The nationwide typical credit history– which had actually been progressively increasing for over a years– succumbed to the 2nd year in a row, according to a brand-new report from FICO, designer of among ball games most commonly utilized by lending institutions.

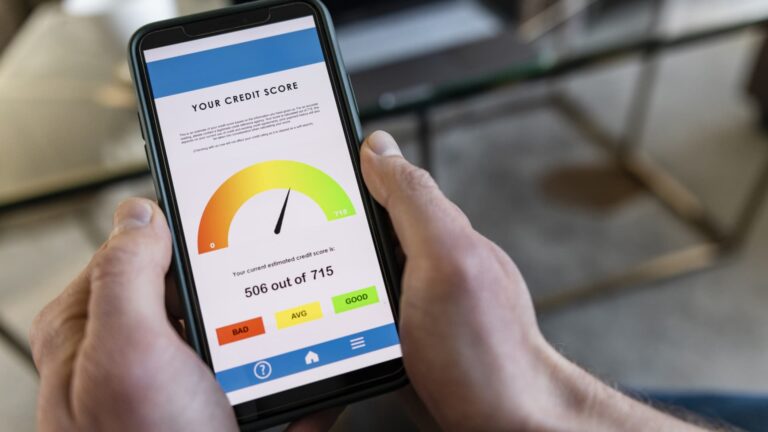

The typical rating is now 715, below 717 in 2024 and 718 in 2023. FICO ratings vary in between 300 and 850.

High rate of interest and greater costs have actually been a drag on lots of Americans’ monetary standing. Customers, in general, are falling much deeper into financial obligation, triggering a boost in charge card balances and a boost in missed out on payments, FICO discovered. That added to the typical rating decrease.

” I’m not shocked that credit rating are slipping,” stated Matt Schulz, primary credit expert at LendingTree. “Countless Americans are having a hard time strongly in the face of persistent inflation, high rate of interest, a challenging task market and general financial unpredictability– and bumpy rides frequently require difficult choices.”

Trainee loan delinquencies are crucial aspect

The resumption of federal trainee loan delinquency reporting on customers’ credit was another substantial contributing aspect to decreasing ratings, according to FICO.

In a March report, the Federal Reserve Bank of New york city alerted that trainee loan debtors who are late on their payments would experience “substantial drops” in their credit rating.

At first, those debtors taken advantage of the pandemic-era forbearance on federal trainee financial obligation, which marked all overdue loans as existing. Typical credit rating for trainee loan debtors increased by 11 points in between completion of 2019 to the end of 2020, the Fed scientists discovered. Nevertheless, that relief duration formally ended on Sept. 30, 2024.

More from Personal Financing:

More customers utilize lease payments to improve their credit history

Some tasks might not receive the ‘no tax on suggestions’ policy

Trump administration to alert households about trainee financial obligation threats

The resumption of trainee loan delinquency reporting caused a spike in the rate of current, extreme delinquencies, according to FICO’s report.

Even more, trainee loan delinquencies might continue to increase in the months ahead, mostly due to modifications in the accessibility of income-driven payment strategies, according to Tommy Lee, senior director of ratings and predictive analytics at FICO.

Not all debtors are having a hard time

While the current “K”- shaped financial healing triggered monetary tension for some debtors, others have actually reinforced their monetary position. Now, more customers score in the greatest and least expensive rating varieties, FICO likewise discovered.

” While the typical rating has actually decreased, there are customers who are taking advantage of all-time highs in the stock exchange and valuing home costs,” stated Lee. “ They have actually ended up being wealthier with the characteristics in the stock exchange and the property market.”

How to get a much better credit history

For those who have actually suffered the effects of lower credit rating, which might consist of lowered credit line, greater rate of interest for brand-new loans and limited credit gain access to in general, there are methods to improve your rating practically instantly, professionals state.

” Among the crucial things to understand is that FICO ratings are vibrant,” Lee stated.

A few of the very best methods to enhance your credit history boil down to paying your costs on time on a monthly basis, just requesting credit as required and keeping your usage rate, or the ratio of financial obligation to overall credit, listed below 30% to restrict the impact that high balances can have, Lee stated.

Increasing your credit history to great (740 to 799) from reasonable (580 to 669) might conserve you more than $39,000 over the life time of your balances, an analysis previously this year by LendingTree discovered — with the biggest effect from lower home mortgage expenses, followed by favored rates on charge card, automobile loans and individual loans.

” There’s extremely little in life that’s more costly than having rotten credit,” LendingTree’s Schulz stated. “It can cost you 10s of countless dollars throughout the years in costs and interest.”

Register For CNBC on YouTube.