Secret takeaways:

-

Bitcoin’s rate carefully tracks international liquidity development, with liquidity discussing as much as 90% of its rate motions, according to Raoul Friend.

-

In the long term, international liquidity continues to broaden, driven by the increasing financial obligation levels in numerous nations.

-

On a much shorter timeframe, international liquidity follows a cyclical pattern, with Michael Howell forecasting the existing cycle to peak by mid-2026.

Bitcoin (BTC) rate is infamously conscious international liquidity. Some experts reach calling their connection near-perfect, with a lag of about 3 months. This relationship is sustaining the existing bullish story as BTC rate skyrockets back above $100,000, however the length of time can this pattern last?

Liquidity is Bitcoin’s quiet rate motorist

Raoul Friend, the creator of International Macro Financier, just recently provided a speech on the strong connection in between Bitcoin and international M2 liquidity. In a wrap-up published by Paul Guerra, Friend’s message describes: in spite of looming issues– economic crisis dangers, geopolitical stress, and other international stress factors– increasing liquidity as the dominant force behind property rate action.

According to Friend, broadening liquidity supports to 90% of Bitcoin’s rate action and as much as 97% of the Nasdaq’s efficiency. Certainly, a chart comparing international M2 (with a 12-week lead) and Bitcoin’s rate reveals a practically exceptional positioning.

Friend likewise frames the problem in individual financing terms. He states there’s an 11% “covert tax” on everyone, made up of 8% currency debasement and 3% international inflation. He keeps in mind,

” If you’re not making more than 11%/ year, you’re getting poorer by meaning.”

Bitcoin has actually returned approximately 130% every year considering that 2012, in spite of remarkable drawdowns. That makes it among the most uneven bets of the previous years– and it’s surpassed the Nasdaq by over 99%.

What drives international liquidity?

At its core, international liquidity is sustained by broadening the cash supply. As independent financier Lyn Alden puts it,

” Fiat currency systems are mostly based upon ever-growing financial obligation levels. The cash supply continually grows in every nation for this factor.”

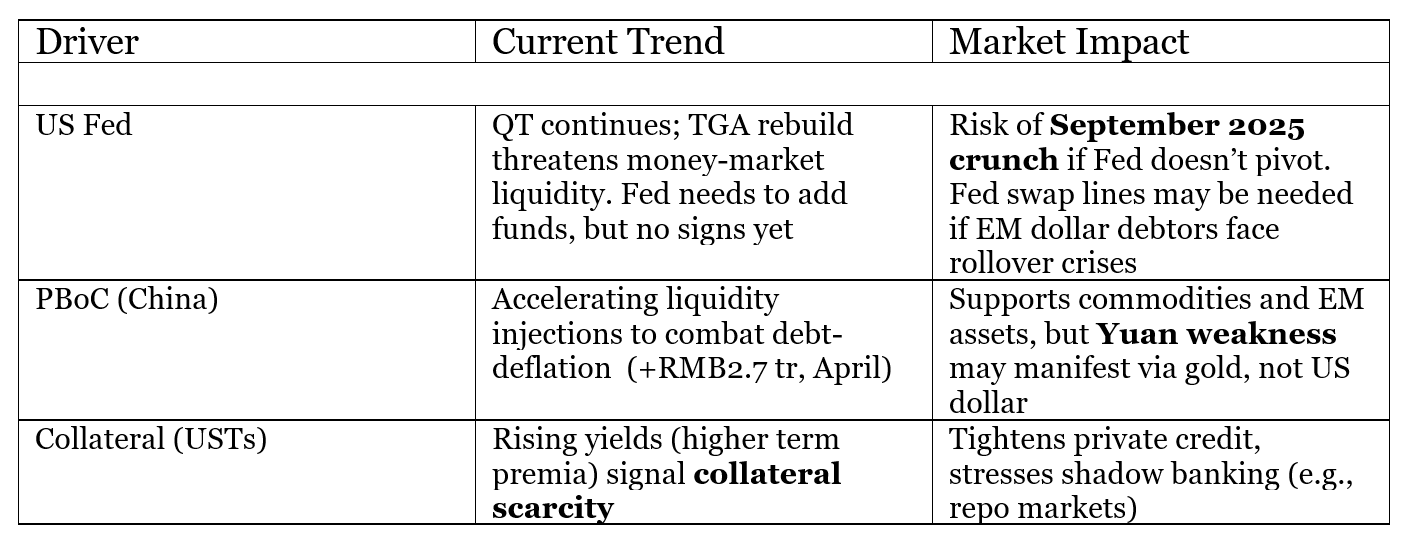

This uses a top-level view of international liquidity and recommends its long-lasting growth is structural. Nevertheless, this development isn’t direct. Over much shorter timespan, it varies based upon particular motorists. Michael Howell, author of “Capital Wars,” recognizes 3 primary motorists presently affecting international liquidity: the United States Federal Reserve, individuals’s Bank of China (PBoC), and banks providing through security markets.

Howell likewise indicates indirect impacts that show a lag of 6 to 15 months. These consist of the world company cycle, oil costs, dollar strength, and bond market volatility. A weak international economy and a softening dollar usually enhance liquidity. However increasing bond volatility tightens up security supply and chokes loaning, weakening liquidity.

Related: New bull cycle? Bitcoin’s go back to $100K mean ‘substantial rate relocation’

For how long will international liquidity increase?

Michael Howell thinks that international liquidity relocations in approximately five-year cycles, and is now en route to its regional peak. He forecasts the existing cycle to grow by mid-2026, reaching an index level of around 70 (listed below the post-COVID index of 90). That would mark a turning point, with a subsequent recession being a most likely result.

The current development in international liquidity originates from the quickly deteriorating world economy, which is most likely to trigger additional reducing by reserve banks. Individuals’s Bank of China has actually currently started injecting liquidity into the system. The Fed now deals with a hard option: continue combating inflation or pivot to support a significantly vulnerable monetary system. At its Might 7 conference, rates were held steady, however the pressure on Chair Jerome Powell is installing, specifically from United States President Donald Trump.

At the very same time, financial unpredictability is increasing United States Treasury yields and sustaining bond market volatility, both signs of security deficiency and tightening up credit conditions. In time, these pressures are most likely to end up being headwinds for liquidity growth. On the other hand, a looming economic crisis is anticipated to compromise financier danger cravings, additional draining pipes liquidity from the system.

Even if a slump lies ahead in 2026, international liquidity still has space to run, a minimum of through 2025. Which matters for Bitcoin.

Howell notes,

” The most likely inescapable policy reaction of ‘more liquidity’ is a fantastic future prophecy. It develops the upward course of relentless financial inflation that eventually underpins hedges such as gold, quality equities, prime property realty, and Bitcoin.”

Surprisingly, Howell’s liquidity cycle approximately lines up with Bitcoin’s four-year halving cycle. The previous indicate a prospective peak in late 2025, and the latter in early 2026. If history rhymes once again, that merging might set the phase for a significant rate relocation.

This post does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.