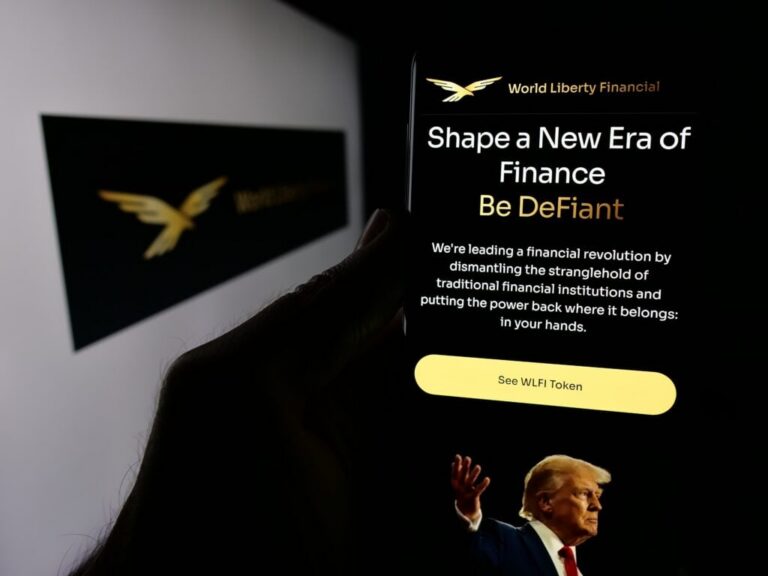

World’s biggest cryptocurrency exchange Binance (CRYPTO: BNB) holds the lion’s share of World Liberty Financial USD (USD1), the stablecoin provided by a Trump household cryptocurrency endeavor.

Concentration A Warning?

The cryptocurrency leviathan manages $4.7 billion of the stablecoin’s $5.4 billion overall supply, according to information from on-chain analytics firm Arkham, very first kept in mind on Forbes

Keep in mind that Binance’s 2023 settlement with the Treasury Department disallows it from serving American clients. Forbes stated that the 87% of USD1 kept in Binance-controlled wallets would “primarily be hung on behalf of clients outside the U.S.”

Binance didn’t right away return Benzinga’s ask for remark. A reaction from World Liberty Financial, the cryptocurrency platform behind USD1, is likewise waited for.

USD1’s Strategic Increase

CZ has consistently rejected these claims, clarifying it was a deal payment– not a financial investment in World Liberty Financial. Remarkably, he stated at the World Economic Online Forum in Davos that Binance’s U.S. affiliate is preparing a return.

Although disallowed from functional participation under a 2023 plea contract connected to anti-money laundering failures, CZ stays a managing investor and prominent figure at Binance.

Disclaimer: This material was partly produced with the aid of Benzinga Neuro and was examined and released by Benzinga editors.

Picture Courtesy: T. Schneider on Shutterstock.com

Market News and Data gave you by Benzinga APIs

To include Benzinga News as your favored source on Google, click on this link.