The $64 Trillion Concern

As we composed previously this month (” The $64 Trillion Concern”), the most essential concern with regard to stocks is whether President Trump means his brand-new tariffs to stabilize trade or not. Many market individuals, consisting of hedge fund supervisor Costs Ackman, still think the tariffs are merely a working out method. That indicates that stocks have even more to fall, since the pivot to a brand-new financial design hasn’t been priced in.

That’s still real, however a couple of associated concerns have actually emerged ever since that we need to attend to.

Why Does Trump Keep Discussing Making Offers On Tariffs?

If Trump’s objective is to stabilize trade, there actually isn’t much to work out. The other nation either purchases more from us or we purchase less from them, or both; those are the only methods to stabilize trade. If China, for instance, fine-tunes its tariff program, however still runs enormous trade surpluses with us, why would Trump be pleased by that?

The other issue with Trump’s talk of dealmaking is that it makes many individuals believe he’s not severe about stabilizing trade. And if CEOs do not believe he’s severe about it, they will be less most likely to sustain the expenses needed to move production to the U.S. And if business do not move production here, we’ll have the worst of both worlds: greater expenses for imports without a revival in domestic production.

Can We Keep The World’s Reserve Currency Without Trade Deficits?

A couple of experts, consisting of Cullen Roche, have actually recommended we can’t, however we really did have the world’s reserve currency and trade surpluses– for 26 years. The U.S. dollar formally ended up being the world’s reserve currency with the Breton Woods contract in the summer season of 1944. At that point, we had actually been running trade surpluses almost every year considering that 1870, which pattern continued up until 1970.

Would It Be So Bad If We Can’t?

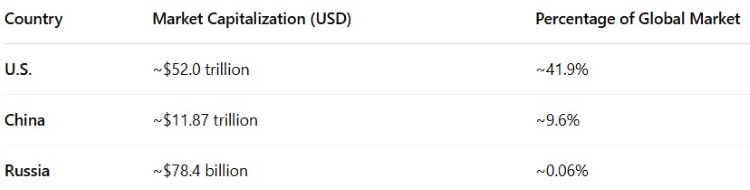

How has having the world’s reserve currency assisted us just recently? Let’s compare the U.S. to 2 nations that do not have the world’s reserve currency, however do have relentless trade surpluses, Russia and China.

You might object that unlike Russia and China, the U.S. is “currently abundant”, so we had less possible for enhancement. Definitely, that holds true, if you compare our stock exchange …

However how does that or our reserve currency status assist the state of our facilities or public areas? Compare New York City to Moscow …

Or to Shanghai …

Are the Chinese actually losing out on not having the world’s reserve currency? Are we utilizing ours to obtain so we can tidy up New york city and repair its facilities? Not rather.

Would we miss out on having the world’s reserve currency, if, in exchange, we reindustrialized?

Is the Status Quo Even Sustainable?

Critics of Trump’s tariff policy appear to believe that we could have kept the status quo (seasonal, expanding, trade deficits) forever, however is that real? Warren Buffett didn’t believe so when he composed this alerting about our trade deficits in Fortune He utilized a parable of 2 islands, Squanderville and Thriftville, which you can check out at that link. Let’s consider this in more concrete terms though.

All U.S. dollars eventually need to be invested in America. Nations that have trade surpluses with us, like China, can’t discover sufficient products or services of ours they wish to purchase. So what else can they make with their dollars? They can purchase U.S. securities, of which the biggest, putatively best, and the majority of liquid are U.S. Treasury bonds. Or they can purchase U.S. realty. However the length of time would our Treasuries stay appealing to them, if we keep running enormous financial deficits (recommending we’ll require to pump up away our financial obligation)? And the length of time would our realty stay appealing to them, if the existing trajectories of our cities and theirs continue?

Narrowing Our Focus To The Near Term

Whatever the responses to the concerns above, the photo in the near term appears clearer. It promises that we are currently in an economic downturn. The DOGE cuts alone most likely kicked that off (even inefficient federal government costs promotes the economy), and the DeepSeek Sputnik minute in January most likely contributed to it, by cooling huge tech capex. When it comes to the tariffs, while big business need to have the ability to adjust to them, by moving production. However as Ryan Petersen keeps in mind below, the majority of small companies that import from China will not have the ability to adjust.

That does not indicate stabilizing trade isn’t needed or worth doing, however that there’s most likely to be a huge financial hit in the near term.

What This All Way For Financiers

Stocks most likely have even more to fall this year. On top of the DOGE cuts, the continuous ripples from DeepSeek, and the tariffs, the Trump administration’s crackdown on Ivy League universities might trigger a few of the biggest endowments to dispose stocks.

What To Do About It

If you are a conservative financier

Think about hedging. As a pointer, you can download the Portfolio Armor optimum hedging app by intending your iPhone video camera at the QR code listed below (or by tapping here, if you read this on your phone). Our app can assist you discover the least pricey hedges provided your threat tolerance and timespan.

If you are an aggressive financier

Watch out for chances en route down. Consider all of those small company Ryan Petersen alerted will fail, for instance. The majority of them aren’t openly traded, however there are a couple of openly traded suppliers a number of them utilize. We have bearish trades teed up on those suppliers. If you would like a direct when we position them, do not hesitate to sign up for our trading Substack/occasional e-mail list listed below.

Market Disaster Update

Benefited from today’s market crisis to leave a number of bearish bets …

Alternatives

- Places On Apple, Inc. AAPL Purchased for $1.81 on 4// 14/2025; cost $2.71 on 4/21/2025. Earnings: 50%

- Places On Nvidia Corporation NVDA Purchased for $1.56 on 4/9/2025; cost $4.02 on 4/21/2025. Earnings: 158%

And include a number of bullish bets. We’ll want to include the bearish bets pointed out above on the next bounce.

If you want to remain in touch

You can scan for optimum hedges for private securities, discover our existing leading 10 names, and develop hedged portfolios on our site. You can likewise follow Portfolio Armor on X here, or end up being a totally free customer to our trading Substack utilizing the link listed below ( we’re utilizing that for our periodic e-mails now).

© 2025 Benzinga.com. Benzinga does not offer financial investment guidance. All rights booked.