Bitcoin proxy stocks for financiers in 2025: Method Inc vs. BlackRock, compared

When financiers desire direct exposure to Bitcoin without really holding it, they typically turn to what’s referred to as a Bitcoin proxy stock. These are equities or funds that mirror Bitcoin’s rate motions, providing a method into the crypto market through conventional financing.

2 of the most popular examples today are Method Inc (previously MicroStrategy) and BlackRock’s iShares Bitcoin Trust (IBIT).

Method has actually ended up being notorious for turning its business balance sheet into a Bitcoin vault, holding over 580,000 BTC since mid-2025.

On the other hand, IBIT uses a cleaner, managed path: an area Bitcoin exchange-traded fund (ETF) backed by real Bitcoin (BTC), constructed for institutional and retail financiers alike.

This post compares the 2 as portfolio proxies, taking a look at threat, efficiency and who every one is actually for.

It will begin with Method’s story, discussing how it turned into one of the best-known Bitcoin proxy stocks.

Inside Method’s crypto portfolio

In August 2020, under the management of Michael Saylor, MicroStrategy made a remarkable pivot: assigning $250 million from its money reserves to acquire approximately 21,454 BTC.

This marked a relocation from organization intelligence software application to a Bitcoin treasury business. At the time, Saylor argued that Bitcoin was a more powerful, more contemporary type of digital gold than money and efficiently changed the business into a distinct monetary instrument, providing financiers leveraged direct exposure to Bitcoin through equity.

From that preliminary financial investment, the business institutionalised its crypto method. By late 2024, it had actually collected around 444,000 BTC, moneyed through convertible bonds, equity raises and financial obligation, basically obtaining to purchase more Bitcoin in a high-stakes flywheel method.

Then, in February 2025, MicroStrategy officially altered its name to Method Inc, total with an elegant “B” logo design and orange branding, formally welcoming its Bitcoin-first identity.

Since mid‑2025, Method holds roughly 580,250 BTC, strengthening its position as the biggest business Bitcoin holder worldwide.

Did you understand? Method holds more Bitcoin than many nations. In truth, it holds more than all sovereign countries other than the United States, China and the UK.

What is BlackRock’s Bitcoin ETF stock?

Now let’s turn to BlackRock, whose entry into the Bitcoin market brought the world’s biggest possession supervisor into direct competitors with veteran crypto locals.

In January 2024, after years of United States SEC resistance, the regulator authorized a slate of area Bitcoin ETFs. BlackRock’s iShares Bitcoin Trust (IBIT) was amongst them.

Unlike Method, which holds Bitcoin on its balance sheet, IBIT is a pure monetary item: a one-to-one, physically backed ETF that enables financiers to get direct exposure to Bitcoin without touching the possession itself. No wallets or personal secrets– simply a ticker, a brokerage account and an SEC filing.

The reception was explosive. By February 2024, IBIT had actually collected over $50 billion in possessions under management, turning into one of the fastest-growing ETFs in history.

BlackRock didn’t stop there. In March 2025, it introduced a European variation of the fund throughout Xetra, Euronext Paris and Amsterdam with a short-term 0.15% management charge, among the most affordable in the market.

Maybe most informing is how seriously BlackRock is taking this bet. In early 2025, the company included IBIT to numerous of its design portfolios, consisting of multi-asset and alternative techniques.

Executives have actually even recommended that Bitcoin might be beginning to decouple from tech stocks, providing special diversity for contemporary portfolios.

Did you understand? BlackRock submitted its Bitcoin ETF application utilizing Coinbase for both custody and surveillance-sharing, marking among the very first times a significant possession supervisor partnered with a crypto-native exchange to satisfy SEC needs.

Bitcoin proxy stocks contrast

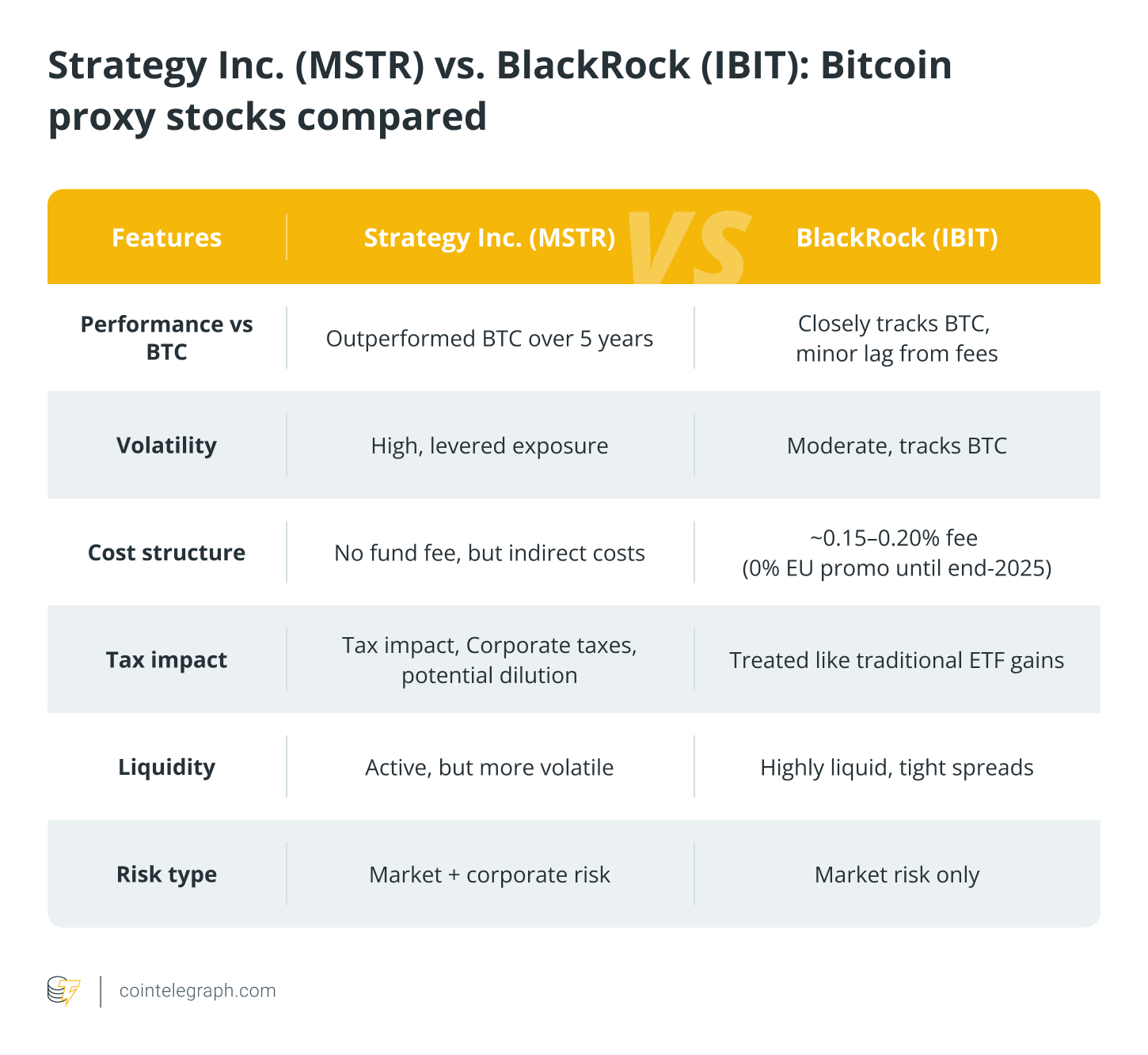

Method and IBIT both provide direct exposure to Bitcoin, however how they do it and what that implies for financiers could not be more various.

Method (MSTR) has actually regularly surpassed Bitcoin over the previous 5 years, thanks to take advantage of and aggressive build-up. However with that benefit comes volatility: The stock typically swings more difficult than Bitcoin itself. IBIT, by contrast, is constructed to track Bitcoin’s rate straight. It does so with high precision however lags a little due to management charges.

The threat profiles show this split. Method is a high-beta equity with business balance sheet direct exposure. It depends on convertible financial obligation and equity raises to sustain its BTC method. IBIT prevents all of that. As an area ETF, it holds Bitcoin in custody and provides financiers tidy direct exposure without company-specific dangers.

Costs and taxes likewise vary. Method has no yearly management expense, however financiers handle possible dilution, business tax results and governance dangers. IBIT charges around 0.15% -0.20% every year (totally free through 2025 in Europe) however features tight spreads, deep liquidity and no business luggage.

Here’s how Method (MSTR) is various from BlackRock (IBIT):

Bitcoin direct exposure through stocks: Leveraged equity or managed ETF?

If you’re bullish on Bitcoin and riding the volatility belongs to the video game for you, Method might make good sense. If you choose tidy, regulated direct exposure, IBIT is the much better fit.

Method deals amplified direct exposure thanks to take advantage of and aggressive build-up. However be all set for wild equity swings connected to BTC rate changes and dilution cycles driven by financial obligation and equity raises.

With BlackRock, you get direct access to Bitcoin’s rate without stressing over wallets, secrets or business capital maneuvers. Its low yearly charge (~ 0.15% -0.20%, with a short-term 0% deal in Europe) uses simpleness and openness over take advantage of and intricacy.

Institutional crypto investing vs. retail investing

Institutional financiers and speculators (consisting of hedge funds and active traders) are drawn to Method for its high-beta direct exposure and the trading chances developed by its business actions.

On the other hand, retail and long-lasting financiers tend to prefer IBIT. It’s dealt with like a mainstream ETF– perfect for diversity and ease of gain access to.

BlackRock management has actually clearly argued that consisting of a little allotment (1% -2%) of Bitcoin through IBIT can improve portfolios by supplying returns that aren’t securely associated with equities.

They highlight Bitcoin’s growing capability to decouple from tech stocks and function as an unique macro possession class.

What’s next for Method Inc and BlackRock in the Bitcoin period?

Both Method and IBIT are placed to grow with the marketplace, however in extremely various methods.

Method is anticipated to keep including Bitcoin to its balance sheet, continuing its high-conviction, high-leverage method. The business’s “Bitcoin capital allotment method” consists of more financial obligation and equity issuance, indicating future efficiency will stay securely connected to BTC rate action and possibly susceptible to margin pressure.

That stated, institutional assistance is growing: BlackRock now owns over 5% of Method’s stock, indicating self-confidence in its long-lasting thesis.

IBIT’s course is cleaner and more scalable. After its record-breaking launch in the United States, the fund broadened into Europe in March 2025 with a minimized 0.15% charge, attracting both retail and institutional capital.

With regulative clearness enhancing and worldwide hunger for area Bitcoin ETFs increasing, IBIT is most likely to end up being the default option for passive direct exposure.