As a guideline of thumb, whenever gold rates increase, the hidden financial ramifications recommend that business such as Steel Characteristics Inc STLD might have a hard time.

Skyrocketing bullion need shows a shift far from cyclical and commercial plays towards safe-haven properties. Gold’s not creating profits or paying dividends represents an indictment versus risk-on habits. However, existing uncommon situations require a closer– and strangely enough positive– take a look at STLD stock.

To be sure, President Donald Trump‘s administration has actually sparked worries of a drawn-out and awful trade war. While the tariffs that support the president’s financial policies in theory assist domestic markets, it needs to be kept in mind that worldwide supply chains are precisely that– worldwide. Vindictive procedures can harm the U.S. economy which’s not something policymakers can quickly neglect, offered the obstacles American homes deal with.

However, domestic steel manufacturers cheered President Trump’s 25% tariffs on steel and aluminum imports executed recently. In spite of a speedy vindictive relocation by the European Union, the domestic sector has actually notably swung greater. In the tracking 5 sessions, the VanEck Steel ETF SLX has actually gotten almost 5%.

That stated, the disagreement over the core commercial product is complex. Steel manufacturers have actually argued that the Trump tariffs close loopholes, allowing a more beneficial environment for domestic financial investments and production. Nevertheless, due to greater expenses, downstream need might suffer.

Still, cash talks– and the clever cash is signifying positive winds ahead.

Unusual Options Activity Shines the Spotlight on STLD Stock

Amongst the essential indications that retail financiers ought to keep an eye on is Benzinga’s choices scanner, which highlights uncommon activity in the derivatives market. Basically, choices represent the play ground of advanced financiers. For that reason, deal context or volume that goes beyond regular or anticipated specifications might represent prominent signals.

Unlike technical indications such as moving averages, clever cash deals recommend what might occur next– not what did occur. To be reasonable, expert and institutional traders can get their projections incorrect. Nevertheless, these gamers have access to the very best resources and are putting lots of money on the table. For that reason, uncommon choices activity represents weighted viewpoints.

Throughout the Tuesday session, STLD stock represented a crucial emphasize in Benzinga’s uncommon choices screener, with the majority of the significant deals bring bullish belief. Probably, a lot of financiers will concentrate on the acquisition of call choices. Based upon the strike rate and the premium paid, it’s affordable to presume that STLD might poke its head above $139 by mid-May.

What’s possibly most interesting, however, are the offered $140 puts, which end on April 17. At the time of the deal, the quote (or the premium got for the written/sold puts) was $14.60. Deducting this figure from the strike rate lead to a breakeven rate of $125.40. Mentioned in a different way, the put author will take paper losses listed below this point (from an intrinsic worth viewpoint).

Need to STLD stock catch drawback pressure, the put author will naturally sustain task threat. This setup highly suggests that the trader is comfy owning Steel Characteristics stock at the viewed reduced rate of $125.40 (the strike rate minus the premium got). That’s fantastic intelligence for those who wish to trade STLD directly.

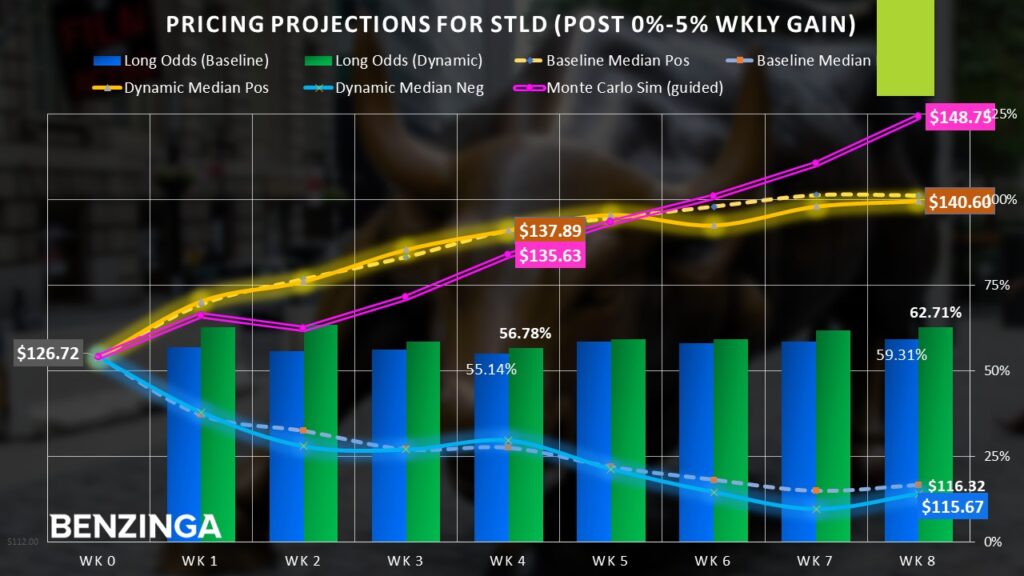

Lastly, financiers ought to acknowledge that STLD stock gain from an upward predisposition. Utilizing information given that January 2019, a long position held for any offered eight-week duration has a 59.31% possibility of increasing. Under vibrant conditions of modest momentum– with STLD presently up 1.5% in the previous 5 sessions– the possibilities do not materially alter.

In reality, the empirical information recommends that the chances of long-side deals enhance.

Following the Smart Cash to Revenues

At this point, financiers have 2 options: observe the political cautions and prevent the steel market completely or follow the clever cash streaming into STLD stock. Honestly, either technique has its set of validations. Still, the daring type might wish to think about the latter path.

Presuming that the bullish thesis turns out, a reasonable benefit target over the next four-and-a-half weeks is around $138. This projection is based upon average favorable returns under standard and vibrant conditions. Even more, a market-realistic Monte Carlo simulation exposes a cost forecast of nearly $136.

With the above market intelligence in mind, financiers might purchase the 130/135 bull call spread ending April 17. This deal includes purchasing the 130 call (at a time-of-writing ask of $400) and all at once offering the $135 call (at a quote of $210). The earnings of the brief call partly balanced out the debit spent for the long call, resulting in a net money investment of $190, the most that can be lost in the trade.

To be clear, both calls are out the cash (OTM); for this reason, the “inexpensive” net debit paid. Even more, the trade focuses on the analytical argument undergirding STLD stock and is much more aggressive than the clever cash. Nevertheless, the optimum payment of over 163% is very appealing.

For those who wish to follow the institutional gamers more carefully, the 125/130 bull spread ending Might 16 is offered. Nevertheless, the payment falls rather substantially to 85.2%. At the very same time, it’s probably among the most high-confidence trades one might make in the domestic steel market.

Read Next:

Image: Vladimir Mulder/Shutterstock. com

© 2025 Benzinga.com. Benzinga does not offer financial investment recommendations. All rights scheduled.