The wise cash or informally the whales do things a little in a different way from everyone else, positioning them on loftier ground. One example of this contrast comes thanks to gambling establishment operator Wynn Resorts, Limited WYNN Due to the fact that of difficult financial situations originating from inflation to tariffs, it’s simple to presume that WYNN stock would be a loser under today environment. Nevertheless, the reverse holds true, calling for a better look.

To be reasonable, both from a preliminary look and a much deeper evaluation, WYNN stock would appear an extremely dangerous long wager. As a wave of pessimism has actually swept American families, with the Customer Self-confidence Index plunging to its least expensive level in over a year. The Trump administration’s trade war has actually intensified continuous issues of inflation and equity market volatility, adding to the ugly atmosphere.

Nominally, the abovementioned index fell by 7.2 indicate 92.9, representing its 4th successive month-to-month decrease. Per information launched by The Conference Board, it’s likewise the most affordable reading because late 2022. Due to the fact that of the larger ramifications, the significant indices were silenced, with the S&P 500 having a hard time to keep its head above parity.

Under these conditions, one typically would not anticipate WYNN stock to surpass. Yet on Tuesday, the equity completed the day 1.3% greater. Essentially, the counterproductive relocation is tough to discuss aside from a belief divergence. When filtered for earnings level, all customer groups revealed weakening belief other than for families making above $125,000 yearly.

It’s likewise possible that especially young customers’ fondness for travel and experiences might have resulted in favorable vibes for WYNN stock. Still, The Conference Board previously reported that the variety of Americans preparing getaways in the next 6 months struck a 15-year low, leaving out COVID-19. For that reason, the bullishness in WYNN is an extremely contrarian relocation.

WYNN Stock Pops from Smart Cash Need

In spite of the rather awful background that Wynn Resorts discovers itself in, 2 significant advancements from the wise cash have actually emerged. Initially, WYNN stock has actually been a recipient of expert purchases up until now this year. Most just recently, 10% owner Fertitta Home Entertainment obtained 1.7 million shares of WYNN, resulting in an overall deal of almost $145.71 million.

When experts offer shares, such deals are tough to figure out precisely as there might be a number of reasons that, consisting of entirely ordinary ones. On the other hand, when experts purchase shares, the analysis is simple: they expect capital gratitude.

The 2nd driver for WYNN stock is that the wise cash is moving into the underlying derivatives market. Previously in the day, Benzinga’s alternatives scanner determined uncommon activity, with net belief leaning optimistically. Remarkably, the most bullish trade was for offered $87 puts with an expiration date of March 28.

To rapidly evaluate, put holders have the right however not the commitment to offer the hidden security at the noted strike rate. On the other end of the trade, put sellers (or authors) get earnings for financing the danger that the security in concern will not fall. If it does fall listed below the breakeven limit, put sellers might be obliged to purchase the stock, a procedure called project.

From Tuesday’s uncommon alternatives activity, retail financiers might presume that the wise cash does not see WYNN stock falling materially listed below $87. However, in the worst-case circumstance, the wise cash is likewise obviously comfy owning shares at around $85.35, which is the strike rate minus the premium gotten (or the quote rate of $1.65).

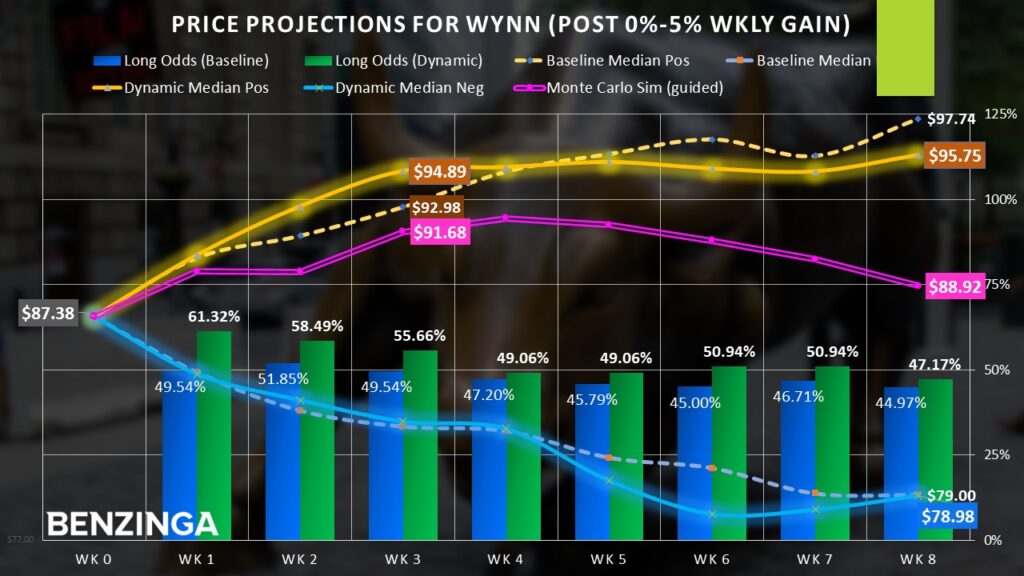

Bold traders can utilize this market intelligence and release an aggressive alternatives trade. It needs to be kept in mind, though, that a person of the primary threats here is that WYNN stock over the previous 6 years struggles with an unfavorable predisposition. A long position held for any provided eight-week duration just has a 45% opportunity of increasing, which isn’t excellent.

Still, not all hope is lost. The subtlety is that when WYNN stock encounters modest momentum– such as its present run of 2.5% over the previous 5 sessions– the likelihoods of advantage tend to be pressed forward to the very first couple of weeks following stated momentum.

Acquired Wagers for the Aggressive Bettor

For aggressive traders wanting to draw out fast revenues, the 86/89 bull call spread ending this Friday might be appealing. This deal includes purchasing the $86 call (at a time-of-writing ask of $286) and concurrently offering the $89 call (at a quote of $82). The earnings from the brief call balanced out the debit spent for the long call, leading to a net money expense of $204.

In the above trade, the optimum benefit is the distinction in between the strike costs (increased by 100 shares) minus the money expense or $96. This equates to a payment of a little over 47%, which is set off ought to WYNN stock struck the brief strike target of $89 at expiration. While the payment isn’t the most generous, it’s a sensible target provided Tuesday’s intraday high, which surpassed $89.

Another daring trade to think about is the 89/91 bull spread for the alternatives chain ending April 11. This trade tries to advantage WYNN’s analytical propensity of increasing in the early weeks following modest momentum before ultimately lessening. While far riskier, the temptation is that this deal presently provides an optimal payment of 115%.

Read Next:

Image: Shutterstock

© 2025 Benzinga.com. Benzinga does not supply financial investment guidance. All rights scheduled.