contributes to the wealth divide. Up until now in 2025, over 1.09 million layoffs have actually been revealed– up 65% from the very same duration in 2015 and on rate for the worst year because the pandemic. Task cuts rose 175% in October alone, according to Opposition, Gray & & Christmas.

Wall Street Bets On The Advantage Of Inequality

Financiers are currently reacting to the brand-new usage map. The Kraneshares Global High-end Index ETF (NYSE: KLXY) has actually increased for 5 straight sessions since Nov. 13, showing growing self-confidence in premium brand names.

The leading 10 holdings in the Kraneshares Global High-end Index– which together represent 65% of the fund’s overall weight– are LVMH Moët Hennessy– Louis Vuitton (OTCPK: LVMUY), Compagnie Financière Richemont SA (OTCPK: CFRUY), L’Oréal S.A. (OTCPK: LRLCY), EssilorLuxottica (OTCPK: ESLOY), Hermès International (OTCPK: HESAY), Moncler S.p.A. (OTCPK: MONRF), Ralph Lauren Corp. (NYSE: RL), Deckers Outdoor Corp. (NYSE: DECK), Ferrari N.V. (NYSE: RACE), and Kering SA (OTCPK: PPRUY).

For financiers aiming to place around this pattern, do not miss out on Benzinga’s newest research study function: 4 Stocks To Think About Purchasing As High-end Costs Keeps Increasing

Image: Shutterstock