Secret takeaways:

-

Ether futures open interest has actually risen 40% in 1 month, while the area ETH ETFs marked 4 successive weeks of inflows.

-

ETH’s Gaussian channel sign recommends a rally to $3,100 to $3,600 might happen.

Ethereum’s native token, Ether (ETH), has actually combined in between $2,300 and $2,800 for the previous 1 month, however this sideways stage might be pertaining to an end. The 4-hour chart reveals ETH keeping assistance from the 200-day rapid moving average (EMA), and the cost is forming a covert bullish divergence with the relative strength index (RSI). A covert bullish divergence takes place when the cost types greater lows while signs like RSI form a lower low, signifying a pattern breakout.

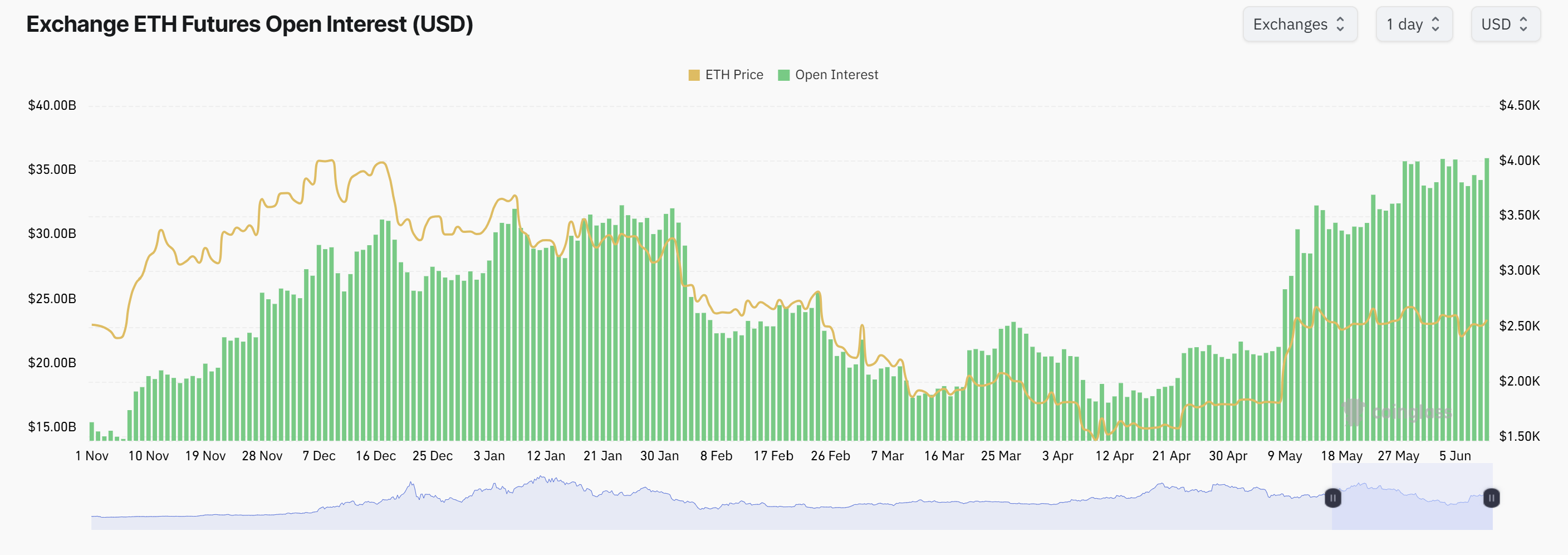

Ethereum futures open interest (OI) information from CoinGlass reveals a 40% boost to $36 billion from $26 billion over the last 1 month, showing growing trader self-confidence in the middle of cost debt consolidation, a pattern that tends to precede breakouts.

Area Ethereum ETFs rise as BlackRock continues to purchase

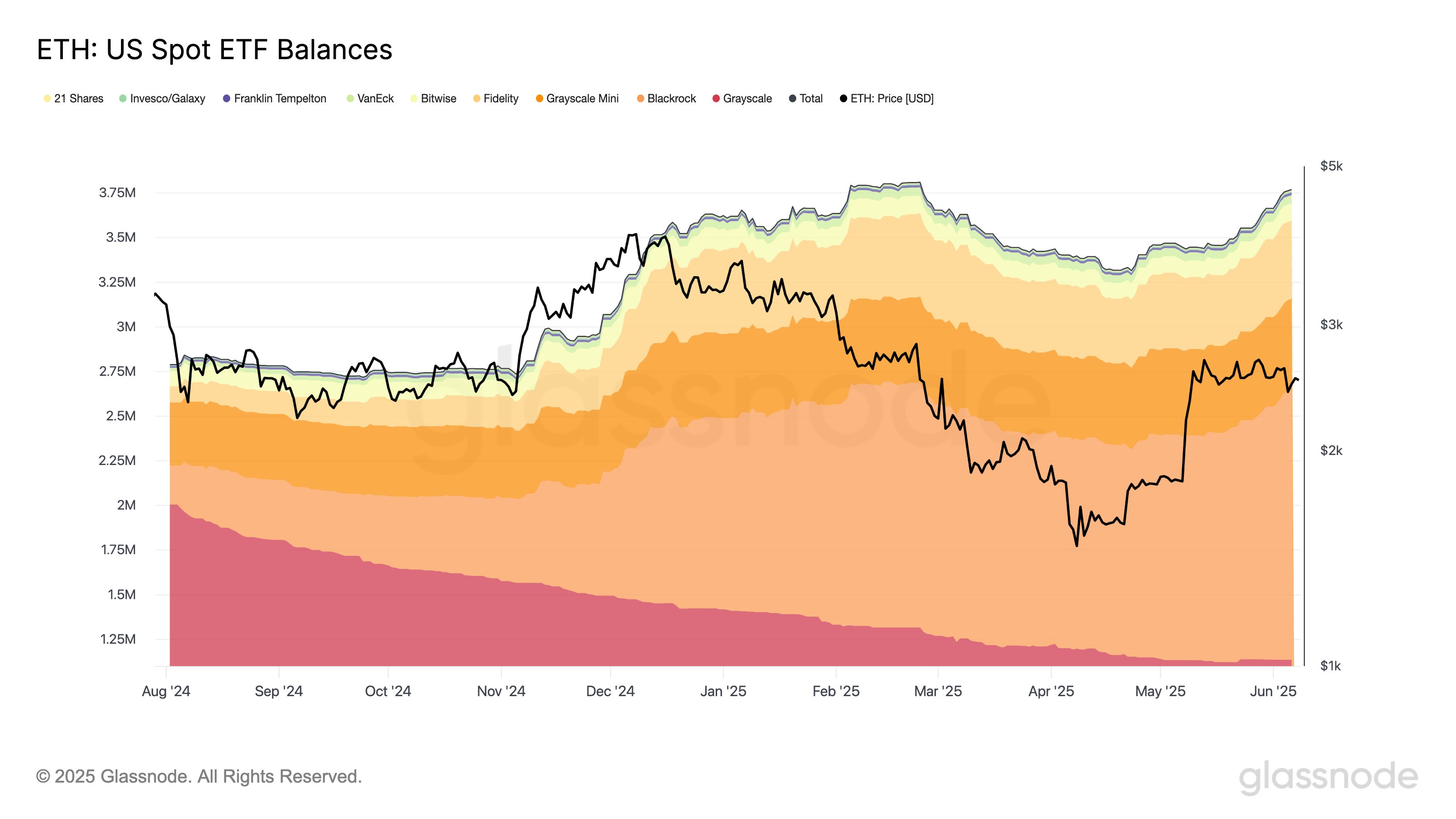

The area Ethereum exchange-traded funds (ETFs) marked their 4th straight week of net inflows, including 97,800 ETH, pressing overall holdings to 3.77 million ETH.

On The Other Hand, BlackRock is silently collecting Ethereum, holding 1.5 million ETH ($ 2.71 billion) in custody and tokenizing properties onchain. This possession management company has actually purchased $500 million in Ethereum over the previous 10 days, showing institutional conviction in the altcoin, regardless of its cost being 48% listed below its all-time high.

Cointelegraph reported that Ether-based financial investment items led inflows amongst crypto ETPs recently, drawing in $296 million regardless of a market downturn as financiers wait for regulative clearness from the United States Federal Reserve. This marks the seventh successive week of inflows, the very best because President Trump’s 2024 election triumph, with Ether ETPs now making up over 10.5% of overall crypto ETP properties under management. CoinShares likewise kept in mind a substantial healing in financier belief.

Related: Ethereum personal privacy roadmap proposes EU GDPR-safe blockchain style

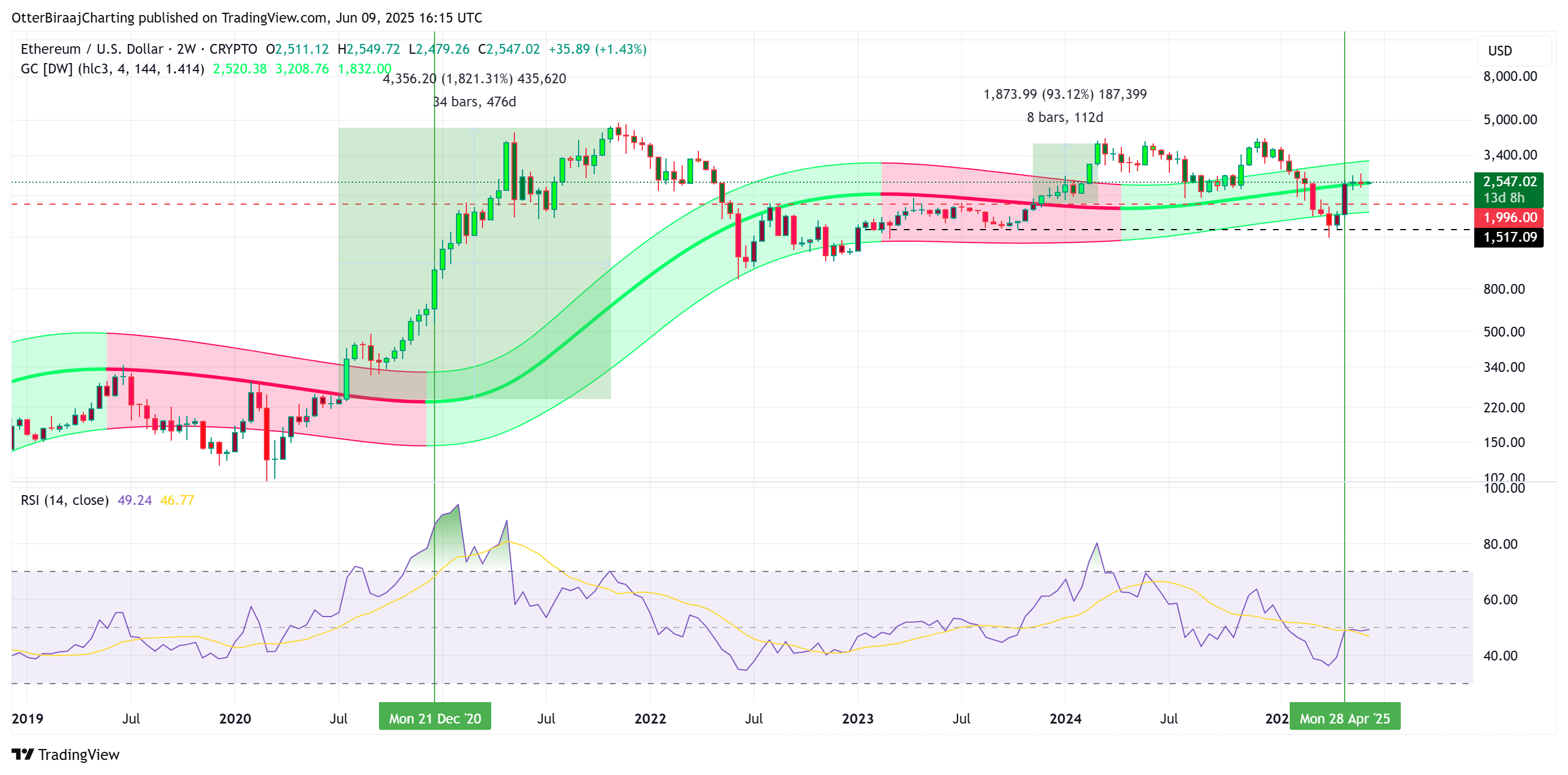

ETH is back in the Gaussian channel midline

ETH cost is likewise back above the mid-line of the Gaussian channel, a vibrant market pattern sign. The Gaussian or Regular Circulation Channel plots cost motions within a vibrant variety, adjusting to market volatility.

Historically, rallies have actually happened when Ethereum exceeds its Gaussian Channel midline. For example, in 2023, ETH skyrocketed 93% to $4,000 following such a crossover, while in 2020, it escalated by 1,820%.

With ETH supporting above this crucial sign at $2,570, technical analysis forecasts a possible push towards $3,100 to $3,600 if the momentum holds, supported by the channel’s historic precision in forecasting short-term gains.

Related: Cost forecasts 6/9: SPX, DXY, BTC, ETH, XRP, BNB, SOL, DOGE, ADA, BUZZ

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.