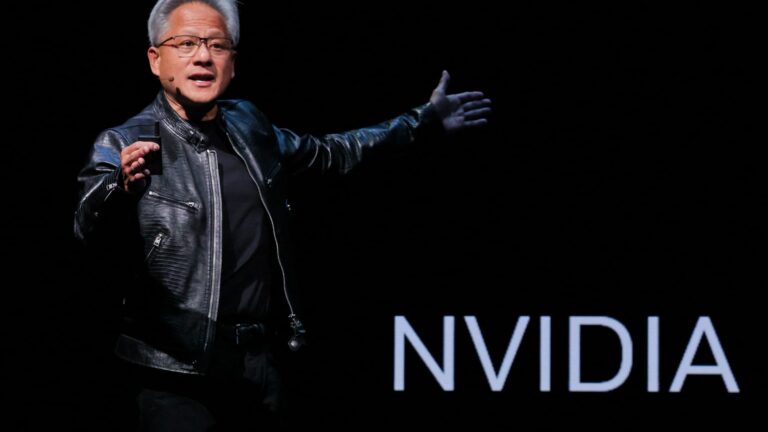

Here are Friday’s greatest get in touch with Wall Street: Citi upgrades Wynn to purchase from neutral After a modification in expert protection, Citi updated the gambling establishment business and states it’s shooting on all cylinders. “On the other hand, WYNN brings the most inorganic development capacity to the table, with a significant job now on the horizon (UAE), the brand name strength to be a strong competitor for any chances beyond the horizon or, additionally, the capital generation and balance sheet health to go into a capital return stage beginning in 2027/2028.” Find out more. KeyBanc starts Elanco as obese KeyBanc stated the family pet health business is a share gainer. “ELAN’s Newest Development Products Launches Are Exposed to A Few Of the Fastest Growing and Largest Markets in Animal Health.” Citi starts Zeta Global as buy Citi stated it sees an appealing entry point for the software application marketing tech business. “We start protection of Zeta Global with a Buy ranking and $26 target rate (~ +50% benefit) as we see it well placed to catch wallet share in marketing innovation, and digital media invest.” William Blair upgrades Cognizant Innovation Solutions to surpass from market carry out William Blair stated it’s bullish on the innovation services business. “In general, Cognizant has momentum after 5 successive quarters of favorable natural continuous currency development for business.” Raymond James renews Nvidia as strong buy Raymond James resumed protection of the stock and states it stays engaging. “NVIDIA Corporation leads in AI and is a core holding. NVIDIA maintains considerable competitive moats with a comprehensive and fully grown software application stack arising from over a years running start, a strong neighborhood supported by the leading designers, and its full-stack systems technique and platform cadence.” Loop starts SiTime Corporation as buy Loop stated it sees a multitude of favorable drivers ahead for the semiconductor chipmaker. “We are starting protection of SiTime, Corp (SITM) with a Buy ranking and $350 rate target.” Raymond James upgrades Doximity to strong purchase from outperform The company stated presence has actually enhanced for the software application business. “We’re updating Doximity from Outperform to Strong Buy following a substantial dislocation in shares publish F2Q outcomes, with the existing risk/reward at 25x FCF looking too engaging to neglect. While we comprehend financier concerns around seasonality and assistance viewpoint, we really believe the long-lasting development visibility/durability is enhancing.” Find out more. Goldman Sachs downgrades Bath & & Body Functions to neutral from buy Goldman devalued the stock following profits. “We are devaluing BBWI to a Neutral from Buy offered our company believe management’s method modification represents a noteworthy modification in business thesis.” UBS repeats Apple as neutral UBS stated its checks reveal wait times stays “raised” for Apple’s iPhone. “UBS Proof Laboratory information that tracks iPhone accessibility throughout 30 locations recommends wait times continue to tick lower WoW for the Base and Pro Max usually, the 2 designs that stay raised on a YoY compare.” Rothschild & & Redburn Certara as buy The company stated Certara has upside prospective. “We introduce protection of Certara, the marketplace leader in software application modelling for drug advancement, with a Buy ranking and $10 rate target, which provides 21% prospective benefit.” Deutsche Bank resumes Carvana as buy Deutsche stated the business advises the company of Amazon. “We are resuming protection of Carvana with a Buy ranking and a $395 Target Rate. To us, Carvana, like Amazon before it is a traditional market-leading 1P e-commerce gamer that remains in the early innings of doubling down on the benefits managed to it by means of a totally verticalized facilities.” Oppenheimer downgrades T-Mobile to carry out from outperform The company stated it’s worried about a cost war. “T-Mobile Downgrading to Carry Out: Market Rate War Will Hurt Flowshare and Margins Oppenheimer starts IBM as outperform Oppenheimer stated it sees “margin growth.” “We are starting protection of International Company Machines (IBM) with an Outperform ranking and a $360 rate target …” Morgan Stanley starts MapLight Therapies Morgan Stanley stated the biotech business is well placed. “We start protection of MapLight Therapies with an Obese ranking and a $34 PT.” Baird upgrades WillScot to surpass from neutral Baird stated financiers need to purchase the dip in the portable centers business.” WSC’s multi-year cyclical decline has actually hurt. Nevertheless, our company believe 3Q25 was a watershed quarter, considerably reducing expectations and developing what our company believe could/should be an investable bottom.” Berenberg starts Interparfums as buy The company stated it sees development capacity for the appeal business. “Interparfums, Inc (IPAR) is an extremely focused business, exposed to simply one Charm classification: scent. It stays a little name in a $43bn market, providing a significant development runway. Its extremely versatile and asset-light service design, combined with the long-lasting vision of its 2 creators, has actually shown– and will stay– disruptive.” Citi upgrades Cushman and Wakefield to purchase from neutral Citi stated it sees balance sheet deleveraging for the property business. “We are updating CWK t o Purchase from Neutral as our company believe the enhancement in the deal market and leasing environment will: 1) continue to drive outsized profits development, and 2) enable CWK to continue to carry out on deleveraging its balance sheet.”

Related Articles

Add A Comment