In the existing market session, Zimmer Biomet Holdings Inc. ZBH cost is at $102.35, after a 0.09% spike. Nevertheless, over the previous month, the stock reduced by 6.85%, and in the previous year, by 17.39% Investors may be thinking about understanding whether the stock is underestimated, even if the business is carrying out up to par in the existing session.

A Take A Look At Zimmer Biomet Holdings P/E Relative to Its Rivals

The P/E ratio determines the existing share cost to the business’s EPS. It is utilized by long-lasting financiers to examine the business’s existing efficiency versus it’s previous profits, historic information and aggregate market information for the market or the indices, such as S&P 500. A greater P/E shows that financiers anticipate the business to carry out much better in the future, and the stock is most likely misestimated, however not always. It likewise might show that financiers want to pay a greater share cost presently, due to the fact that they anticipate the business to carry out much better in the approaching quarters. This leads financiers to likewise stay positive about increasing dividends in the future.

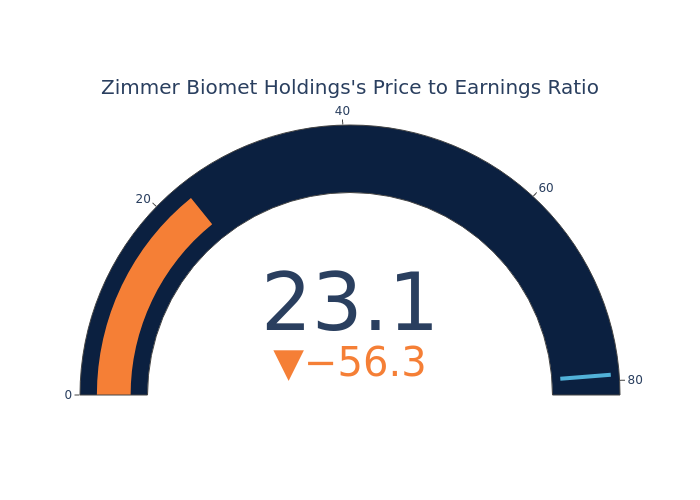

Zimmer Biomet Holdings has a lower P/E than the aggregate P/E of 79.42 of the Healthcare Devices & & Products market. Preferably, one may think that the stock may carry out even worse than its peers, however it’s likewise possible that the stock is underestimated.

In conclusion, the price-to-earnings ratio is a beneficial metric for evaluating a business’s market efficiency, however it has its restrictions. While a lower P/E can show that a business is underestimated, it can likewise recommend that investors do not anticipate future development. Furthermore, the P/E ratio need to not be utilized in seclusion, as other aspects such as market patterns and organization cycles can likewise affect a business’s stock cost. For that reason, financiers need to utilize the P/E ratio in combination with other monetary metrics and qualitative analysis to make educated financial investment choices.

Market News and Data gave you by Benzinga APIs