TLN reverses early decrease after alert

Talen Energy (NASDAQ: TLN) experienced a Power Inflow today, a substantial occasion for those who follow where clever cash goes and worth order circulation analytics in their trading choices.

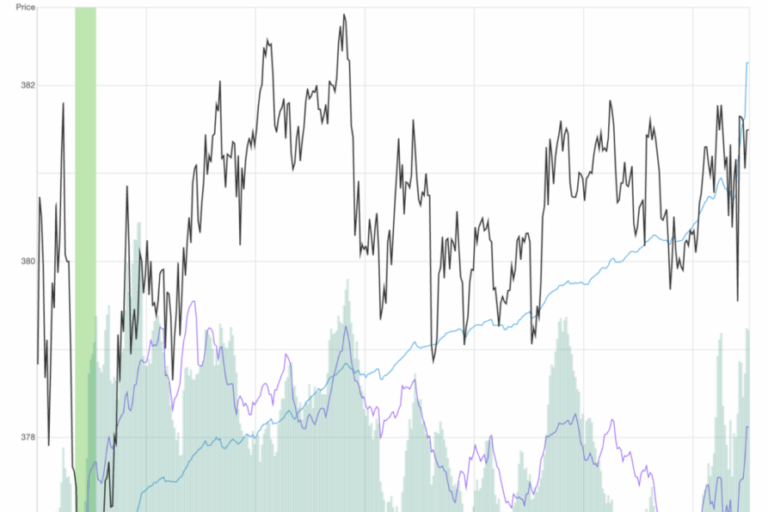

Today, at 10:00 AM on August 27th, a substantial trading signal took place for Talen Energy (TLN) as it showed a Power Inflow at a rate of $ 376.61. This indication is essential for traders who wish to know directionally where organizations and so-called “clever cash” relocations in the marketplace. They see the worth of making use of order circulation analytics to direct their trading choices. The Power Inflow indicates a possible uptrend in Talen’s stock, marking a possible entry point for traders wanting to profit from the anticipated up motion. Traders with this signal carefully expect continual momentum in Talen’s stock cost, analyzing this occasion as a bullish indication. Stock costs increase when there are more purchasers than sellers. This is what Order Circulation Analytics has to do with.

Signal description

Order circulation analytics, aka deal or market circulation analysis, different and research study both the retail and institutional volume rate of orders (circulation). It includes evaluating the circulation of buy and offer orders, in addition to size, timing, and other associated attributes and patterns, to get insights and make more educated trading choices. This specific indication is analyzed as a bullish signal by active traders.

The Power Inflow takes place within the very first 2 hours of the marketplace open and usually indicates the pattern that assists evaluate the stock’s general instructions, powered by institutional activity in the stock, for the rest of the day. This is noted as Big Offer circulation on our platform.

By including order circulation analytics into their trading techniques, market individuals can much better analyze market conditions, recognize trading chances, and possibly enhance their trading efficiency. However let’s not forget that while seeing clever cash circulation can offer important insights, it is essential to include efficient threat management techniques to safeguard capital and alleviate prospective losses. Utilizing a constant and efficient threat management strategy assists traders browse the unpredictabilities of the marketplace in a more regulated and calculated way, increasing the possibility of long-lasting success

If you wish to remain upgraded on the most recent alternatives trades for TLN Benzinga Pro offers you real-time alternatives trades informs.

Market News and Data gave you by Benzinga APIs and consists of companies, like https://tradepulse.net/?utm_source=Benzinga&utm_medium=Article&utm_campaign=brand_awareness_Aug2025

which are accountable for parts of the information within this post.

After Market Close UPDATE:

The cost at the time of the Power Inflow was $ 376.61 The returns on the High cost ($ 382.80) and Close cost ($ 381.50) after the Power Inflow are respectively 1.6% and 1.3% The outcome highlights the value of a trading strategy that consists of Earnings Targets and Stop Losses that show your threat hunger.

This post is for informative functions just and does not make up monetary recommendations, financial investment suggestions, or a solicitation to purchase or offer securities. The analysis is based upon stock order circulation information, however precision is not ensured. Investing includes threat, consisting of possible loss of principal, and previous efficiency is not a sign of future outcomes. Please seek advice from a certified monetary consultant before making any financial investment choices.

Benzinga Disclaimer: This post is from an unsettled external factor. It does not represent Benzinga’s reporting and has actually not been modified for material or precision.