Prominent financier Peter Lynch when opened about his early experiences in the stock exchange, his preliminary financial investment, and the viewpoint that directed his effective investing profession.

What Occurred: Lynch, who is popular for his effective stint at Fidelity’s Magellan Fund, traced his interest in the stock exchange back to his youth in the 1950s. His interest was ignited while working as a caddie at a golf club in West Newton, where he would frequently overhear business executives going over stocks.

While studying at Boston College on a caddie scholarship, Lynch made his very first financial investment in Flying Tiger, an air cargo business.

Persuaded of the future of air freight, he invested $1,000. The stock’s worth skyrocketed throughout the Vietnam War as the business was associated with moving soldiers, providing Lynch his very first “10 bagger”– a term he created for a stock that returns 10 times the financial investment.

Lynch’s financial investment viewpoint highlights the value of letting effective stocks run. He thinks that a couple of “10 baggers” can make up for average or badly carrying out stocks in a financier’s portfolio. In Lynch’s words, “You need to let the huge ones offset your errors.”

Likewise Check Out: Peter Lynch’s Market Observation: ‘Even More Cash Has Actually Been Lost By Financiers Getting Ready For Corrections, Than Has Actually Been Lost In Corrections Themselves’

” The trick is if you have a great deal of stocks, some will do average, some will do alright, and if one of 2 of them increase huge time, you produce a wonderful outcome. And I believe that’s the guarantee to some individuals. Some stocks increase 20-30 percent and they eliminate it and they keep the pets. And it’s sort of like watering the weeds and eliminating the flowers. You wish to let the winners run. When the enjoyable ones improve, contribute to them, which one winner, you generally see a couple of stocks in your life time, that’s all you require,” Lynch stated throughout an interview.

In spite of losing out on numerous stocks that increased ten-fold throughout his period at Magellan, Lynch’s technique showed to be effective. He repeated that in investing, being best 6 times out of 10 is thought about excellent, and highlighted the value of taking calculated dangers.

Why It Matters: Lynch’s journey from a caddie to a well known financier highlights the value of interest, determined risk-taking, and persistence in effective investing.

His viewpoint of letting effective stocks run and permitting “10 baggers” to offset less effective financial investments provides important insights for both newbie and skilled financiers.

His story acts as a pointer that success in investing does not constantly originated from being best all the time, however from being best sufficient times and letting those successes run.

Read Next

Peter Lynch’s Recommendations: ‘If You Can’t Discuss to an 11-Year-Old in 2 Minutes or Less Why You Own the Stock, You Should not Own It’

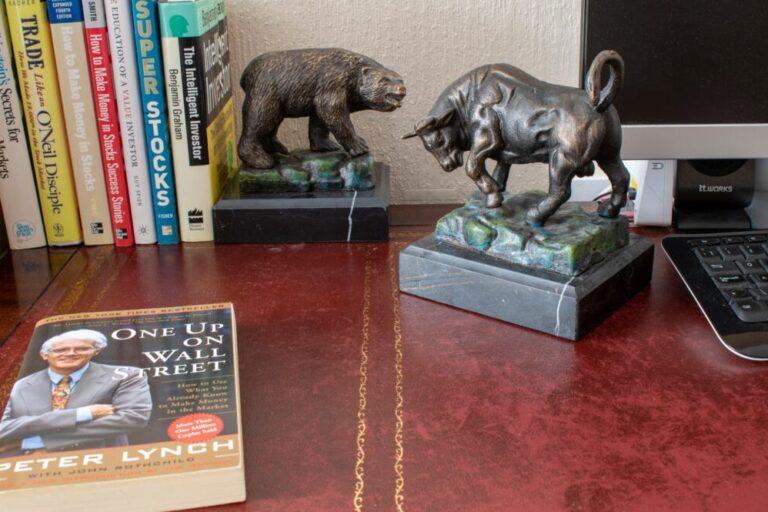

Image: Shutterstock/AVM Images