The most oversold stocks in the monetary sector provides a chance to purchase into underestimated business.

The RSI is a momentum indication, which compares a stock’s strength on days when rates increase to its strength on days when rates decrease. When compared to a stock’s rate action, it can offer traders a much better sense of how a stock might carry out in the short-term. A possession is normally thought about oversold when the RSI is listed below 30, according to Benzinga Pro.

Here’s the current list of significant oversold gamers in this sector, having an RSI near or listed below 30.

SWK Holdings Corp SWKH

- On March 19, SWK Holdings reported quarterly profits of 54 cents per share. SWK CEO Jody Staggs stated, “Throughout the 4th quarter, we closed an approximately $8.0 million term loan with Triple Ring and broadened our credit center with Eton to $30.0 million. In February 2025, we closed a $15.0 million funding dedication with Impedimed.” The business’s stock fell around 13% over the previous month and has a 52-week low of $14.45.

- RSI Worth: 20.8

- SWKH Cost Action: Shares of SWK Holdings fell 2.9% to close at $14.78 on Thursday.

- Edge Stock Scores: 84.16 Momentum rating with Worth at 63.67.

Fiserv Inc FI

- On April 24, Fiserv provided FY25 changed EPS assistance with its midpoint listed below quotes. The business reported quarterly earnings development of 5% year-over-year to $5.13 billion, beating the expert agreement price quote of $4.84 billion. Development was 5% in the Merchant Solutions sector and 6% in the Financial Solutions sector. The business’s stock fell around 21% over the previous month and has a 52-week low of $146.25.

- RSI Worth: 20.8

- FI Cost Action: Shares of Fiserv dipped 18.5% to close at $176.90 on Thursday.

- Benzinga Pro’s charting tool assisted recognize the pattern in FI stock.

Waton Financial Ltd WTF

- On April 2, Waton Financial revealed the closing of going public with synchronised complete workout of the over-allotment alternative. The business’s stock fell around 62% over the previous month and has a 52-week low of $4.05.

- RSI Worth: 19.8

- WTF Cost Action: Shares of Waton Financial fell 6.5% to close at $7.60 on Thursday.

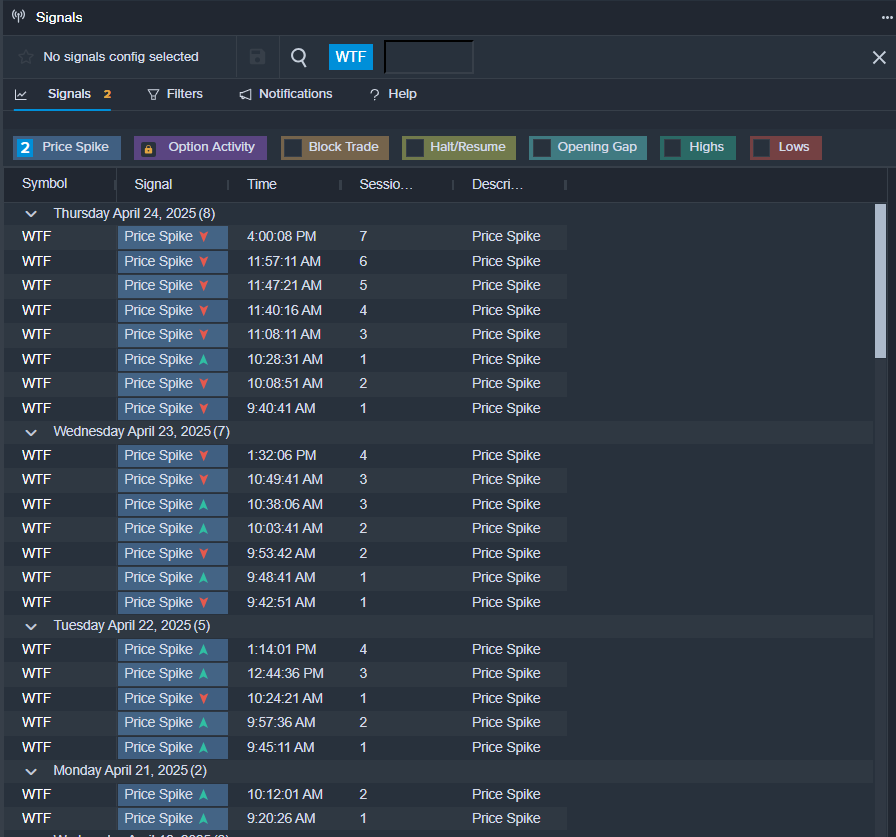

- Benzinga Pro’s signals include informed of a prospective breakout in WTF shares.

Discover More about BZ Edge Rankings– click to see ratings for other stocks in the sector and see how they compare.

Read This Next:

Picture by means of Shutterstock

Market News and Data gave you by Benzinga APIs