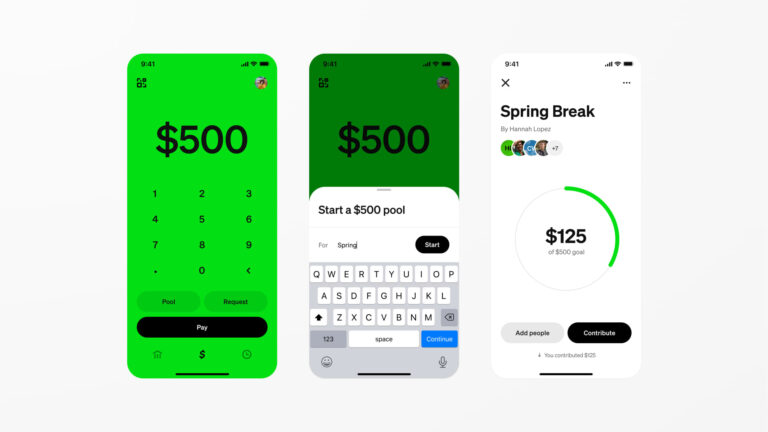

Money App’s brand-new Swimming pools include lets users set a group financing objective, name the swimming pool, and welcome factors.

Courtesy: Money App

Money App is going on the offensive in peer-to-peer payments.

The Block– owned payments platform on Tuesday revealed Swimming pools, a brand-new peer-to-peer function created to make group payments basic. It’s the business’s very first significant P2P item launch in almost 2 years.

” This is the very first time we’re entering into out-of-network payments with Swimming pools,” stated Owen Jennings, Block’s head of service, describing the function’s capability to accept contributions by means of Apple Pay or Google Pay from individuals who aren’t on Money App.

Swimming pools permits users to produce and handle a shared balance for group payments– whether splitting a supper costs or gathering funds for a group journey. Contributions can be made through Money App or by means of Apple Pay and Google Pay, which opens the experience to users outside the app for the very first time.

By sharing a Swimming pool link, organizers can gather funds even from buddies who do not utilize Money App, making out-of-network involvement much easier.

The launch comes as Money App races to restore momentum in a high-stakes competition with Venmo, which has actually been gradually growing under brand-new management at PayPal

PayPal reported its second-quarter outcomes before the marketplace opened Tuesday. Venmo had another knockout quarter, with profits growing more than 20% year over year– its greatest development rate given that 2023.

That followed a likewise strong very first quarter where Venmo’s profits development doubled the rate of payment volume, driven by increasing adoption of debit cards, immediate transfers, and online checkout. The gains were sustained by much heavier usage of Venmo debit cards, immediate transfers, and online checkout combinations. PayPal does not break out Venmo profits.

For Block, the launching of Swimming pools is a tactical reset. The business published frustrating first-quarter lead to Might, missing out on profits expectations and confessing had actually lost concentrate on growing Money App’s user base.

” Cash is basically social in nature,” Jennings stated.

” We desire Money App to be the monetary os for the next generation … to basically be the cash app where a consumer can run their whole monetary life,” included Jennings, who was formerly Money App’s chief running officer.

That consists of reinvesting in the peer-to-peer functions that initially made the app popular, and now intending to make them more social and available– performance that’s main to Money App’s more comprehensive development technique.

Factors can sign up with a swimming pool and send out cash through Money App or external wallets like Apple Pay and Google Pay.

Courtesy: Money App

Jennings stated opening access to Apple and Google accounts is a chance to get more active users and bring individuals into the community.

The business sees each non-user who adds to a swimming pool as a possible transform.

” This item is basically tailored at network growth and enhancing the virality of our peer-to-peer items,” he included. “It’s the structure of Money App– it’s how Money App began, however it’s likewise the development engine that fuels whatever else.”

Internally, the rollout represents a cultural shift at Block. The function went from concept to introduce in simply a couple of months, driven by what Jennings referred to as “high speed, high quality” advancement powered in part by internal AI tools like the business’s open-source assistant, Goose.

” The rate of advancement on this and our capability to get it in clients’ hands feels truly various this year,” Jennings stated. “Particularly in the previous 3 or 4 months, relative to how things felt about a year earlier.”

He included that the shift isn’t distinct to Block.

” You’ll most likely broadly see that in the market, where the rate of advancement is going to get as the minimal expense of an excellent line of code continues to fall. And this is simply an excellent example of how we had the ability to move truly quickly.”

When a swimming pool reaches its target, organizers can close it and move the gathered funds straight into their Money App balance.

Courtesy: Money App

The launch likewise shows CEO Jack Dorsey’s call to return Money App to its core development engine. On the business’s first-quarter revenues call, Dorsey acknowledged the platform’s current underperformance

” I simply do not believe we were focused enough and had adequate attention on the network and the network density, which is our structure,” he stated.

While Money App continues to broaden its banking and financing items– including its FDIC-approved Borrow program– Dorsey stressed that the app’s success still depends upon peer-to-peer engagement.

” We obviously wish to deepen engagement with our clients through banking services and Obtain,” he stated. “However at the very same time, we require to make certain that we continually grow our network, which begins with peer-to-peer.”

Swimming pools is created to drive natural user development– not direct profits.

” We’re not taking a look at this from an earnings maximization viewpoint,” Jennings stated. “This is extremely tailored at network growth and returning to a location where actives are growing at a healthy clip.”

The tool features integrated development tracking, smooth combination with Money App’s banking tools, and the capability for organizers to set a target quantity and share a link to gather contributions.

Swimming pools is presently offered to a restricted set of Money App users, with a more comprehensive rollout anticipated in the coming months. For Block, it’s the start of what Jennings referred to as a brand-new chapter– one concentrated on generating income feel “more multiplayer.”

VIEW: Mastercard stock leaps as it connects Fiserv’s brand-new stablecoin to its worldwide payments network