Nitat Termmee|Minute|Getty Images

The chances of a U.S. economic crisis have actually increased in the middle of an intensifying trade war. However the majority of financiers must disregard the impulse to get away for security by leaving the marketplace, economists state.

Rather, the very best method to brace for a financial shock is by confirming principles like property allotment and diversity, they stated.

” You’re trying to find balance instead of casting your lot with any one financial result,” stated Christine Benz, director of individual financing and retirement preparation for Morningstar.

The likelihood of a financial decline increased to 36% in March from 23% in January, according to fund supervisors, strategists and experts surveyed for a current CNBC Fed Study. A current Deutsche Bank study pegged the chances at nearly 50-50.

President Donald Trump hasn’t dismissed the possibility of a U.S. economic crisis and previously this month stated the economy remained in a “duration of shift.”

Economic downturn isn’t guaranteed, however, and financial experts usually concur the opportunities are reasonably low.

‘ Market timing is a bad concept’

Attempting to forecast when and if an economic crisis will take place is almost difficult– and acting upon such worry typically causes bad monetary choices, consultants stated.

” Market timing is a bad concept,” stated Charlie Fitzgerald III, a qualified monetary organizer based in Orlando, and an establishing member of Moisand Fitzgerald Tamayo. Attempting to forecast market motions and exit before a decrease resembles “betting, it’s turning coins,” he stated.

When it concerns investing, your method needs to resemble seeing paint dry, he stated: “It needs to be dull.”

He typically informs financiers to concentrate on guaranteeing their portfolio is effectively diversified rather of fretting about an economic crisis.

More from Personal Financing:

Stock volatility positions an ‘chance’

How tariffs sustain greater costs

The ‘threat zone’ for retired people when stocks dip

When the economy heads towards an economic crisis, it’s natural for financiers to fret about falling stock costs and the effect on their portfolio. However financiers on a regular basis make missteps and think improperly, professionals state.

Psychological habits– offering stocks throughout market declines and missing out on the rebounds– is a huge factor financiers underperform the broad market, professionals stated.

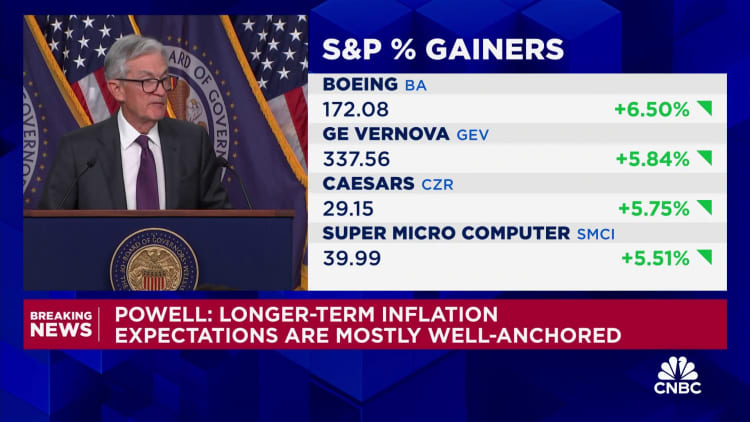

The typical stock financier made 5.5 portion points less than the S&P 500 in 2023, for instance, according to DALBAR, which performs a yearly financier habits research study. Financiers made about 21% while the S&P 500 returned about 26%, DALBAR stated.

The story was comparable in 2022: Financiers lost 21% while the S&P 500 decreased 18%, it discovered.

Stocks have actually constantly recuperated after bottoming out throughout economic crises, Fitzgerald stated. Missing out on those rebounds can be pricey, he stated.

” I ‘d certainly advise individuals to tap on the brakes before making huge shifts in anticipation of some market result,” Benz stated.

Examine your property allotment

That stated, the possibility of an economic crisis is a great time for financiers to review their portfolios and make little modifications, if needed, professionals stated.

Advisors recommend financiers analyze their property allotment to ensure it’s proper for their objectives and timeline, and to rebalance if their allowances have actually left whack. They must be diversified amongst (and within) property classes, professionals stated.

A target-date fund or well balanced fund kept in a pension might be excellent choices for financiers who wish to contract out property allotment, diversity and rebalancing to an expert property supervisor, Benz stated.

Young financiers conserving for retirement– and who are more than twenty years from reaching their financial investment timeline– must usually be 100% in stocks, Fitzgerald stated.

Nevertheless, there is one exception: Financiers who are likewise conserving for a short-term requirement within 3 to 5 years, maybe a deposit on a home, must not keep those funds in the stock exchange, Fitzgerald stated. Put that cash in a more secure location like a cash market fund, so you understand it’ll exist when you require it, he stated.

Retirees and near-retirees might gain from a less dangerous portfolio, professionals stated. An allotment of 60% stocks and 40% bonds and money, or a 50/50 split are excellent beginning points, Benz stated.

Senior citizens usually require to keep a piece of their portfolio in stocks– the development engine of a portfolio– to assist their financial investments last through aging, consultants stated. Bonds usually function as a ballast throughout economic crises, normally increasing when stocks are falling, they stated.

Retirees who count on their financial investments for earnings must prevent withdrawing from stocks if they’re decreasing throughout an economic crisis, consultants stated. Doing so, specifically within the very first 5 or two years of retirement, raises the chances that a senior citizen will diminish their portfolio and outlast their cost savings, research study programs. (This is called “series of returns” threat.)

Retirees who do not have a container of bonds and money from which to pull throughout such times might gain from preparing while the economy is still strong, Benz stated.

” If you have actually a portfolio built all right, [a recession] will be unpleasant and the waves will toss [the ship] around a bit, however the ship isn’t going to sink,” Fitzgerald stated.