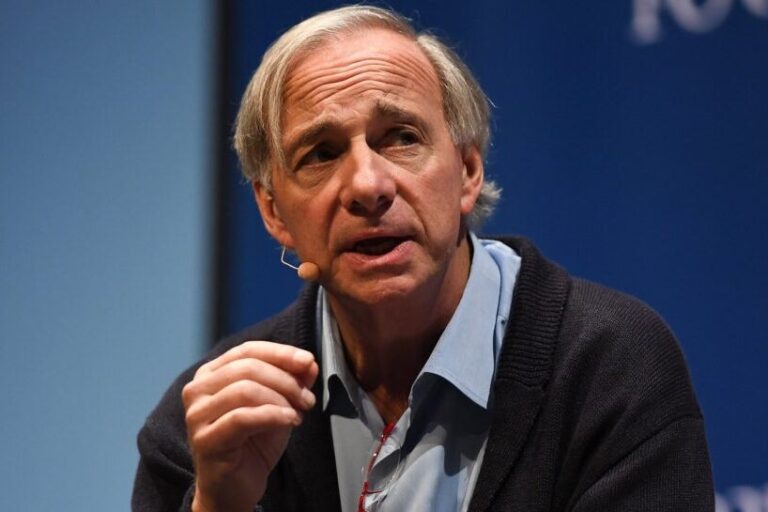

In the wake of President Donald Trump‘s budget plan costs approval, billionaire and monetary consultant Ray Dalio prepares for severe financial consequences.

What Taken Place: Dalio has actually voiced severe apprehensions about the monetary future of the United States. President Trump’s “One Huge Beautiful Costs” is predicted to intensify the nationwide financial obligation from approximately $230,000 per family to $425,000 within the next years.

In a post on X, Dalio warns that this nationwide financial obligation rise will have extreme repercussions. The costs is anticipated to lead to a yearly expense of about $7 trillion versus an earnings of around $5 trillion.

As an outcome, the financial obligation, presently 6x of the earnings, 100% of GDP, and about $ 230,000 per household, will increase to about 7.5 x the earnings, 130% of GDP, and $425,000 per household over the next years.

This increase will raise the interest and primary payments on the financial obligation from about $10 trillion to approximately $18 trillion, leading to considerable costs lowerings, extraordinary tax boosts, or comprehensive cash printing and decline.

Likewise Check Out: United States Deals With ‘Monetary Cardiovascular Disease,’ Ray Dalio Alerts– Shares Financial Investment Methods: ‘The Safest Financial Investment That You Can Solve Now Is An Inflation-Indexed Bond’

Dalio proposes that the option to this looming financial crisis is to cut costs and raise taxes to reduce the yearly deficit to GDP ratio.

He alerts that if these procedures are not quickly executed, “huge, agonizing interruptions will likely happen.”

Why It Matters: The anticipated doubling of the United States nationwide financial obligation over the next years is a major issue.

The anticipated repercussions of this boost, consisting of considerable costs lowerings, extraordinary tax walkings, and possible cash decline, might have significant ramifications for the United States economy.

Dalio’s caution acts as a plain suggestion of the requirement for financial obligation and tactical financial preparation to alleviate these possible interruptions.

Read Next

Ray Dalio Shares His Meme Stock Trading Technique: ‘The Majority Of Financiers Do Not Consider Market Rates, They Do Not Pay Enough Attention To Its Rates’

Image: Shutterstock