The cryptocurrency market continued to rise this previous week as the total digital property market capitalization went beyond $3.27 trillion, an 8.6% boost over the previous week.

Bitcoin (BTC) reached a high of $103,600 on Might 8 after recovering $100,000 for the very first time because January. Its market supremacy likewise rose above 60%, showing more bullish BTC belief. This marked the 3rd time BTC has actually broken through 6 figures because it reached the turning point on Dec. 5, 2024, and once again on Jan. 20, ahead of United States President Donald Trump’s inauguration.

The BTC increase accompanied Trump revealing a trade handle the UK, which might consist of eliminating a 10% blanket tariff on all imports.

In the larger crypto area, Ethereum’s Pectra upgrade executed much-needed enhancements for the crypto environment. The upgrade was followed by a 26% rate rise for Ether (ETH), increasing from $1,800 on Might 7 to over $2,300 on Might 9.

Bitcoin DeFi sees rise in mining involvement regardless of drop in TVL

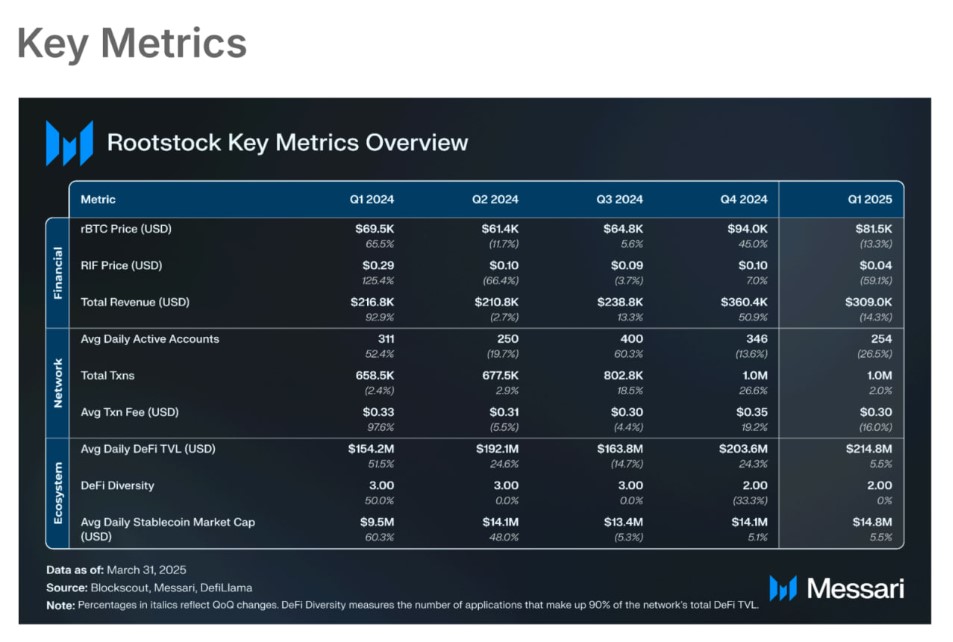

Messari’s “State of Rootstock” report for 2025 revealed that merged mining involvement rose to an all-time high of 81% in Q1 2025, up from 56.4% in the previous quarter. The rise was credited to onboarding significant mining swimming pools SpiderPool and Foundry.

The increase of mining assistance enhanced Rootstock’s hash power above 740 exahashes per second. This went beyond Bitcoin’s overall network hashrate tape-recorded in October 2024, marking a more fully grown stage for the platform’s merged mining development.

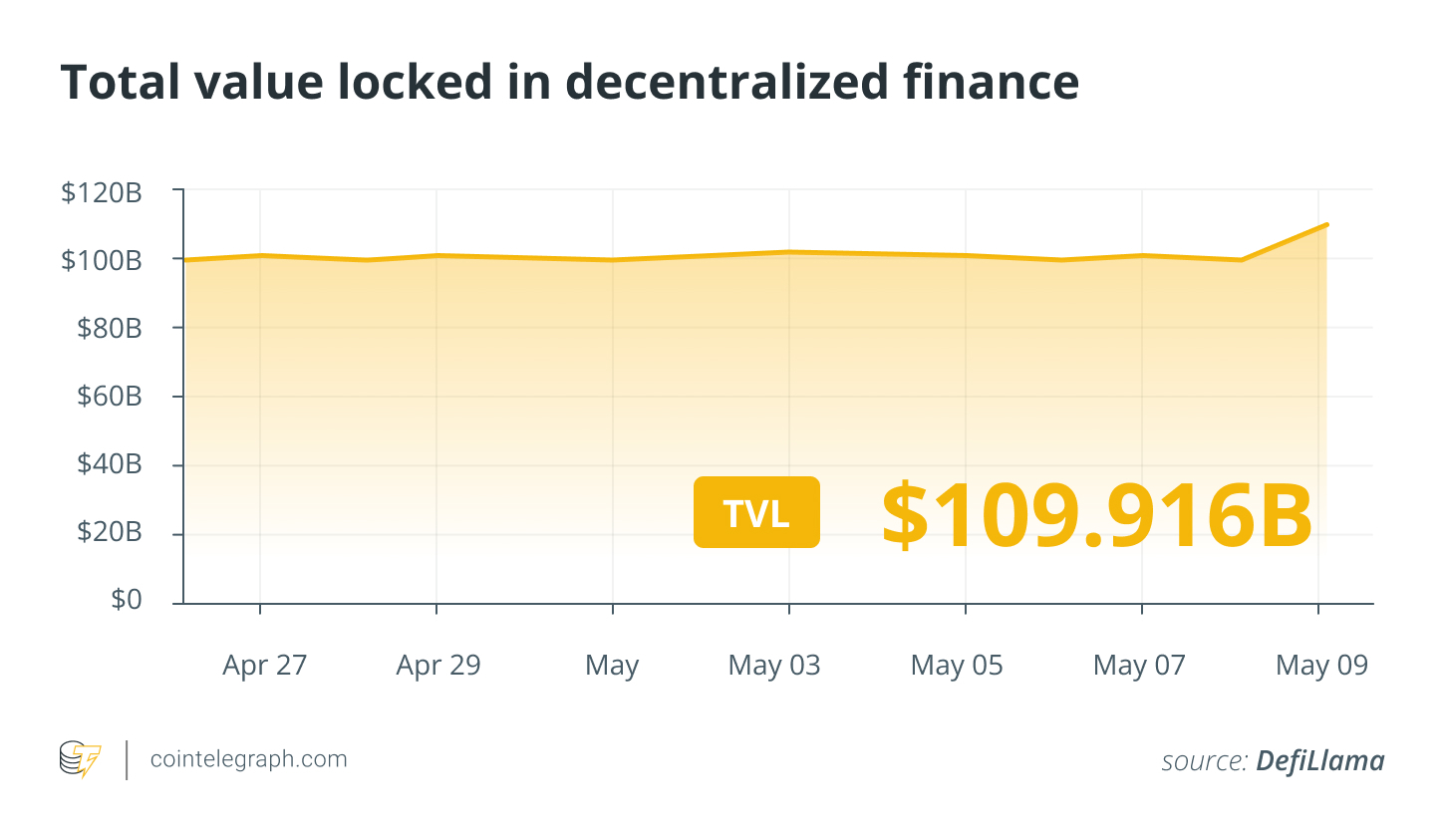

The rise in merged mining involvement came as Rootstock’s environment dealt with headwinds. In Q1 2025, Rootstock’s overall worth locked (TVL) decreased. Its Bitcoin TVL dropped 7.2%, while the dollar-denominated TVL fell by over 20% quarter-on-quarter.

This mirrored a more comprehensive down pattern throughout the DeFi sector, with Ethereum-based DeFi TVL revealing a 27% decrease in the exact same duration.

Continue reading

Hacken CEO sees “no shift” in crypto security as April hacks struck $357 million

Crypto hacks in April saw almost $360 million in properties taken throughout 18 events. This represented a practically 1,000% boost over the quantity lost in March.

The biggest loss originated from an unapproved Bitcoin transfer. On April 28, blockchain private investigator ZachXBT reported a suspicious deal of Bitcoin worth $330 million. He later on validated that it was a social engineering attack that targeted a senior American.

In a Cointelegraph interview at the Token2049 occasion, Hacken CEO Dyma Budorin informed Cointelegraph that the market continues to count on restricted security procedures even after the $1.4 billion Bybit hack event. Budorin stated that the area executes restricted procedures rather of releasing thorough methods.

” The majority of the tasks believe, ‘Okay, we did pentests. That suffices. Perhaps bug bounty. That suffices.’ It’s inadequate,” Budorin informed Cointelegraph.

Continue reading

AI decentralized apps are coming for the Web3 throne: DappRadar

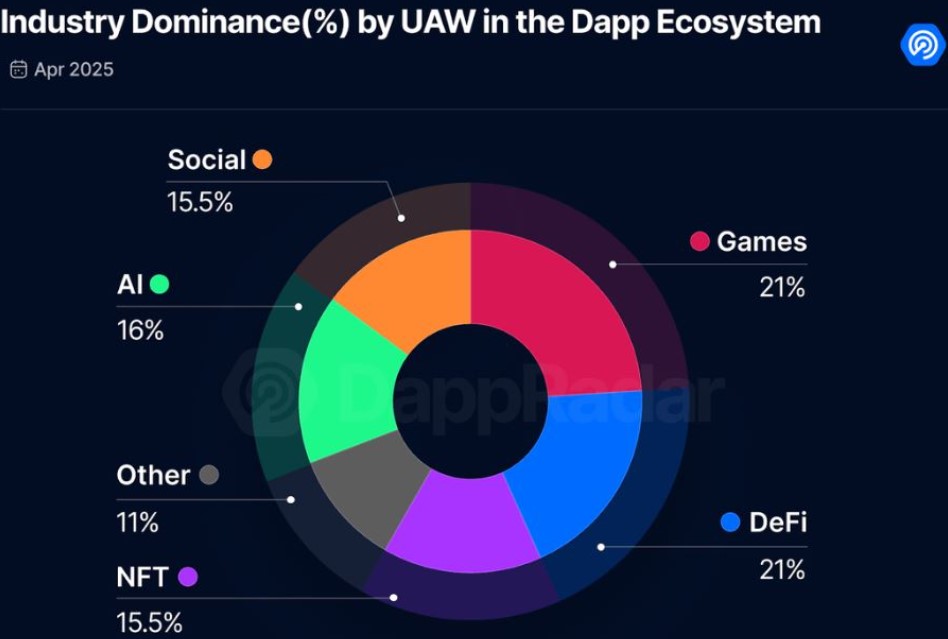

While video gaming and DeFi hung on to the leading area in the decentralized applications (DApps) environment, expert system is gradually capturing up.

Blockchain analytics platform DappRadar revealed that Video gaming and DeFi saw 21% DApp supremacy in April. Nevertheless, AI DApps reached 16%, up from the 11% tape-recorded in the platform’s February information.

” As user interest in expert system tools grows throughout markets, AI-powered DApps are progressively taking their location in the decentralized environment,” DappRadar expert Sara Gherghelas stated.

Gherghelas included that if the pattern continues, AI might challenge the supremacy of DeFi and video gaming, indicating a “brand-new period” in the DApp landscape.

Continue reading

Bitcoin-backed loans “apparent” next action– Xapo Bank CEO

Bitcoin holders are ending up being more positive in utilizing their BTC to obtain funds. In a Token2049 interview, Xapo Bank CEO Seamus Rocca informed Cointelegraph that financiers’ state of minds have actually moved from short-term speculation to a more long-lasting outlook on Bitcoin.

Rocca stated that the self-confidence originates from more comprehensive institutional adoption and Bitcoin’s rate levels that are “no place near” liquidation.

Rocca stated Bitcoin-backed loans permit holders to remain exposed to the property when dealing with unforeseen costs. The executive stated the clever thing to do is not offer the property when the rate boosts.

Nevertheless, when life obstructs, Rocca stated financiers can prevent liquidating their Bitcoin by obtaining versus the property and paying interest. In this manner, they can hang on to the properties regardless of requiring liquidity for their costs.

Continue reading

DeFi Market Introduction

According to information from Cointelegraph Markets Pro and TradingView, the majority of the 100 biggest cryptocurrencies by market capitalization ended the week in the green.

The memecoin Pepe (PEPE) increased by over 53% as the week’s greatest gainer, followed by the Pudgy Penguins (PENGU) token, which was up by 47% throughout the previous week. Ether (ETH) was the third-biggest gainer, revealing a boost of 35%.

Thanks for reading our summary of this week’s most impactful DeFi advancements. Join us next Friday for more stories, insights and education concerning this dynamically advancing area.