Open the Editor’s Digest free of charge

Roula Khalaf, Editor of the feet, picks her preferred stories in this weekly newsletter.

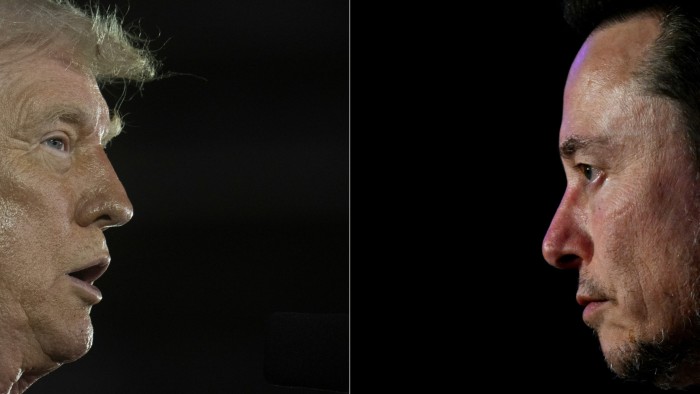

Elon Musk’s expert system business xAI was surrounding a $5bn financial obligation funding plan to money brand-new information centres and chips to power its organization. Then on Thursday the world’s most affluent male torpedoed his relationship with United States President Donald Trump.

Musk’s lenders at Morgan Stanley need to now compete with this brand-new problem as prospective financiers attempt to evaluate the fallout from the remarkable unravelling of Musk’s ties to the president, according to individuals informed on the matter. The financial obligation might be more pricey too, they included.

Before the 2 guys introduced into a war of words– that included Trump’s risk to rip up Musk’s federal government agreements– financiers had actually positioned more than $4bn of orders for the offer.

Providing cash to an AI endeavor coming from the president’s “very first pal”, as Musk described himself, likewise appeared like a strong bet.

The interest was drawing Morgan Stanley near to the goal on the financial obligation raising, with huge name financiers such as TPG in tow.

The interest was so high that Morgan Stanley had actually drifted the possibility that xAI may secure less expensive funding than they had actually at first pitched.

However that prices is now up in the air, with some financiers betting xAI might need to pay up to secure the funding.

The multibillion-dollar loaning plan is still anticipated to be divided in between set- and floating-interest rate loans in addition to a business bond, and an individual informed on the matter stated the $5bn capital raising was still on track.

Bankers had previously in the week disputed minimizing the voucher on the bonds and fixed-rate loans from 12 percent to 11.5 percent, while the floating-rate loan was anticipated to cost with a rates of interest 7 portion points above the standard drifting rate of interest.

” This makes it even harder,” someone performing due diligence on the offer stated of Musk’s fallout with Trump. “You require federal government assistance for that entire environment, not simply for this. It needs to have some influence on. individuals’s convenience level with supporting it.”

xAI management satisfied financiers on Thursday as the 2 guys locked heads on social networks, sharing forecasts for the business’s organization and its development potential customers.

Morgan Stanley had actually pitched the financial obligation to big credit stores who might put orders of a minimum of $100mn and had actually targeted much of the exact same financiers who had actually consented to purchase loans from xAI’s sibling business, social networks website X, previously this year, numerous individuals stated.

In an indication of the impact the kerfuffle was having on Musk’s companies, costs on X’s financial obligation moved to about 96 cents on the dollar from more than 99 cents a day previously.

Even before the spat, Morgan Stanley had actually dealt with some financier pushback. Lenders had actually raised worry about the files that underpin the offer, asking for that xAI strengthen a variety of conventional safeguards that are provided to financiers. Those consist of the quantity of incremental financial obligation xAI can handle also just how much money it can pay to its financiers.

Others had actually raised concerns about the copyright that protects the loan plan and the worth of the security. The financial obligation is likewise protected by information centres xAI is developing.

Some financiers had actually indicated they would leave the offer if their issues were not satisfied, which might reduce just how much cash xAI has the ability to raise or increase its interest concern. Morgan Stanley is working towards a due date of June 17 to work out these terms.

xAI did not right away react to an ask for remark. Morgan Stanley and TPG decreased to comment.

Financiers who have actually been performing due diligence on the financial obligation stated xAI was lossmaking and incomes were little. However their financial investment thesis remains in part underpinned by the business’s equity appraisal and their belief xAI will start to offer profitable business agreements to utilize its innovation.

” It’s an item that will most likely be among the winners of business AI,” one loan provider stated. “On the customer side OpenAI has a huge lead however on the business side they can be a product gamer which will deserve a lot more than $15bn to $20bn.”

The Financial Times reported on Monday that xAI was releasing a $300mn share sale that would value the group at $113bn.

However, some lenders have actually grumbled about the restricted information that has actually been shared up until now.

Individuals knowledgeable about the offer stated that Morgan Stanley was keeping a tight yoke on access to the information space and on calls with management. Someone included that a slide deck xAI supplied ahead of a management discussion to financiers on Thursday had approximately 10 or less slides.

” It was truly quite fugazi and I state that as a fan of the xAI information space,” the individual stated, utilizing a slang term for phoney.

” It’s all dream, it’s a concept,” a 2nd individual stated of the discussion. “They are investing cash, not earning money yet.”

Extra reporting by Robert Smith in London