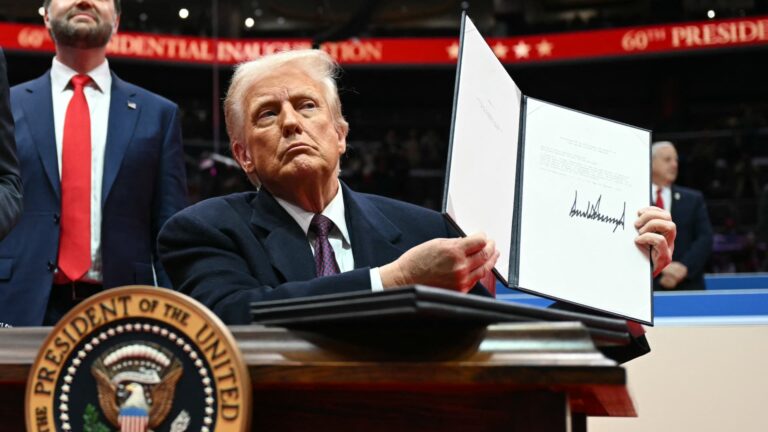

United States President Donald Trump holds letter to the UN mentioning the United States withdrawal from the Paris Contract throughout the inaugural parade inside Capital One Arena, in Washington, DC, on January 20, 2025.

Jim Watson|Afp|Getty Images

Financiers have actually continued to pull cash from so-called ESG funds in early 2025 in the middle of an “heightening” reaction sustained by President Trump’s “anti-climate program” and his administration’s policies targeting variety, equity and addition efforts, according to a brand-new Morningstar report.

Likewise called socially accountable, sustainable, effect or values-based investing, “ecological, social and governance” funds let individuals invest according to specific worths like environment modification or business variety.

Financiers withdrew $6.1 billion from ESG funds in the very first 3 months of 2025, after tugging out $4.3 billion in Q4 2024, according to Morningstar.

More from Personal Financing:

Customers are investing as trade wars raise economic downturn danger

Where young people are more than likely to deal with moms and dads

Customers making monetary modifications in reaction to tariffs

The exodus in Q1 marked the 10 th successive quarter of outflows.

” The ongoing anorexia nervosa amongst United States financiers for sustainable funds can be partially credited to an anti-ESG reaction, which has actually heightened considering that the return of President Trump to the White Home,” according to the report.

Since completion of Q1, U.S. financiers held $330 billion in ESG funds, about 10% of the worldwide overall.

Pushback versus environment, DEI policies

Yaorusheng|Minute|Getty Images

Even before Trump took workplace, constantly high rate of interest weighed on efficiency in sections of the ESG market, like tidy energy and other “green” stocks, according to Morningstar. Greater loaning expenses problem the renewables sector due to the fact that the jobs can be capital-intensive.

However Trump included extra pressure.

Within days of his inauguration, Trump revealed the U.S. would withdraw from the Paris arrangement, obstructed aids for electrical automobiles, promoted more fossil-fuel production and began a “substantial pushback” versus DEI policies, Diana Iovanel, a senior markets economic expert at Capital Economics, composed in a research study note in March.

In late March, the Republican-led Securities and Exchange Commission stopped protecting a climate-change disclosure guideline in court. There’s likewise unpredictability about the fate of the Inflation Decrease Act, a historical environment modification mitigation law signed by President Joe Biden.

Even before Trump’s 2nd term started, a minimum of 18 Republican-led states had actually embraced “anti-ESG legislation,” triggering some big property supervisors to “pare back” their ESG efforts, Iovanel composed.

Trump likewise signed an executive order to remove all DEI-related requireds and programs within the federal government, triggering significant corporations like Walmart ( WMT), Lowe’s ( LOW) and Meta ( META) to start “downsizing their DEI dedications,” Morningstar composed.

Why Trump isn’t ‘video game over’ for ESG

Regardless of the headwinds, Trump’s program “isn’t ‘video game over’ for ESG investing,” Iovanel composed.

Need for ESG financial investments “is here to remain” even in the face of political pressure, she composed.

For one, regardless of Republican antipathy for ESG investing, it likewise has sufficient assistance, Iovanel composed. States such as California have actually executed pro-ESG guidelines, and studies suggest most big property supervisors (consisting of ones in the U.S.) purchase ESG possessions regardless of the evident debate, she composed.

Need amongst specific financiers likewise appears fairly high, particularly amongst more youthful financiers, experts stated.

About 84% of specific financiers in the U.S. have an interest in sustainable investing, according to a 2024 Morgan Stanley study. Approximately 2 thirds, 65%, of participants stated their interest had actually increased in the previous 2 years.

While critics deride it as “woke” commercialism, supporters state there’s a strong financial investment thesis for ESG.

Particularly, they argue that ESG investing positions financiers for greater long-lasting returns due to the fact that business that embrace such practices are poised to be more resistant, and for that reason more effective, than peers.