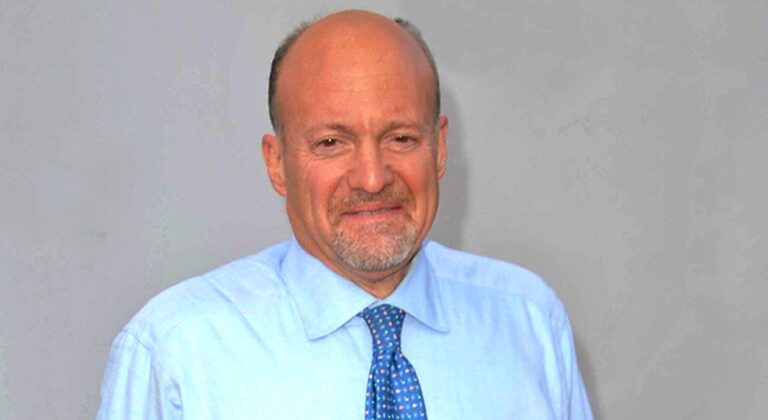

television host Jim Cramer is leaning back into the bank trade, stating that depressed assessments throughout the sector have actually developed a chance, which one stock, in specific, sticks out with the most possible.

Bank Stocks Are ‘All Low-cost’

On Tuesday, in a post on X, the popular host of CNBC’s “Mad Cash” stated, “The banks are all inexpensive,” while pointing out one specific banking stock as the “most inexpensive of all,” which, as an outcome, uses the “most upside” relative to others.

The stock he’s describing is Virginia-based Capital One Financial Corp. (NYSE: COF), the sixth-largest bank in the United States. Cramer stated that he’s backed this name for a long stretch, and kept in mind that he’s kept his bullish view on it “for 60 points.”

See Likewise: Bank Of America, Citigroup, EQT And More On CNBC’s ‘Last Trades’

This begins the heels of Capital One’s $35.4 billion acquisition of Discover Financial Provider, which closed previously this year and is anticipated to produce considerable synergies.

The business likewise holds $56.92 billion in excess capital, offering it space to support buybacks, while the stock trades at simply 10.91 times forward incomes.

| Stocks | Year-To-Date Efficiency | Price-To-Earnings Ratio |

| JPMorgan Chase & & Co. ( NYSE: JPM) | +25.21% | 14.61 |

| Wells Fargo & Co. ( NYSE: WFC) | +26.64% | 13.04 |

| Bank of America Corp.( NYSE: BAC) | +20.89% | 12.32 |

| Citigroup Inc. (NYSE: C) | +56.46% | 11.03 |

| Goldman Sachs Group Inc.( NYSE: GS) | +52.46% | 15.82 |

| Capital One Financial Corp. | +29.15 % | 10.91 |

Other Experts Turn Bullish

A number of other popular experts have actually turned bullish on Capital One in current weeks, with Wolfe Research study starting protection of the stock with an “Obese” score and a target of $270 a share, previously today, which represents a benefit of 16.97%.

Citigroup experts have actually likewise restated their “Purchase” score on the stock, while raising their target from $275 to $290, representing a 25.64% upside from present levels.

The banking sector has actually had a terrific run this year, with a crucial driver being the 2025 Federal Reserve tension test, which significant banks passed with capital delegated spare, resulting in $100 billion being returned in the kind of dividends and buybacks.

Shares of Capital One were up 0.09% on Tuesday, closing at $230.81, and are up 0.52% over night. The stock ratings high up on Momentum in Benzinga’s Edge Stock Rankings, with a beneficial cost pattern in the brief, medium and long terms. Click on this link for much deeper insights into the stock, its peers and rivals.

Picture courtesy: Shutterstock