Nvidia Corp‘s (NASDAQ: NVDA) exit from China has actually been framed as a policy-driven blow, however AI-focused financiers might see it as a possibility for the business to double down on high-margin chances somewhere else.

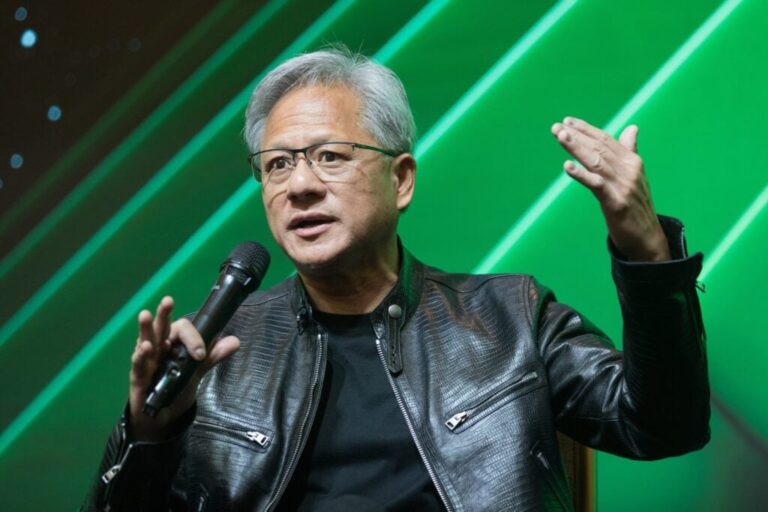

Recently, CEO Jensen Huang kept in mind the business went from 95% market share in China to no– a substantial market loss on paper. Nvidia’s monetary projections no longer presume any earnings from China, he included.

Yet the genuine story depends on where Nvidia is directing its resources now: into AI information centers, business GPUs, and cloud collaborations that are driving extraordinary need.

Check Out Likewise: Nvidia’s Silicon Silk Roadway: From China’s Firewalls To Saudi Arabia’s Data Palaces

Moving Focus From Volume To Success

China represented scale, however not always the high-margin development that powers Nvidia’s AI management. Freed from the geopolitical and compliance difficulties of the Chinese market, Nvidia can now concentrate on premium AI chips, business releases, and U.S.-friendly cloud collaborations.

Financiers must see this as a reallocation of capital from politically constrained volume to sectors where Nvidia can record prices power and strong margins, a subtle however significant shift in method.

Supply Chains That Align With AI Development

The China exit likewise requires Nvidia to straighten its supply chains and production top priorities. By concentrating on nations and partners lined up with Western innovation policies, Nvidia minimizes regulative danger and makes sure quicker release of AI-focused GPUs to hyperscale cloud suppliers– the really engines of AI earnings development.

Simply put, what appears like a market loss is in fact a functional pivot towards the fastest-growing and most rewarding sectors of the AI market.

The Financier Takeaway

Nvidia’s no direct exposure to China is headline-grabbing, however the genuine ramification has to do with tactical prioritization. By trading geographical scale for profit-focused AI development, Nvidia is banking on sectors with more powerful prices power, less political danger, and greater margins.

For financiers, the lesson is clear: in some cases policy expenses aren’t a loss– they’re a forced lens that hones concentrate on where the cash in fact remains in AI.

Read Next:

Image: Shutterstock