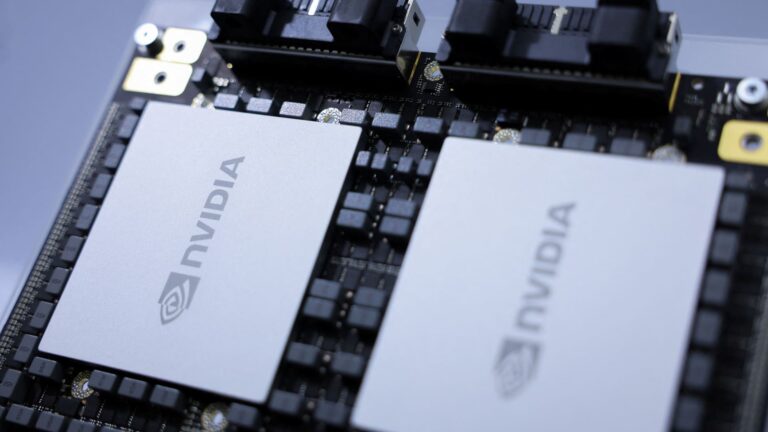

Here are the most significant contact Wall Street on Wednesday: Morgan Stanley repeats Alphabet as obese The financial investment bank stated the bull case is continuing following the judgment in the DOJ-Alphabet antitrust case. “Analysis of Judge Mehta’s treatments highlight how they are most likely benign and not likely to remove GOOGL’s leading position. Modifications, item development, and business habits patterns matter now to press towards our $260 bull case.” Learn more. Bank of America repeats Apple as buy Bank of America raised its rate target on the iPhone maker to $260 per share from $250.” AAPL shares traded up after market on report that the judge in the DOJ-Google antitrust case had actually provided a memorandum viewpoint on treatments needed of Google.” Learn more. Morgan Stanley upgrades Kraft Heinz to equivalent weight from underweight The financial investment bank stated the bear thesis has actually played out for the stock. “We update KHC to EW as our previous UW thesis has actually mostly played out, with price quotes now more sensible and [organic sales growth] revealing early indications of stabilization.” Bernstein upgrades Hubspot to surpass from market carry out Bernstein stated macroeconomic concerns are easing off for Hubspot.” HubSpot is the leader in [small and mid-sized business] Sales, Service and Marketing and has actually been regularly growing out of the marketplace.” JPMorgan repeats Nvidia as obese JPMorgan stated the stock stays well placed in AI. “We just recently went to Hot Chips 2025 and came away with a restored sense that explosive development in AI adoption throughout customer and business utilize cases will continue to drive a multi-year cycle of robust need for sophisticated calculate, memory and networking innovations. … Versus this background of strong AI patterns, we continue to see AVGO, NVDA, AMD, MRVL, MTSI and ALAB as crucial recipients.” Raymond James upgrades Regeneron to surpass from market carry out Raymond James stated in its upgrade of the biotech business that it provides “development (and development) at an affordable rate.” “Presuming protection of REGN show an Outperform ranking, $673 rate target.” Rothschild & & Business Redburn upgrades Icon to purchase from neutral The bank states it sees reservations enhancing for the life sciences business. “We see a path to financier self-confidence returning as ICON’s gross reservations most likely go back to YoY development in 3Q25, validating that the need weak point seen over the previous 4 quarters has actually been cyclical, not structural.” Wolfe upgrades Delek to surpass from peer carry out Wolfe states shares of the oil refining business have more “space to run.” “DK Upgrade to OP – space to run! Situations are reset on distinctive benefit.” UBS upgrades Teck Resources to purchase from neutral UBS stated in its upgrade of Teck Resources that the mining business is turning a corner. “After product underperformance, we see the risk/reward as appealing.” Morgan Stanley names Western Digital a leading choice Morgan Stanley raised its rate target to $99 per share from $92. “Following mgmt conferences, we acquired increased self-confidence in WDC’s tech roadmap, and leave more positive that WDC’s 20%+ evaluation discount rate vs. peers is baseless.” Rothschild & & Business Redburn upgrades Chipotle to purchase from neutral The company sees an appealing risk/reward for Chipotle. “With dislocated evaluation embedding drawback circumstances, the risk-reward now alters favorably. We update to Purchase from Neutral, with our the same $55/share rate target suggesting c28% upside possible.” Needham upgrades TransUnion to purchase from hold Needham stated the credit tracking stock is turning a corner. “Our company believe tha t TRU is poised to have a strong 2H25 and beyond, led by strong momentum with FinTech customers, an enhancing outlook in India, and home loan questions reprieve as rates appear to lastly be heading in the ideal instructions.” Baird upgrades BorgWarner to surpass from neutral Baird stated shares of the autoparts provider have space to run. “Having actually remained in a net upgrade posture YTD, we are more leaning into cyclical torque updating BWA, while likewise moving pro-cyclical names with intensifying company-specific drivers higher in our stack ranking general.” Melius upgrades Cummins to purchase from hold Melius sees a number of favorable drivers ahead for Cummins. “We are updating CMI shares to Purchase, and raising our two-year rate target to $500, 25% upside from today’s rate.” UBS repeats McDonald’s as buy UBS stated it’s much more bullish on the junk food chain following a series of conferences with management. “We just recently went to a supper with MCD Chairman and CEO Chris Kempczinski, CFO Ian Borden and VP of IR Dexter Congbalay, and came away with enhanced self-confidence MCD will enhance consumer worth understandings and drive market share gains in the United States with time.” Wells Fargo starts Archrock at obese Wells stated the gas supply business is well placed. “We’re starting protection of AROC with an Obese ranking and PT of $30/sh. Wolfe starts CoStar Group at outperform Wolfe states it’s bullish on shares of the property business. “We are starting protection of CSGP with an Outperform ranking and $105 YE26 rate target, representing 19% benefit.” Bank of America upgrades Valero to purchase from neutral Bank of America stated the oil refiner is now much better placed.” VLO is flattish from when we introduced last fall, however in our view much better located than they were then due to the Light-Heavy outlook.”

Related Articles

Add A Comment