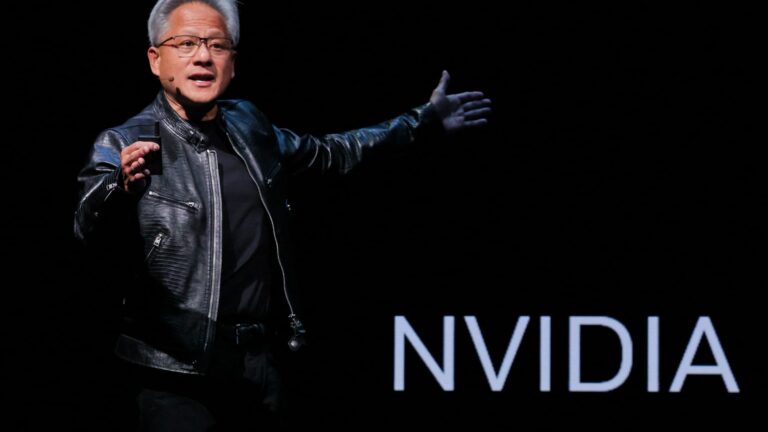

Here are Tuesday’s most significant contact Wall Street: Goldman Sachs starts Transformation Medication as buy Goldman stated the oncology business is well placed. “We start protection on Transformation Medicines (RVMD) with a Buy ranking and 12-month cost target of $65.” Goldman Sachs starts Alkermes as buy Goldman stated it likes the biopharma business’s pipeline of items. “We start protection on Alkermes (ALKS) with a Buy ranking and 12-month PT of $43. ALKS is a recognized industrial business whose fully grown portfolio of neuropsych properties.” Barclays starts Ralliant as obese Barclays stated the accuracy tech business has an “undemanding” evaluation. “RAL in our view represents an unusual type in MI [multi industry] nowadays– a pure play, premium property with depressed cycle characteristics (for sales and margins) and an evaluation that looks undemanding.” Oppenheimer repeats Nvidia and Broadcom as outperform Oppenheimer raised its cost target on Nvidia to $200 per share from $175 and on Broadcom to $305 per share from $265. “Our leading choices are NVDA, AVGO, MRVL, and MPWR.” JPMorgan downgrades SolarEdge to neutral from obese JPMorgan devalued the stock generally on evaluation. “We are devaluing SEDG to Neutral from Overweight, provided the stock’s substantial outperformance just recently, …” Deutsche Bank starts Jazz Pharmaceuticals as buy Deutsche stated in its initiation of Jazz that it’s a “development story w/ varied industrial portfolio.” “At present, the business’s focus is on establishing and advertising more ingenious biopharma properties, though the stock continues to trade at depressed multiples relative to commercial-stage peers.” Rosenblatt starts Gitlab as buy Rosenblatt stated the software application business is well placed for development and share gains. “In our view, the development in and intricacy of modern-day cloud and emerging GenAI applications and the upsell chance for GitLab offer substantial runway for development.” Goldman Sachs starts Nutanix as buy Goldman stated shares of the software application business have more space to run. “We start on Nutanix with a Buy ranking and $95 Rate Target, seeing it as an essential modernization play for business browsing tradition facilities shifts.” Evercore ISI repeats Tesla as in line The company stated it’s remaining careful on Tesla shares. “Our company believe the stock, today, is progressively both sound & & SIGNAL based upon: 1) Unabated unfavorable modifications, 2) Frustrating AV rollout, 3) Significantly dissentious political publishing, & & 4 )Technicals on edge.” JPMorgan upgrades California Resources to obese from neutral JPMorgan stated the energy business is underestimated. “We are updating CRC to Obese (from Neutral) as our company believe the stock is underestimated on a sum-of-the-parts basis.” Wells Fargo repeats Microsoft as obese Wells raised its cost target on Microsoft to $600 per share from $585. “Current field work recommends no downturn in need for MSFT’s AI options, boosting our self-confidence in the 4Q & & FY26 setup ahead. Even more, current expense actions assist balance out growing deprec problem, making it possible for DD%+ EPS development next year.” Find out more. Morgan Stanley downgrades Freeport-McMoRan to equivalent weight from obese Morgan Stanley stated it sees “couple of favorable drivers” today for the metals and mining business. “We still see some benefit i n FCX shares as the business gain from relatively high direct exposure to COMEX copper costs and a strong gold outlook, however the risk-reward now looks less engaging, with couple of favorable drivers in the near term.” Morgan Stanley downgrades Ameriprise Financial to underweight from equivalent weight The company devalued the monetary services business generally on evaluation. “Slower development at AMP rel to peers drives our downgrade to UW (from EW). Bank of America repeats Netflix as buy Bank of America stated it’s sticking to Netflix shares ahead of profits later on today. “We prepare for that Netflix’s (NFLX) 2Q25 outcomes will be at least in line with assistance on essential metrics consisting of profits, OI [operating income] and EPS.” Bank of America repeats Meta as buy The company raised its cost target on the stock to $775 per share from $765.” Meta is our 2025 leading Online advertisement stock as best-positioned business to gain from AI-driven marketing share gains and upside.” Bank of America repeats Amazon as buy The company stated it thinks Amazon’s Prime Day was a success. “Likewise, we believe efforts like enhanced stock positioning & & robotics most likely drove quick shipping speeds (we got our orders in 1 to 2 days) and strong customer complete satisfaction.” Jefferies downgrades DoorDash to hold from purchase Jefferies devalued the stock on evaluation. “With the stock up 45% YTD and evaluation at a 120% premium to Web, we downgrade to Hold provided DASH’s strong execution and development algorithm appear totally shown.” Evercore ISI downgrades Southwest to in line from outperform Evercore devalued the stock on evaluation. “Our ranking on LUV shares is decreased to In-Line from Outperform on YTD outperformance and relative evaluation growth.” Bank of America upgrades National Fuel to purchase from underperform Bank of America stated it sees an appealing entry point for the varied energy business. “We are double updating NFG to Purchase and raising our PO to $107.” Susquehanna starts Ryder System as favorable The company stated the trucking business is poised for a rerating. “Our company believe Ryder has a clear course to strong profits development from 1) Cyclical Inflection; 2) Stagflationary Truck Environment; and 3) Capital Release from Strong FCF, even without a rerating.” Cantor Fitzgerald starts Oklo as obese Cantor stated the nuclear power business is a market leader.” Oklo is leading the way for the world to securely shift to a nuclear powered future.” Truist starts World Life as buy Truist stated the monetary services business is a “resilient long-lasting entertainer at a discount rate.” “In our view, financiers can now buy GL shares at a discount rate evaluation due to the fact that of a misdirected brief report and, to a lower level, short-term volatility in medical usage.” Monness Crespi Hardt & & Co downgrades American Express to neutral from buy Monness devalued the stock generally on evaluation. “We are devaluing Amex to a Neutral – following a 45% runup considering that updating – thinking about shares trade at the 93rd %ile of NTM EPS numerous + mathematics needed to finance a greater cost.”

Related Articles

Add A Comment