Secret Takeaways:

-

Bitcoin is driven by its capability to carry out well in risk-on and risk-off environments, according to Bitcoin Suisse.

-

Bitcoin’s Sharpe ratio of 1.72, 2nd just to gold, highlights its maturity as a property, using exceptional risk-adjusted returns.

-

A buyer-dominant market signals strong institutional and retail interest that might drive a supply capture and break brand-new highs in Might.

Bitcoin (BTC) rate breached the $100,000 mark for the very first time given that January, sustaining speculation of a brand-new all-time high above $110,000 in Might. According to Bitcoin Suisse, a crypto custody company, BTC’s bullish momentum comes from its capability to grow in risk-on and risk-off environments given that the United States governmental elections.

Information from its “Market Rollup” report highlights Bitcoin’s high Sharpe ratio of 1.72, a crucial monetary metric that determines risk-adjusted returns by dividing a property’s typical return (minus the safe rate). A greater Sharpe ratio shows exceptional risk-adjusted returns, and in 2025, Bitcoin’s robust rating, gone beyond just by gold, highlights its growing maturity as a property.

Over the previous 2 quarters, BTC stood out as a dual-purpose financial investment. It serves as a macro hedge in risk-off environments, gaining from geopolitical stress and de-dollarization issues. In risk-on situations, it acted as a high-conviction development property, with over 86% of its supply in earnings. As highlighted in the chart, Bitcoin kept a favorable net return through numerous essential stages given that November 2024. Bitcoin Suisse head of research study Dominic Weibei stated,

” In this environment, Bitcoin has actually become the Swiss army knife property. Whether equities rally or bonds collapse, BTC trades on its supply-demand basics, providing a win-win profile that conventional possessions just can’t use.”

Cointelegraph reported that Bitcoin is preparing for the next leg of an “velocity stage,” according to Fidelity Digital Assets’ Q2 2025 Signals Report. Fidelity expert Zack Wainwright described that Bitcoin’s historic propensity to go into explosive rate rises is identified by “high volatility and high earnings.”

Related: Bitcoin eyes sub-$ 100K liquidity– Enjoy these BTC rate levels next

Bitcoin area purchasers turn “dominant”

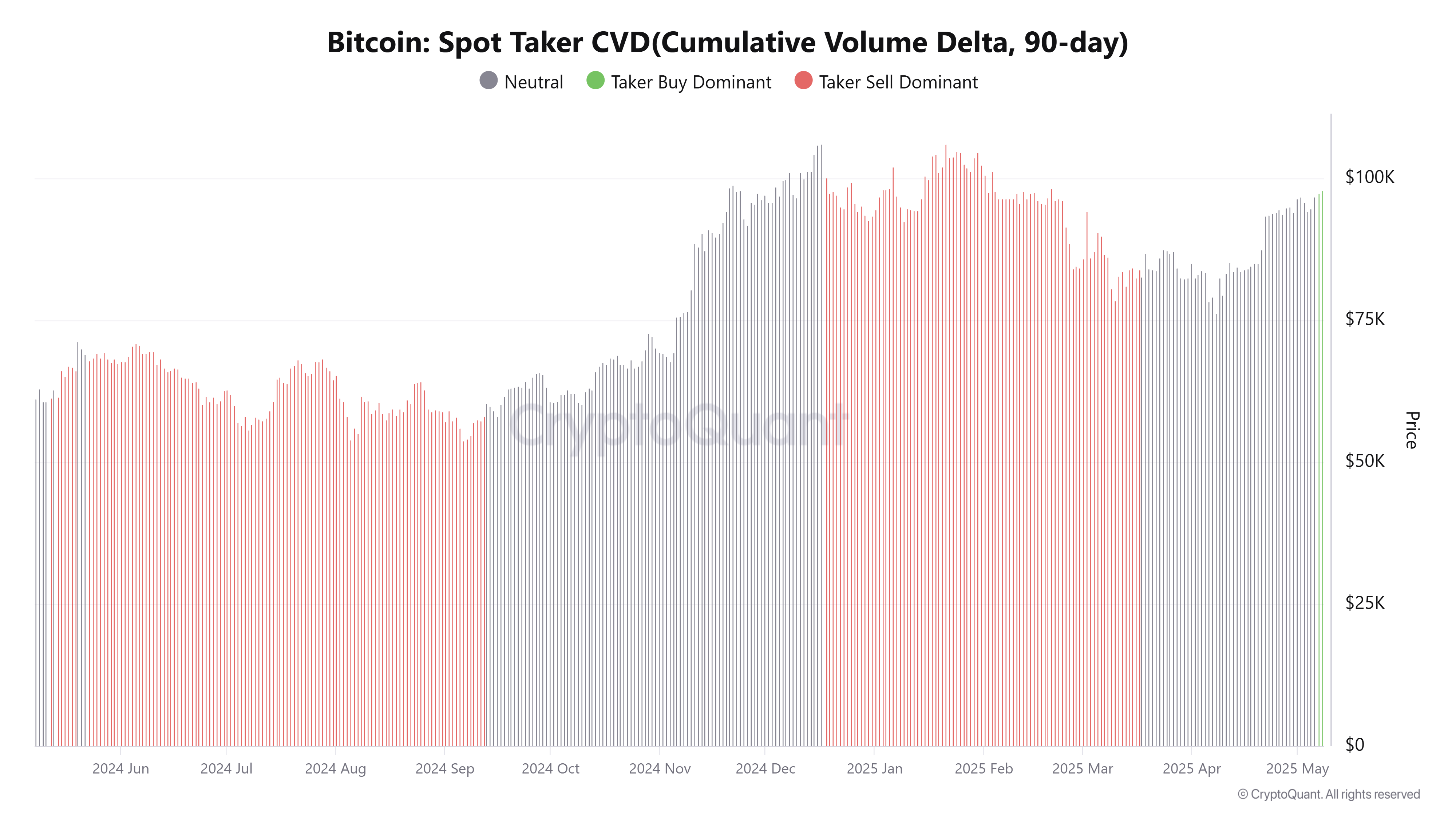

On Might 7, Bitcoin area taker cumulative volume delta (CVD) over 90 days turned purchaser dominant for the very first time given that March 2024. The 90-day area taker CVD, which determines the net distinction in between market buy and offer volumes, shows purchaser or seller activity over an extended duration. This shift to “taker purchase dominant” aggressive purchasing pressure, driven by institutional interest and area Bitcoin ETF inflows, i.e., over $4.5 billion area inflows given that April 1.

This structural modification in need and Bitcoin’s robust Sharpe ratio might enable BTC to take advantage of existing market conditions. As corporations and organizations hurry into Bitcoin, a supply capture might move costs past $110,000 in May.

Related: How high can Bitcoin rate go?

This post does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.