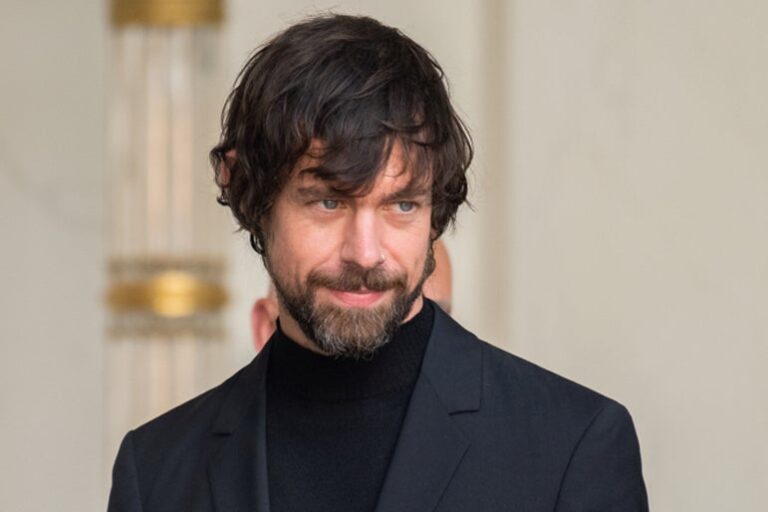

After Block Inc. XYZ ended up being the very first U.S. company to utilize Nvidia Corp.’s NVDA brand-new expert system clusters, its CEO and creator, Jack Dorsey stated that he anticipates it to be 30 times more effective as compared to existing applications.

What Occurred: Leveraging 10s of countless GB200 Superchips, Nvidia’s DGX SuperPOD with GB200 systems provides the computational power required to train and run modern AI designs with trillions of criteria.

Dorsey’s Block ended up being the very first North American business to release this cluster for AI research study. Following its “codename goose” AI structure launch, this relocation enhances Block’s dedication to AI development.

Thanking the Jensen Huang– led chipmaker, Dorsey in an X post stated that he anticipates the training and research study on these brand-new systems to be 30 times more effective than any existing system.

To advance open-source generative AI research study and training, especially in underexplored locations, Block will release resources in an Equinix Inc. EQIX information center.

See Likewise: Nvidia Evaluation Drops After 2025 Thrashing: Chipmaker’s Cost Decreases 41% From Its Peak When ChatGPT Was Released

Why It Matters: CTO Dhanji R. Prasanna highlighted the business’s concentrate on groundbreaking AI services, intending to level the playing field for clients through unique techniques.

The Grace Blackwell-powered DGX SuperPOD, understood for its capability to speed up AI development, will allow Block’s engineering groups to train bigger, advanced designs.

This relocation builds on Block’s previous AI efforts, which have actually consisted of deepfake detection and hyper-realistic created audio, more strengthening its devotion to pressing the borders of AI innovation.

Cost Action: Shares of Block were 35.56% on a year-to-date basis and increased 1.1% to $55.90 on Wednesday. It likewise fell 34.79% over the in 2015.

In premarket on Thursday, the stock dropped 0.54%.

According to Benzinga Edge Rankings, XYZ’s worth stays healthy with a bad rate pattern in the brief, medium and long term. Its development rankings, determining historic growth in incomes and income, were likewise low.

Its agreement rate target was $91.22 based upon the 44 experts tracked by Benzinga with a ‘purchase’ ranking. The rate targets varied from a low of $46 to a high of $120. The 3 most current rankings from Macquarie, Seaport Global, and Piper Sandler balanced at $98.67, suggesting a 77.33% advantage.

Read Next:

Disclaimer: This material was partly produced with the assistance of AI tools and was examined and released by Benzinga editors.

Picture courtesy: Shutterstock

Momentum 38.84

Development 50.97

Quality 31.94

Worth 13.59

Market News and Data gave you by Benzinga APIs