A brand-new analysis from economic expert Bob Elliott cautions that a “rise in tariff associated rate walkings” is keeping inflation “stuck above 3%,” successfully erasing any disinflationary relief customers were seeing from falling leas.

Tariffs Are Sustaining ‘Rate Walkings’ While Squeezing Family Costs

In a Substack note, the CEO of Unlimited Funds argued this dynamic is “producing a capture on home costs” as costs for items skyrocket.

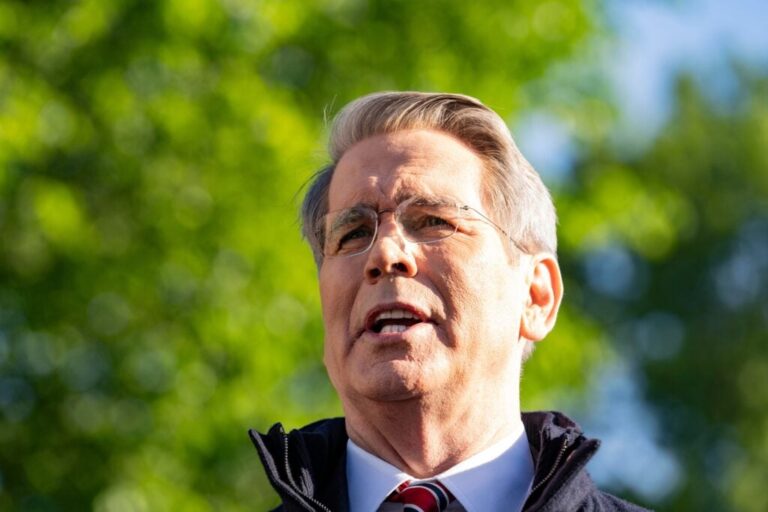

Nevertheless, the analysis, which information how tariff expenses are working “through supply chains,” drew a sharp defense from Treasury Secretary Scott Bessent

In a video published to X, Bessent implicated critics of “cherry-pick[ing]” information to paint a one-sided, unfavorable image of the economy.

” You do not get to cherry choice,” Bessent mentioned. “Inflation is a composite number.” He argued the Donald Trump administration is effectively taming the “horrible price crisis” it acquired, indicating falling costs for products like eggs and gas.

See Likewise: Trump Tariffs Might Fuel Margin Capture, However Not Inflation, Financial Expert States

Tariff-Induced Rate ‘Rise’ Balances Out Lease Relief?

” Leas are boiling down,” Bessent firmly insisted, highlighting the most current month-to-month core inflation figure of 0.2% as “the most affordable that has actually remained in a very long time.”

Elliott’s note, nevertheless, utilizes private-sector charts to argue that this concentrate on leas is misinforming.

He declares the “constant disinflationary pressure originating from determined leas … is being more than balanced out” by the brand-new tariff-related inflation. His analysis indicate information revealing record-high brand-new cars and truck costs and a “noteworthy uptick in costs” for both domestic and imported items.

A Disconnect In The Inflation Argument

The clash highlights a crucial detach in the inflation dispute. The Federal Reserve and the administration have actually signified they will “check out” the tariff walkings, with Jerome Powell seeing them as a “one-time shift in the rate level” instead of an irreversible pattern.

However as Elliott’s note concludes, while policymakers can disregard the rate walkings for setting policy, “families and services can not.”

On Monday, the futures of the S&P 500, Dow Jones, and Nasdaq 100 indices were trading greater.

On The Other Hand, on Friday, the S&P 500 index ended 0.79% greater at 6,791.69, whereas the Nasdaq 100 index increased 1.04% to 25,358.16. On the other hand, Dow Jones advanced 1.01% to end at 47,207.12.

Read Next:

Disclaimer: This material was partly produced with the assistance of AI tools and was examined and released by Benzinga editors.

Image courtesy: Shutterstock