A bulk of Americans now thinks that the recently passed Republican tax and costs expense mainly prefers the rich, opposing GOP declares that the legislation is created to benefit the working class.

What Occurred: A survey from The Associated Press-NORC Center for Public Affairs Research study exposed that around two-thirds of U.S. grownups prepare for that the brand-new tax law will mainly benefit the abundant.

The study likewise found that around 60% of individuals think the law will adversely affect low-income people.

In spite of the GOP’s representation of the legislation as a tax cut for all Americans, Democrats have actually counter-argued that the most affluent will enjoy the most advantages, indicating cuts in Medicaid and food help programs.

The study results recommend that Republicans might require to work more difficult to encourage the general public, as President Donald Trump‘s approval ranking on federal government costs has actually seen a decrease given that spring.

Most of participants understand the brand-new law, and those with more understanding about it are more likely to think it prefers the rich.

Likewise Check Out: Donald Trump’s Approval Ranking Jumps Amongst Child Boomers– Here’s What’s Driving It

Issues have actually been voiced concerning possible influence on caretakers and low-income people, who fear losing access to important services such as daycare and food stamps.

Surprisingly, even amongst Republicans, lots of concur that the rich are most likely to benefit more from the tax and costs law. Roughly half think the law will prefer the abundant over the middle-class or low-income people.

In spite of these understandings, Democrats and independents are most likely than Republicans to think the law might hurt them personally.

The survey likewise recommends that the high expense of the law might be affecting popular opinion, with lots of Americans thinking the federal government is spending too much.

Why It Matters: This shift in popular opinion might have substantial political ramifications. If the understanding that the GOP tax expense prefers the rich continues, it might affect citizen habits in future elections. Additionally, it might impact public assistance for future tax and costs legislation proposed by the GOP.

The findings of this survey emphasize the value of clear interaction and openness in policy-making, as public understanding can considerably affect the success and approval of legislation.

Read Next

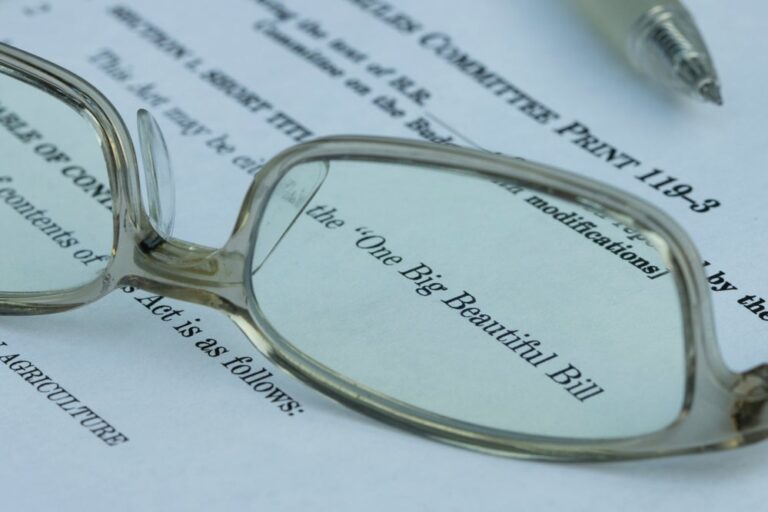

Trump’s Megabill Brings Tax Breaks for the Wealthy and Well-being Cuts– Here’s How Your Earnings Taxes Might Modification

Image: Shutterstock/Tada Images