Numerous tech giants cheered a surprise weekend choice from the White Home which protected essential electronic devices from high brand-new tariffs on Chinese imports, most especially Alibaba Group Holding Ltd BABA

Formerly, Alibaba was on a definitive turn-around effort till aggressive rhetoric and positioning– eventually culminating in sweeping brand-new tariffs identified Freedom Day– rattled belief.

Not long after the tariff statement, President Donald Trump revealed a 90-day time out on levies versus particular nations that did not execute vindictive steps. At the very same time, the administration increase import taxes on China to a shocking 145%. Reacting to the relocation, Beijing raised its own tariffs to 125% on Friday.

For that reason, the weekend choice represented an enjoyable and, honestly, a welcome shift in tone. With more individuals fretted about monetary obstacles intensifying into a recession, taking part in a full-blown trade war would harm both countries. Thanks to cooler heads obviously dominating, Alibaba’s stock shot greater.

However, it’s rather possible– maybe even most likely– that the marketplace is excessively bullish in expecting a sustainable, long-lasting option. For something, the principle of preserving one’s honor is an important element of Chinese service culture. Therefore, Trump’s absence of conventional diplomatic grace dangers deepening the fight, not reducing it. Second, the administration alerted that the exemptions will be temporary.

If so, it might be more sensible to presume that while Alibaba’s stock can move higher from here, ultimately, even this mini-rally might slow down and remedy.

Taking What the marketplace Will Offer Alibaba Stock Put Spreads

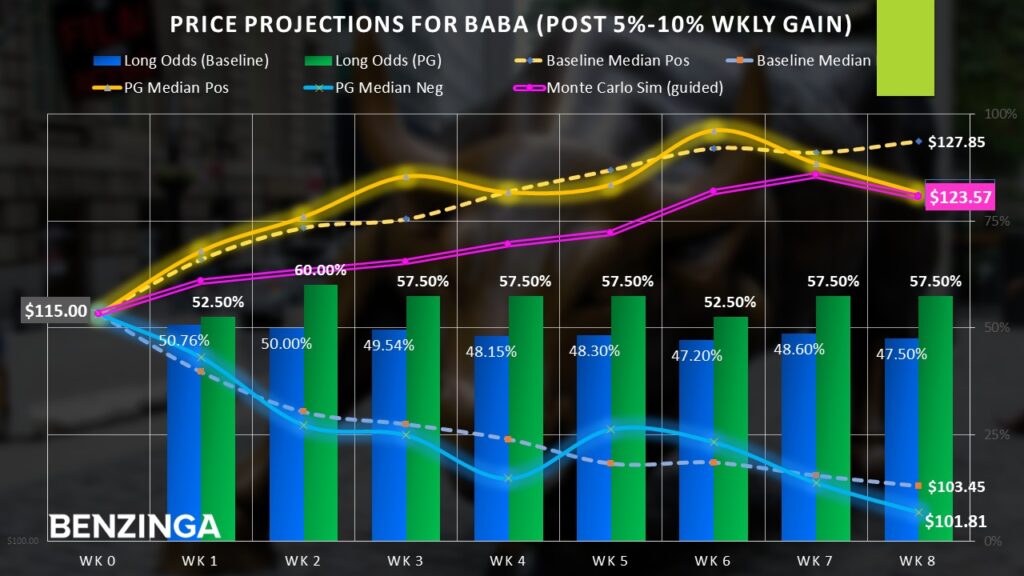

From a longer-term bullish viewpoint, it’s relatively clear that the optimists want to drive BABA stock towards the $130 level, a position where the security developed an upper standard before trade war stress hindered belief. Nevertheless, to get to that point, Alibaba’s stock requires to increase above a multi-year resistance barrier around the $115 to $120 variety.

Since the protecting of particular electronic items from increase tariffs is just short-term and with longstanding problems in between the world’s leading 2 economies yet to be dealt with, the current increase in the tech area might be short-term.

Sweetening the pot is the analytical argument for Alibaba’s bear case. For any offered two-week duration, Alibaba includes a neutral to somewhat upward predisposition. Simply put, if a hundred trades were put on the equity, perhaps 51 or 52 of them would increase by the next 2 weeks on a great streak.

Simply put, such a deal would deserve examining if a bearish trade provides the equivalent of a worth bet– some reward that tilts a neutral trade into one that remains in the gambler’s favor.

The wild card is that Alibaba’s stock tends to be a momentum play. Whenever the equity gains in between 5% and 10% over a one-week duration (such as now), the likelihoods shift in favor of the bulls. At the very same time, the dangers of the present geopolitical environment may not be completely baked in.

Highlighting the Risk-Inverted Put Spread

For those who expect that the optimism in Alibaba will quickly fade, the 120/117 bear put spread out for the alternatives chain ending April 25 appears luring. This deal includes purchasing the $120 put (for a time-of-writing ask of $840) and at the same time offering the $117 put (at quote of $640), leading to a net debit paid of $200.

Need to Alibaba share rates are up to or listed below the $117 short put strike rate at expiration, the optimum benefit is $100, or a tidy payment of 50%. What sticks out, naturally, is that presently, the share rate is listed below the target. Instead of theta (or time decay) working versus the purchaser, it now works for the purchaser.

Basically, the purchaser gets in the sell a winning position on paper and is just awaiting merging to parity– the elegant term for gathering the debit spread’s optimum payment. Usually, credit sellers do the awaiting merging (although in their case, it’s a merging to absolutely no). Therefore, as situations stand now, the 120/117 bear put spread is efficiently risk-inverted.

Lastly, this trade is likewise engaging due to the fact that as a standard, the opportunities that Alibaba’s stock will increase 1.7%– approximately the space in between the brief strike rate and BABA’s present market value– over a two-week duration is just around 42%.

Efficiently, what empirically is a neutral wager leans bearishly under the context of the abovementioned bear put spread. Even if you’re not always unfavorable on Alibaba, the worth bet Wall Street supplies might be too appealing to neglect.

Now Check Out:

Image: Shutterstock

© 2025 Benzinga.com. Benzinga does not supply financial investment guidance. All rights booked.