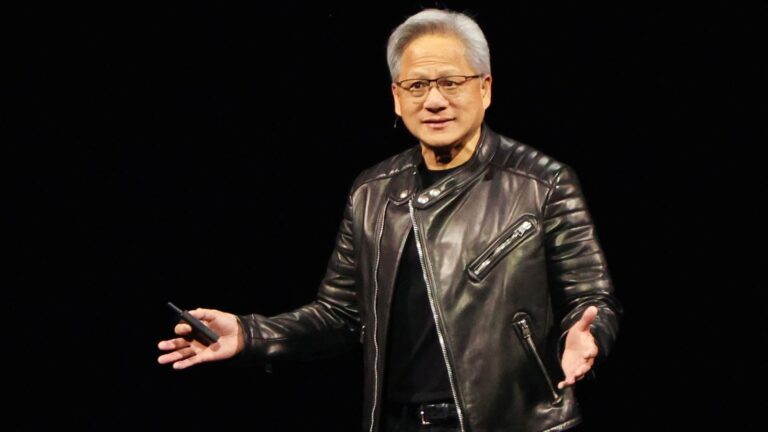

Wall Street experts left Nvidia’s flagship GPU Innovation Conference on Tuesday sensation normally positive on the AI beloved’s future. Throughout a keynote speech, CEO Jensen Huang revealed brand-new chips for releasing expert system designs. These designs are anticipated to deliver in 2026, he stated. Nevertheless, some were left underwhelmed. The stock dropped more than 3% on Tuesday, bringing its year-to-date losses to more than 14%. This is a departure from previous years, as the GTC conference had actually been a favorable driver for shares in previous years. Jefferies expert Blayne Curtis kept in mind that while “the rate of development on all fronts continues to impress and recommends a growing moat vs. peers … we were expecting more evidence points for TAM growth and TCO benefits.” Still, Curtis kept his buy ranking on the stock and $160 cost target, which indicates 60% advantage. Others likewise adhered to their bullish theses. Here’s what the experts needed to state. Bank of America keeps purchase ranking, cost target of $200 The bank’s cost target signals 73% advantage. “We preserve Buy, $200 PO following slate of product/partner statements at flagship GTC conference in addition to publish keynote conference with CFO that show NVDA continuing to deepen its competitive moat in a $1T+ infrastructure/services TAM,” composed expert Vivek Arya. Citi waits buy ranking, cost target of $163 Citi’s target indicate a 41.2% gain. “Net-net, we came out of the keynote assured in NVIDIA’s management which if anything appears to be broadening. We see favorably NVIDIA’s push for reasoning which per business remarks now needs substantially more calculate. Preserve Purchase,” stated expert Atif Malik. Evercore ISI repeats outperform, cost target of $190 Evercore ISI’s cost target indicates a gain of 64.6%. “NVDA CEO’s keynote at its yearly GTC conference strengthens our view that nobody is investing at the rate or magnitude NVDA remains in developing out a full-stack chip+ hardware+ networking+ software application community for the AI computing age, constant with quotes we just recently spoke with hyperscalers that “NVDA has an 8-year lead” and “NVDA’s community is on a various continent,” composed expert Mark Lipacis. “We see the current weak point as a specific purchasing chance.” Deutsche Bank keeps unusual hold ranking, $145 cost target The cost target indicate 25.6% advantage. “In general, NVDA communicated strong-but-warranted bullishness about the strength of its item roadmap, with the business plainly keeping a strong lead in its systems-based technique to serving AI calculate requirements. We praise the business for keeping this lead and for allowing explosive development in the AI community. With reasonably couple of surprises to us from this GTC keynote, we preserve our Hold ranking,” expert Ross Seymore composed. JPMorgan repeats outperform ranking, cost target of $170 JPMorgan’s cost target indicates 47% advantage. “With leading silicon (GPU/DPU/CPU), hardware/ software application platforms, and a strong community, Nvidia is well-positioned to gain from significant nonreligious patterns in AI, high-performance computing, video gaming, and self-governing cars, in our view. NVIDIA continues to stay 1-2 actions ahead of its rivals,” composed expert Harlan Sur. Morgan Stanley keeps obese, $162 cost target The cost target indicate 40% advantage. “While there were no huge surprises in the keynote targeted at designers, the business made a strong case that there will continue to be numerous waves of AI scaling requirements, that they are providing item management through 2027, which near term cloud need is strong,” expert Joseph Moore stated. UBS keeps purchase ranking, $185 cost target The bank’s projection signifies a gain of 60%. “In general, NVDA did a good task setting out the roadmap and exposing the story that calculate need and scaling is seeing any downturn,” composed expert Timothy Arcuri.

Related Articles

Add A Comment