In the face of a frothy market, economist Jim Cramer motivates financiers to persevere, highlighting many favorable stock stories that counterbalance the marketplace’s impracticality.

What Taken Place: Cramer made a case recently, asserting that the present market conditions are far gotten rid of from the dotcom bubble burst of the late 90s. He stressed that regardless of the froth, today’s market is more reasonable.

Cramer accentuated the impracticality in current IPOs like Circle, Figma, and Bullish, which have actually experienced substantial gains because their launch.

On CNBC, he likewise kept in mind Oklo Inc., a company with aspirations to build a compact atomic power plant powered by hazardous waste, whose stock has actually risen 247% year-to-date.

” Flying cars and trucks, supercharged crypto ETFs, deceptive business that seek advice from in wonderful methods, all illogical. I might go on and on,” Cramer stated. ” Is the prevalent impracticality a factor to offer down your positions in completely reasonable stocks? Never.”

Likewise Check Out: Jim Cramer Has Blunt Message for Fed Chair Powell After July Task Numbers Tanked

Trending Financial Investment Opportunities

On the other hand, Cramer indicated Amazon Inc. AMZN and Eli Lilly and Business LLY as circumstances of rationality.

Amazon’s stock climbed up by 3% after the intro of same-day fresh food shipment in over 1,000 U.S. cities and towns. Eli Lilly’s stock likewise experienced an increase when a group from the pharmaceutical business’s management and board of directors acquired stock on the free market.

” Sure, there’s froth, however there are likewise completely genuine relocations in the stocks of fantastic business. I am calling this the year of wonderful thinking, however the reality is you can’t get the runs in the excellent ones without the runs in the bad ones,” Cramer included.

Read Next

Brief Seller Slams Jim Cramer Over Palantir, Implicates Him Of Hyping ‘High-Multiple, Hype-Driven Story’

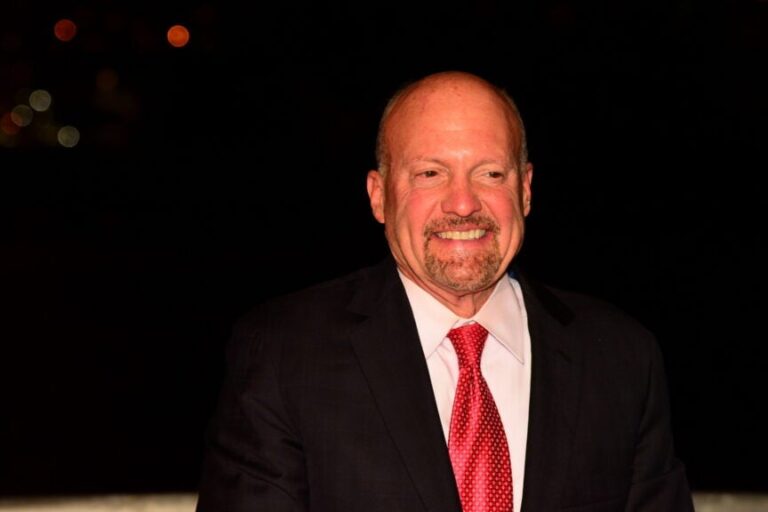

Image: Shutterstock/katz