It’s that season when Wall Street’s leading strategists inform customers where they see the stock exchange heading in the year ahead.

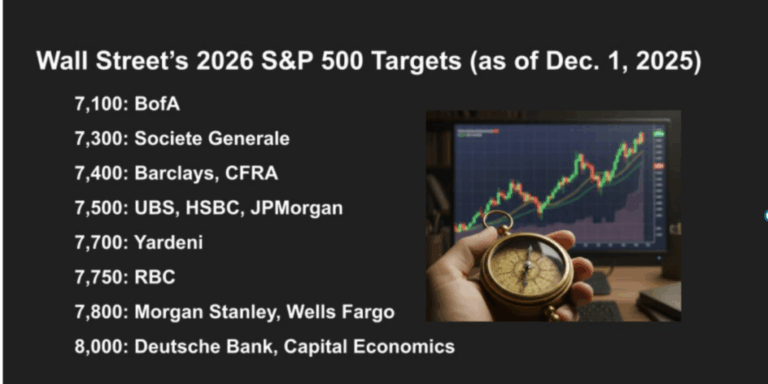

The strategists followed by TKer have year-end S&P 500 targets varying from 7,100 to 8,000. This indicates returns in between 3.3% and 16.4% from Friday’s close.

Following 3 successive years of above-average gains, a few of these targets might appear aggressive. However traditionally, targets tend to presume 8% to 10% returns, constant with the midpoint of this year’s forecasts.

Before we carry on, I ‘d as soon as again care versus putting excessive weight into 1 year targets. It’s exceptionally hard to forecast short-term relocations in the marketplace with any precision. Couple of have actually ever had the ability to do this regularly. Likewise, the marketplace seldom provides a typical return in a given year.

DataTrek’s Nick Colas has actually mentioned that the basic variance around the mean yearly overall return for the S&P 500 is almost 20 portion points! Simply put, the S&P might return 20 portion points basically than the long-lasting average and still be “constant with historic standards.”

With that in mind, here are a few of what’s driving Wall Street’s views on the stock exchange for 2026:

- Profits must take advantage of financial tailwinds: While financial development isn’t anticipated to be magnificent, it must be reinforced by financial stimulus from the One Big Beautiful Costs Act (anticipated to include 0.9% to GDP), simpler financial policy as the Federal Reserve continues to cut rates, trade policy that’s more friendly than 2025, and more costs in AI capex. (Naturally, some sectors are anticipated to do much better than others, however we’re not going to get into that level of information here.)

- There will be some financial obstacles: Inflation is anticipated to stay above the Fed’s 2% target rate. And labor markets are anticipated to stay cool as business concentrate on keeping expenses down by turning to AI for significantly complicated jobs.

- Earnings margins are anticipated to get fatter: Experts anticipate already-high revenue margins to get back at greater in 2026. Notably, the majority of sectors are anticipated to see revenue margin development. Given that the pandemic, business have actually changed their expense structures strongly. This has actually included tactical layoffs, combined office, and financial investment in brand-new devices, consisting of efficiency-enhancing tools powered by AI. These relocations are leading to favorable operating utilize (i.e., the degree to which costs relocation when sales relocation). Learn More here.

- Revenues development must be strong: The agreement requires an excellent 14% revenues development in 2026. The “Stunning 7” names are anticipated to lead the rise, however their development rate is anticipated to cool from current years. On the other hand, revenues development rates are anticipated to get broadly in other sectors. Likewise, it deserves keeping in mind that revenues price quotes tend to be quite precise.

- Evaluations might remain high: The more bullish strategists argue today’s above-average P/E ratios are warranted and must continue through 2026. Some even reached to utilize the word “bubble” to define their views. Learn More here

- However evaluation might be a headwind: The more conservative strategists anticipate P/E ratios to contract from raised levels. That suggests any returns in 2026 would be mostly driven by revenues development.

- Be careful midterm election years: Numerous strategists keep in mind that midterm election years tend to be the weakest of a president’s four-year term. CFRA’s Sam Stovall has the statistics: “The intra-year drawdown for mid-term election years considering that 1946 balanced 18%, which was the greatest of all 4 years of the governmental cycle. In addition, the S&P 500 experienced the weakest typical yearly rate gain, at just 3.8% and increased in rate just 55% of the time, versus a typical gain of 10.8% and 76% frequency of advance for the other 3 years.”

In summary: Broadening revenue margins are anticipated to turn modest earnings development into double-digit revenues development, which must drive stock costs higher. The magnitude of those rate gains will depend upon whether appraisals remain high.

The 2026 S&P 500 rate targets

Below is a roundup of 13 of these 2026 targets, consisting of highlights from the strategists’ commentary.

- BofA: 7,100, $ 310 (since Nov. 26): “Several growth and revenues development both pressed the S&P 500 up 15% this year. In 2026, revenues will do the liſt (we anticipate 14% development, or $310) with about 10pt PE contraction. 7100 indicates ~ 5% rate return. In 2025, policy unpredictability stymied expanding, and assistance stayed soft. However from here, reward devaluation must pull forward capex, business assistance is 2 to 1 bullish, and belief is far from blissful. Liquidity is complete blast today, however the instructions of travel is likely less, not more– less buybacks, more capex, less reserve bank cuts than in 2015, and a Fed cutting just if development is weak.”

- Societe Generale: 7,300, $310 (since Nov. 26): “Fed rate cuts are incomplete organization. The One Big Beautiful Costs Act (OBBBA) has front-loaded stimulus, revenue margins are expanding beyond Tech, and business activity is broadening. AI-driven capex is speeding up, and loaning is up, however utilize stays in check in general. Bottom line: The background is favorable for United States properties– it’s prematurely to call the bull run over.”

- Barclays: 7,400, $305 (since Nov. 19): “1) The AI story keeps rolling, regardless of current volatility stimulated by capex and funding issues, as calculate need continues to scale and money making grows to encapsulate paid users, advertisements, and enterprise/agents; 2) Fed cuts are positive for appraisals, particularly for cyclical/growth equities; 3) simpler monetary conditions support healthy offer activity; 4) worst is most likely past on the tariff front, while United States financial profile has actually enhanced YTD + modest increase from OBBBA; 5) United States ’26 GDP most likely slow vs. LT pattern however much better than the majority of DMs, while United States equities continue to lead RoW in EPS development, margin growth and modifications.”

- CFRA: 7,400 ( since Nov. 24): “In spite of beneficial GDP and EPS projections, 2026 must be unpredictable, considering that it is a mid-term election year, particularly considering that a ‘wave’ is at stake (single-party control of the executive and legal branches). For that reason, as we approach the brand-new year, we encourage financiers to stay invested however watchful, concentrating on greater quality development business.”

- UBS: 7,500, $309 (since Nov. 10): “[E] arnings expectations and appraisals are amongst the greatest in 4 years. Market and design efficiency recommends an impending expanding and reinforcing of development. We see that occurring however just from Q2 2026, with a speed bump up initially as tariffs aggravate the growth-inflation mix momentarily. The marketplace must combine and premium stocks must outshine. From late Q1, we must see an expanding of the rally into lower-quality cyclicals. Base case, we see the S&P 500 increasing to 7,500 in ’26 driven by ~ 14% revenues development, almost half of that from Tech. The contribution from evaluation is most likely to be a little unfavorable.”

- HSBC: 7,500, $300 (since Nov. 24): “… recommending another year of double-digit gains matching the late 1990s equity boom. At that time, like today, tech is leading, return concentration is high, and a brand-new innovation is assuring to be transformational. We anticipate equities to stay supported by the AI-led capex boom. Our associates have weighed in on the concern: Are we in a bubble? Bubble or not– history reveals that rallies can last for rather a long time (3-5 years in the dot com/housing boom), so we see more to come and advise an expanding of the AI trade.”

- JPMorgan: 7,500, $315 (since Nov. 25): “In spite of AI bubble and evaluation issues, we see existing raised multiples properly expecting above-trend revenues development, an AI capex boom, increasing investor payments, and simpler financial and financial policies. Likewise, the revenues advantage connected to deregulation and expanding AI-related efficiency gains stay underappreciated.”

- Yardeni: 7,700, $310 (since Nov. 25): “We anticipate that 2026 will be simply another year of the Roaring 2020s, which stays our base-case situation.”

- RBC: 7,750, $311 (since Dec. 1): “Financier belief might have more space to fall in the near term, however is currently at levels sending out a contrarian buy signal over the longer term. … Expectations for strong EPS development plus some modest evaluation tailwinds from lower rates can balance out the evaluation headwinds from uneasy inflation in the year ahead. … Bonds should not frighten financiers far from stocks. … The expected GDP background is a little a drag on our stock exchange projection. … Combating the Fed does not make good sense.”

- Morgan Stanley: 7,800, $317 (since Nov. 17): “The capitulation around Freedom Day marked completion of a three-year rolling economic crisis and the start of a rolling healing. Our company believe that we remain in the middle of a brand-new booming market and revenues cycle, particularly for a lot of the delayed locations of the index. We believe that the majority of the aspects of a traditional early-cycle environment are with us today– compressed expense structures that set the phase for favorable operating utilize, a historical rebound in revenues modifications breadth, and suppressed need throughout large swaths of the market/economy that were stuck in the preceding rolling economic crisis.”

- Wells Fargo: 7,800, $310 (since Nov. 21): “Our target is driven by our PRSM structure (Earnings, Rates, Belief, Macro). Earnings: +14% YoY for 2026E EPS and +13% for 2027E; Rates: unfavorable due to tight liquidity, however we anticipate a Fed increase; Belief: contrarian Buy signal activated (SPX +7.5% N3M on avg. & & 90% hit rate); Macro: turned favorable for the very first time considering that Jan 2025. The general PRSM rating of 0.2 indicates +12% return over N12M.”

- Deutsche Bank: 8,000, $320 (since Nov. 26): “In 2026, we see robust revenues development and equity appraisals staying raised. We anticipate a pickup in revenues development in 2026 to 14% (from 10% in 2025), taking S&P 500 EPS to $320. Business cost-cutting and the labor market stay dangers, however for administration policies we anticipate checks and balances in the run-up to the mid-term elections. At 25x, the S&P 500 tracking several is well above the historic average (15.3 x) however quickly described by beneficial chauffeurs: greater payment ratios, greater viewed pattern revenues development, less big drawdowns in revenues, and inflation listed below its long-run average.”

- Capital Economics: 8,000 ( since Nov. 19): “[W] e presume that the near-term dangers are more about viewed need for AI, or whether capex is extreme. Our projection for the S&P 500 to increase to 8,000 by end-2026 implicitly presumes that appraisals will increase a lot even more before the bubble, if there is one, bursts.”

2 features of 1 year rate targets ♂

The majority of the equity strategists TKer follows produce exceptionally extensive, premium research study that shows a deep understanding of what drives markets. As a result, the most important things these pros need to use have little to do with 1 year targets. This is what we mainly cover at TKer. (And in my years of engaging with a lot of these folks, a minimum of a few of them do not care for the workout of publishing 1 year targets. They do it due to the fact that it’s asked of them or it’s popular with customers.)

So to begin with, do not dismiss a strategist’s work even if their 1 year target is off the mark.

2nd, I’ll duplicate what I constantly state when talking about short-term projections for the stock exchange:

⚠ It’s exceptionally hard to forecast with any precision where the stock exchange will remain in a year. In addition to the numerous variety of variables to think about, there are likewise the absolutely unforeseeable advancements that take place along the method.

Strategists will frequently modify their targets as brand-new details is available in. In reality, a few of the numbers you see above represent modifications from previous projections.

For the majority of y’ all, it’s most likely inexpedient to upgrade your whole financial investment method based upon a 1 year stock exchange projection.

However, it can be enjoyable to follow these targets. It assists you get a sense of the numerous Wall Street companies’ level of bullishness or bearishness.

I believe RBC’s Lori Calvasina stated it finest: The rate target “must be considered as a compass instead of a GPS. It is a construct that assists to articulate whether our company believe stocks will move greater and why.”

All the best in 2026!

Benzinga Disclaimer: This post is from an unsettled external factor. It does not represent Benzinga’s reporting and has actually not been modified for material or precision.