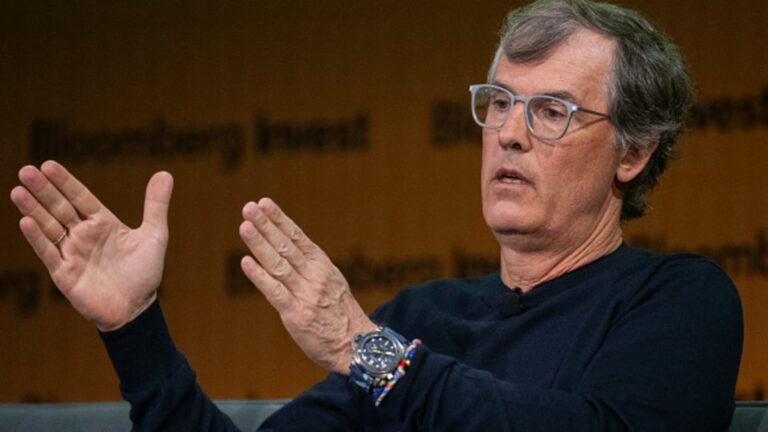

Philippe Laffont’s Coatue Management took a substantial stake in Nvidia-backed expert system facilities service provider CoreWeave in the middle of the very first’s extremely expected March going public. The hedge fund revealed a $534 million holding in CoreWeave, which in late March had the most significant venture-backed tech IPO for a U.S. business given that 2021. On Wednesday, the AI company reported better-than-expected income in the business’s very first profits release given that going public. CoreWeave likewise required faster development than anticipated for this year. Laffont, among the so-called Tiger Cubs who formerly worked under the late Julian Robertson at Tiger Management, owned a variety of stocks connected to the AI boom that has actually been driving the stock exchange over the previous year. Coatue’s leading holdings consisted of a few of the so-called Splendid 7 stocks such as Meta Platforms, Amazon, Microsoft and Nvidia, while the hedge fund likewise had a substantial stake in Taiwan Semiconductor. Likewise throughout the very first quarter, the hedge fund constructed smaller sized stakes in Carvana, Skyworks Solutions, Pinterest, Tempus AI and Astera Labs.

Related Articles

Add A Comment