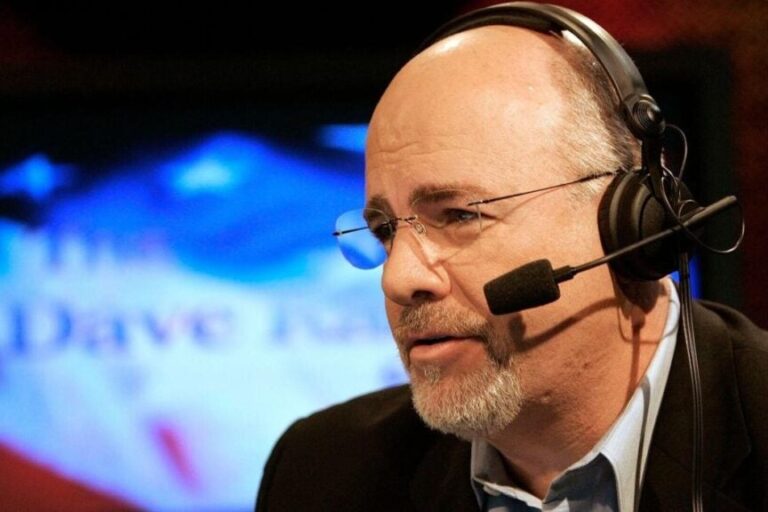

On Tuesday, a caller to The Ramsey Program stimulated dispute after relative prompted him to put cost savings towards his home mortgage rather of financial obligation, triggering Dave Ramsey to provide among his hallmark blunt reactions.

Ramsey Slams Household Home Mortgage Guidance As Caller Arguments $22,000 Cost Savings

The caller, who presented himself as Jeeoff, stated he had about $22,000 in cost savings and $12,500 in exceptional loans while resolving Child Action 2 of Ramsey’s seven-step strategy.

Both his daddy and mother-in-law recommended utilizing his cost savings to pay for the home mortgage.

Ramsey dismissed that concept. “I believe their recommendations is silly. I believe they imply well. However it’s dumb,” he informed the caller. “We have actually led more individuals out of financial obligation into millionaire net worth than any other company operating in America today.”

Ramsey Presses Financial Obligation Reward Before Home Mortgage, Details 7-Month Emergency Situation Fund Strategy

Ramsey prompted Jeeoff to instantly utilize the cost savings to eliminate the $12,500 financial obligation, keep $1,000 aside for emergency situations, and after that reconstruct the fund to a minimum of $20,000.

Without any more financial obligation payments, the caller stated he might conserve about $1,000 a month, however Ramsey challenged him to press it to $1,500, which would bring back the account within 7 months.

” The one vote that does count is your spouse’s,” Ramsey included, worrying that unity in monetary choices was vital.

See Likewise: Border Czar Tom Homan States ‘No Objective’ To Arrest Gavin Newsom In spite of Trump’s Remarks: ‘They Have Not Crossed A Line Yet’

Ramsey’s Child Steps Assist Couple Squash $37,900 Financial Obligation In Under 3 Years

Ramsey developed the Child Steps formula to assist individuals leave financial obligation. It had actually assisted lots of, consisting of a Reddit user who shared her experience of ending up being debt-free after settling $37,900 in less than 3 years.

The 23-year-old spouse described that she and her partner started their Child Steps journey in November 2023.

The majority of their financial obligation originated from trainee loans and car loans, however by following Ramsey’s recommendations, they settled their responsibilities and later on shared their brand-new monetary objectives after ending up being debt-free.

Ramsey Cautions Versus Debt-Driven Lifestyles In The Middle Of Record Charge Card Balances

Ramsey has actually long warned that record-high charge card financial obligation of $1.21 trillion and paycheck-to-paycheck living threaten Americans’ long-lasting monetary security. He typically mentions success stories, like listeners who ended up being debt-free and began investing, as evidence that his methods work.

In early 2024, he utilized social networks to highlight pricey errors, consisting of purchasing homes with single partners, updating cars after insurance coverage payments, and obtaining greatly for low-paying professions.

Calling such options “dumb” and even a “Fruity Pebbles crisis,” Ramsey rather prompted Americans to follow zero-based budgeting, pay with money, and utilize the financial obligation snowball approach. He stressed that while preventing financial obligation is crucial, earnings stays the most effective wealth-building tool.

Read Next:

Disclaimer: This material was partly produced with the assistance of AI tools and was examined and released by Benzinga editors.

Image courtesy: Shutterstock